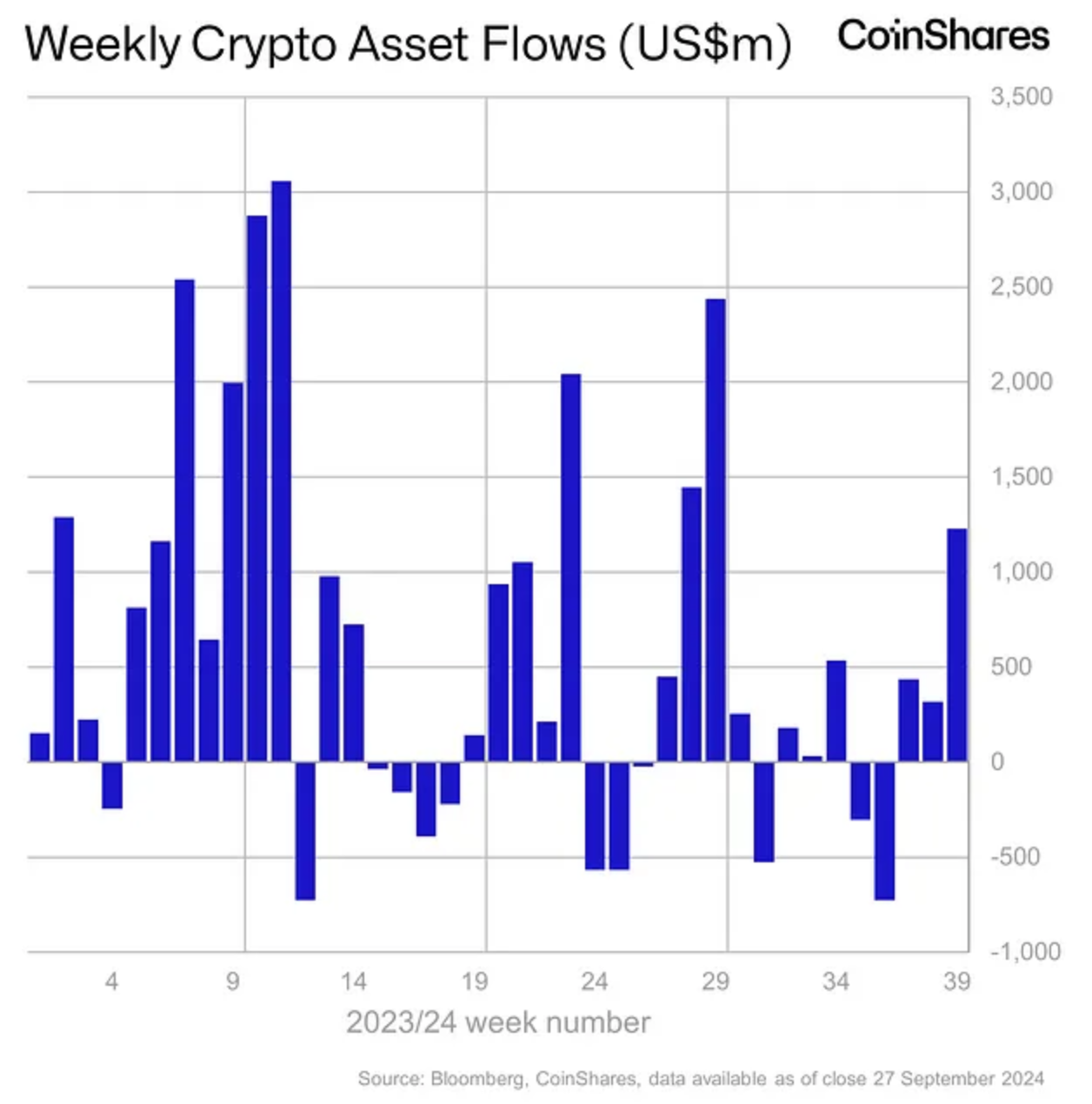

CoinShares Report: Digital Asset Investment Products See $1.228 Billion in Weekly Inflows

In a remarkable display of renewed confidence in the digital asset market, a recent CoinShares report revealed that digital asset investment products attracted a staggering $1.228 billion in inflows last week. This marked the third consecutive week of strong inflows, underscoring growing optimism in the sector as global markets respond to shifting economic and monetary conditions.

Bitcoin and Ethereum Lead the Charge

Unsurprisingly, Bitcoin (BTC) remained the top choice for investors, accounting for the lion’s share of the inflows. According to CoinShares’ Digital Asset Fund Flows Weekly Report, Bitcoin products recorded a massive $1.07 billion in inflows. This dominant position highlights investors’ continued faith in Bitcoin as a store of value and a hedge against macroeconomic uncertainties.

Similarly, Ethereum (ETH), the second-largest cryptocurrency by market capitalization, also saw significant inflows, totaling $86.9 million. While smaller than Bitcoin’s contribution, Ethereum’s consistent inflows reflect sustained interest in the platform’s broader smart contract capabilities and its role in the decentralized finance (DeFi) ecosystem.

Regional Distribution of Inflows and Outflows

On a regional scale, the United States led the inflow surge, registering a staggering $1.17 billion in investments. This dominance is largely attributed to positive market sentiment surrounding the possibility of dovish monetary policies in the U.S. The Federal Reserve’s recent actions and potential future interest rate cuts have boosted investor confidence, prompting a flow of capital into digital assets.

Switzerland came in second, with $84 million in inflows, further demonstrating the institutional adoption of digital assets in the European financial hub. Switzerland, known for its crypto-friendly regulatory framework, has long been an attractive destination for institutional investors looking to diversify their portfolios into digital assets.

In contrast, several other regions reported outflows, signaling caution among investors. Germany experienced the largest outflow, with $20.5 million in assets leaving the market. Other regions that recorded outflows include Brazil ($3 million), Sweden ($2.5 million), and Hong Kong ($1 million). These outflows indicate varying degrees of market sentiment globally, likely influenced by regional economic policies and local regulations surrounding digital assets.

Drivers Behind the Inflows: U.S. Monetary Policy and Positive Price Momentum

The report from CoinShares attributes last week’s robust inflows to growing anticipation of dovish monetary policy in the U.S., which has fueled positive price momentum for digital assets. Market participants increasingly expect that the Federal Reserve may adopt a less aggressive stance on interest rate hikes as inflationary pressures begin to ease.

This expectation has encouraged a shift towards risk-on assets such as cryptocurrencies, with many investors looking to capitalize on rising prices and favorable market conditions. While Bitcoin and Ethereum led the inflows, other altcoins and digital assets are also benefiting from this optimism, positioning the market for potentially more significant growth in the coming months.

CoinShares noted that this inflow pattern aligns with historical trends, where expectations of more accommodative monetary policy have often driven capital into the digital asset space.

A Disconnect Between Inflows and Trading Volumes

Despite the impressive influx of capital, the report also highlighted an interesting anomaly—trading volumes have not seen a corresponding increase. This suggests that while investor confidence is returning, many market participants may be taking a long-term approach, preferring to hold assets rather than engage in active trading.

This dynamic could signal that institutional investors, in particular, are focused on building positions in digital assets rather than speculating on short-term price movements. As a result, trading volumes have remained relatively flat, even as inflows have surged.

According to CoinShares, this trend could indicate that the market is in a phase of accumulation, with long-term investors gradually positioning themselves for future price gains, rather than reacting to short-term volatility.

Looking Ahead: Potential Impact of Monetary Policy and Market Sentiment

With the recent positive inflows, the market appears poised for a period of sustained growth, driven by the anticipation of dovish policies from central banks and strong price performance in the leading digital assets like Bitcoin and Ethereum.

The ongoing institutional interest in the space, as evidenced by the large inflows into digital asset investment products, suggests that crypto is increasingly being viewed as a legitimate asset class. This is further solidified by the continued development of regulated financial products, such as exchange-traded funds (ETFs), that offer exposure to digital assets.

However, there are still regional variations in sentiment, as reflected by the outflows seen in countries like Germany and Brazil. These outflows could be driven by local economic concerns, regulatory uncertainties, or a more cautious investment approach in those regions. As global regulatory frameworks continue to evolve, particularly in Europe and Asia, these factors will likely play a significant role in shaping the future of digital asset markets.

Conclusion: A Bullish Signal for the Crypto Market

The inflows of $1.228 billion into digital asset investment products over the past week signal a renewed confidence in the market, particularly among institutional investors. With Bitcoin and Ethereum leading the charge, and the U.S. dominating the regional inflows, the stage is set for continued momentum in the weeks ahead.

However, the disconnect between inflows and trading volumes highlights that many investors may be adopting a long-term outlook, waiting for further macroeconomic clarity before fully committing to active trading. As anticipation builds around future monetary policy decisions, the crypto market remains well-positioned for growth as we head into the final quarter of 2024.

For those watching the market closely, the coming months could present significant opportunities, especially as macro factors continue to influence the digital asset landscape.

To explore how institutional investors are shaping the future of digital asset investment, check out our in-depth analysis of the rise of crypto ETFs, where we delve into how these financial products are driving mainstream adoption.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

bitcoinworld.co.in

bitcoinworld.co.in