A new leveraged MicroStrategy ETF is firing on all cylinders as its assets jump and its stock soars to a record high.

The T-REX 2X Long MSTR Daily Target ETF has added over $82 million in assets just a week after its launch. According to Eric Balchunas, Bloomberg’s head of ETFs, these inflows place it in the top twenty of all 515 funds launched this year.

The fund, whose ticker is MSTU, has outperformed the Defiance Daily Target 1.75X Long MSTR ETF, which launched in August.

This is wild, the 2x $MSTR ETF was launched a week ago and already has $72m in aum (for context that puts in top 20% of the 515 ETFs launched this year) despite the 1.75x $MSTR ETF having head start and $357m (top 8% of new launches). Both have robust liquidity too. I didn't… pic.twitter.com/t46B8UIBhm

— Eric Balchunas (@EricBalchunas) September 27, 2024

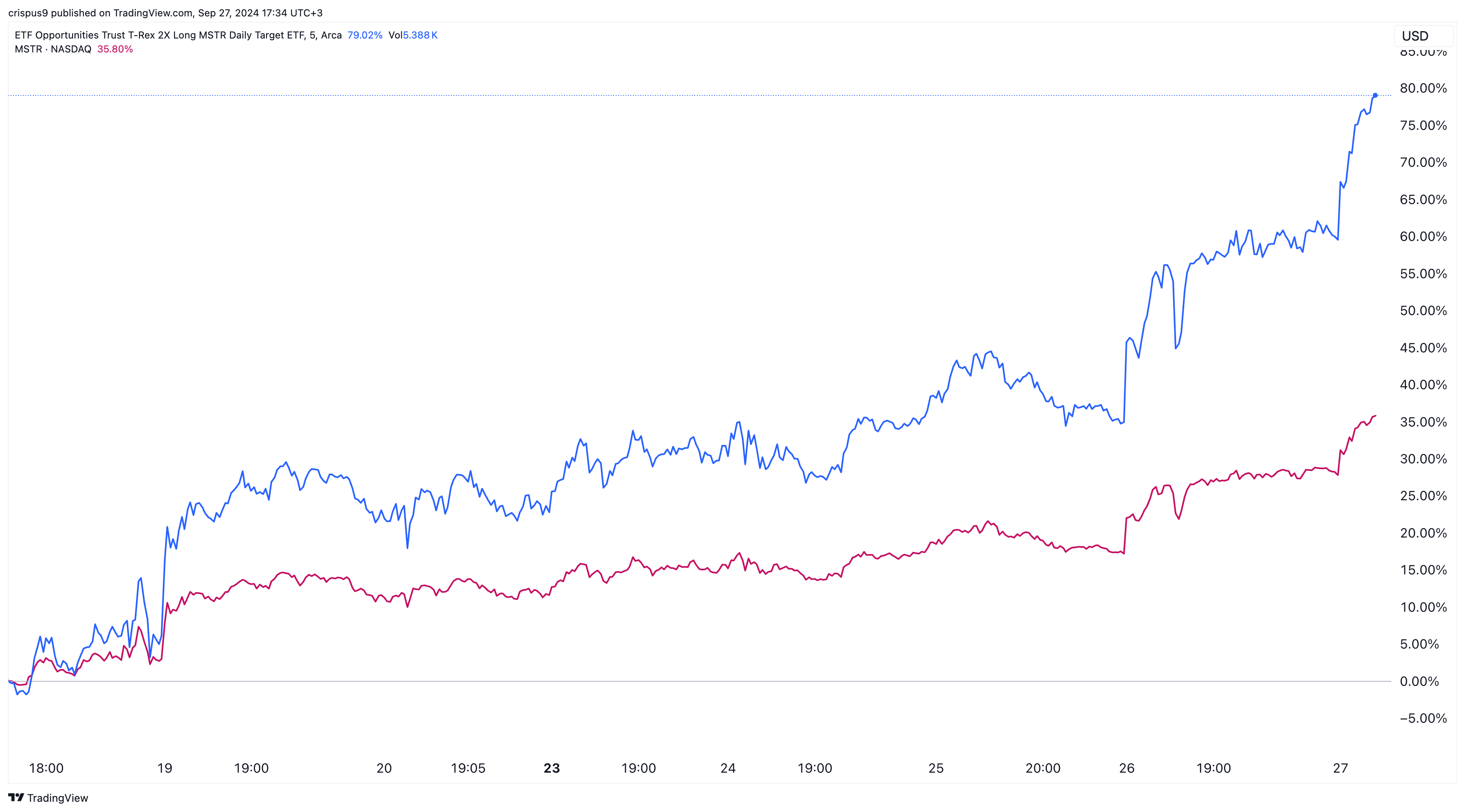

MSTU’s stock surged to a record high of $44 on Friday, Sept. 27, 81% higher than its opening price, making it one of Wall Street’s best-performing assets. It has also outperformed MicroStrategy stock, which has risen by 35% over the same period.

MSTU is a leveraged ETF that aims to achieve 200% of the daily performance of MicroStrategy stock. For example, MicroStrategy shares rose by 6.6% on Friday, while the MSTU fund jumped by 13%.

Historically, leveraged funds perform well when their underlying asset is in an uptrend and vice versa. For instance, the ProShares UltraPro ETF, a leveraged fund that tracks the Nasdaq 100 index, has risen by 373% over the last five years, while the ProShares UltraPro Short QQQ has dropped by 98.8% in the same period.

Both MSTU and MSTX funds have benefited from MicroStrategy’s rebound amid the ongoing Bitcoin bull run. Bitcoin (BTC) rose to $66,000 for the first time in two months, continuing the surge that began earlier this month.

MicroStrategy shares often outperform Bitcoin due to the company’s substantial holdings. The stock has risen by 457% over the last 12 months, while BTC has jumped by 151% during the same period.

Last week, the company bought more coins worth over $458 million, bringing its total holdings to 252,220 worth $16.7 billion.

Many analysts believe Bitcoin will continue rising, driven by Federal Reserve interest rate cuts ahead of the upcoming U.S. general election and Changpeng Zhao’s release from prison.

Additionally, whales have continued accumulating Bitcoin while the exchanges’ balances have slumped to the lowest point this year. Blackrock has continued accumulating Bitcoins, adding 5,894 coins in the last three days.