While not entirely true, the market rally sparked by Donald Trump’s election victory certainly gives the feeling no assets were left behind and failed to experience a surge.

By November 12, companies like Nvidia (NASDAQ: NVDA) and Tesla (NASDAQ: TSLA) had not only caught investors’ eyes but also delivered substantial gains, reinforcing their positions as growth stocks.

Meanwhile, in the cryptocurrency market, Bitcoin (BTC) and Ethereum (ETH) led a digital asset surge, benefiting from renewed investor confidence and speculative interest.

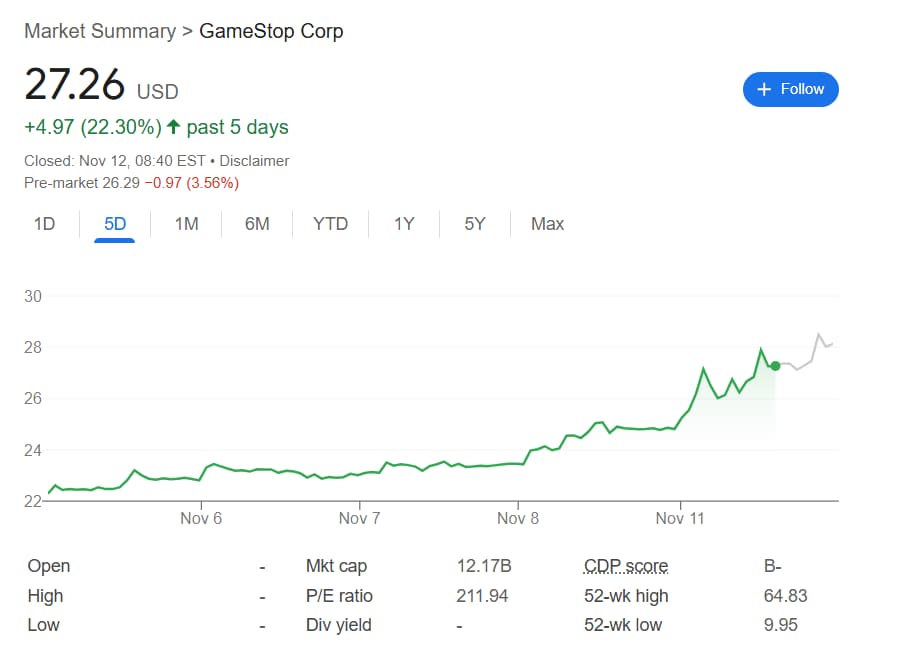

The original meme stock, GameStop (NYSE: GME) – known for its leading role in the late 2020 and early 2021 short squeeze that severely damaged several hedge funds – found its place within the rally, climbing 22.30% in the last five days to its current price of $27.36.

The rally appears to be a true meme stock event as, at press time, no discernible factor contributed to the surge – the sale of original Xbox games does not appear sufficient to fuel a $5 climb, though gaming aficionados are likely to find it exciting.

The notion is further reinforced by the fact that the uptrend looks broken in the Tuesday pre-market as GME shares are down 3.56% from their latest close.

Meme stocks follow GameStop shares to an uptrend

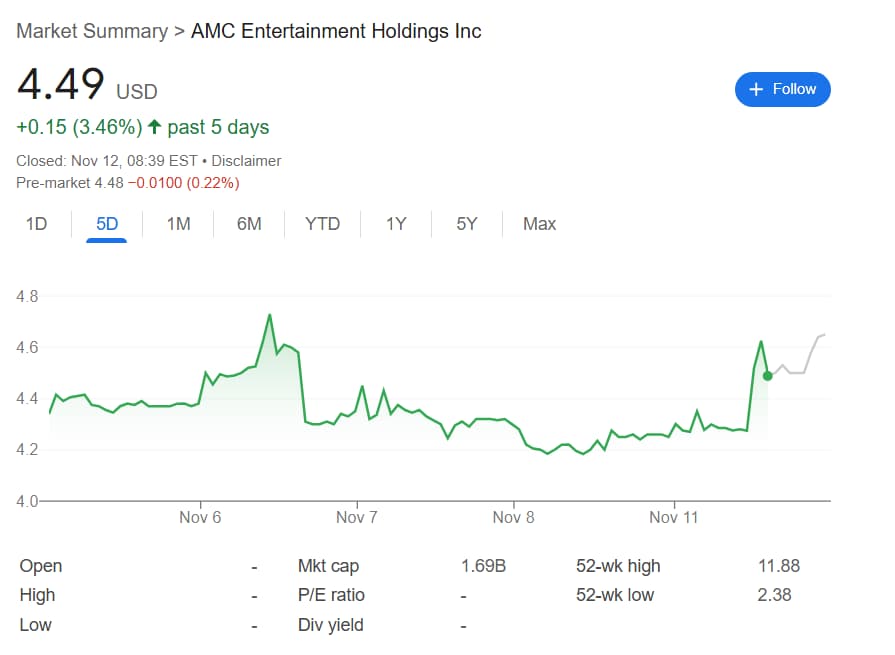

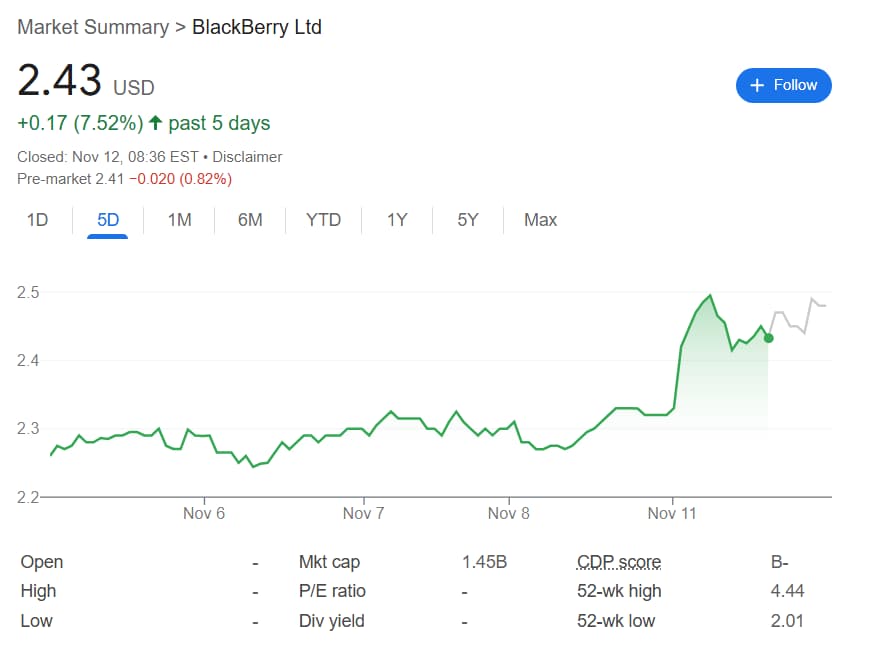

Another point indicating that the stock that once proved a hedge fund killer is being lifted by nothing other than the broader market tide is its peers’ somewhat similar – though weaker – performance.

Specifically, AMC Entertainment Holdings (NYSE: AMC) saw a major climb between Friday, November 8, and Monday, November 11 – the time the bulk of GameStop’s recent gains were made – and AMC stock is up 5.15% to $4.49 within the time frame.

Blackberry (NYSE: BB), the least prominent of the three, also managed a significant 7.52% rise in the last five sessions.

Why meme stocks are rallying

As of November 12, 2024, the three meme stocks appear to be rallying primarily due to the broad surge that has seen, for example, a 4.87% 5-day surge for the benchmark S&P 500 index and a 28.59% increase in the total cryptocurrency market valuation.

Considering that a large goal of the original meme stock craze was a massive short squeeze targeting players deemed corrupt, it is also possible the recent climb was inspired by the huge losses suffered by short-sellers in the wake of Trump’s November 6 victory.

For example, investors betting against Elon Musk’s Tesla have reportedly lost $7.8 billion in a week and may be in for more trouble.

Finally, no matter the exact reasons – or the potential longevity of the GME stock rally – meme assets have generally been doing well in the current market, as exemplified by the stellar performance of joke-based tokens such as Dogecoin (DOGE) and Shiba Inu (SHIB).

Featured image via Shutterstock

finbold.com

finbold.com