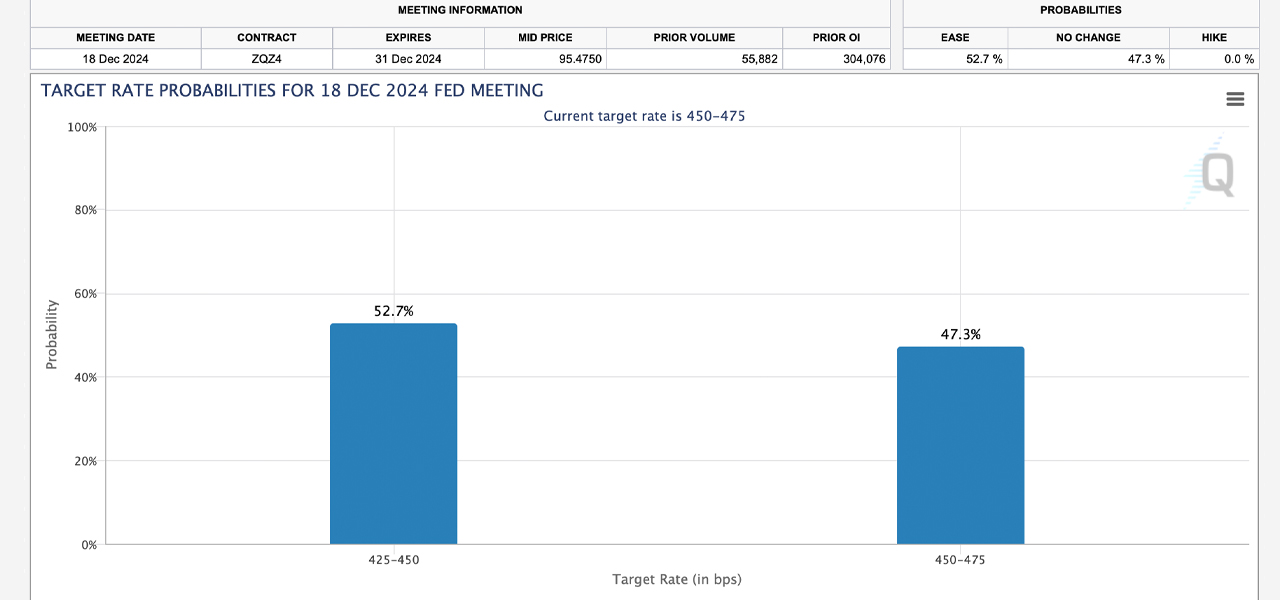

Based on current data, 24 days before the upcoming Federal Open Market Committee (FOMC) meeting, there’s a 52.7% likelihood of a quarter-point rate cut, according to CME Group’s Fedwatch tool.

Markets Signal Mixed Messages Ahead of FOMC Meeting

The U.S. Federal Reserve‘s federal funds rate outlook for December remains a toss-up. The odds of no rate change and a modest 25 basis points reduction are running close, but the quarter-point cut slightly leads. CME’s Fedwatch tool, which leverages the pricing of 30-day Federal Funds futures contracts to predict potential rate shifts, places the probability of a 25bps cut at 52.7%.

This tool calculates probabilities by subtracting the futures contract price from 100, offering a market-driven perspective on anticipated interest rate decisions. Meanwhile, the chances of no cut are also significant, sitting at 47.3%. Analysts continue to hold mixed views on whether the Federal Reserve will lower rates in December.

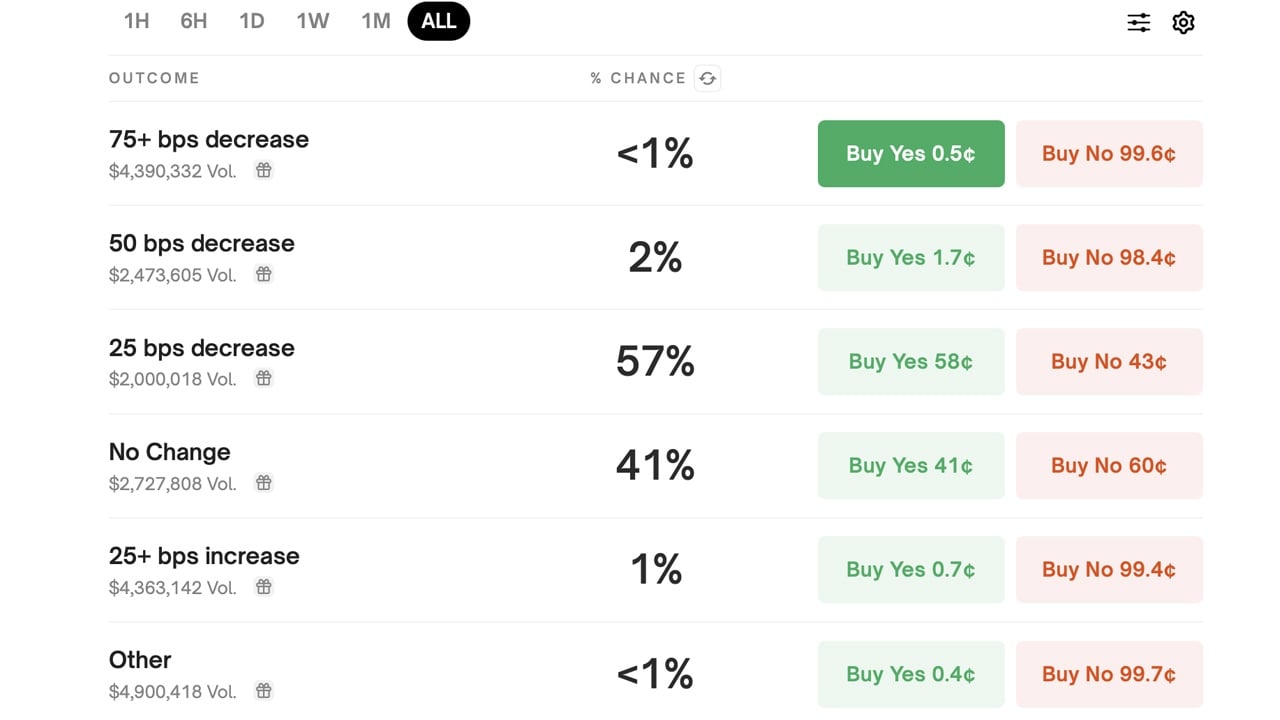

For instance, Morningstar’s Preston Caldwell anticipates a 0.25% cut, pointing to recent inflation metrics and broader economic conditions. On the other hand, Nomura analysts predict a pause, citing strong economic signals. Polymarket bettors mirror this divide, assigning 57% odds to a quarter-point reduction. As of Nov. 24, Polymarket wagers have reached $20.85 million.

Polymarket participants also assign a 41% chance to no rate adjustment, a slim 2% chance to a half-point cut, and a mere 1% to a quarter-point hike at the Dec. 18 FOMC meeting. The evolving probabilities reflect a market grappling with conflicting economic signals. As CME Group’s Fedwatch tool and Polymarket data suggest a slight lean toward easing, the divergence in expert opinions underscores the current uncertainty.

news.bitcoin.com

news.bitcoin.com