The BRICS boys recently invited six new countries to join them in 2024. Out of these six, four countries—UAE, Egypt, Iran, and Ethiopia—have accepted the invitation. Argentina said no, and Saudi Arabia is still deciding.

China and Russia are pushing for this expansion to make BRICS stronger financially and to take on the US and its Western allies. But not everyone in BRICS is on board with this plan.

India, South Africa, and Brazil are not too happy about the fast expansion. They want to slow things down and let the new members settle in first. They worry that if too many countries join at once, it could mess up policies and trade deals.

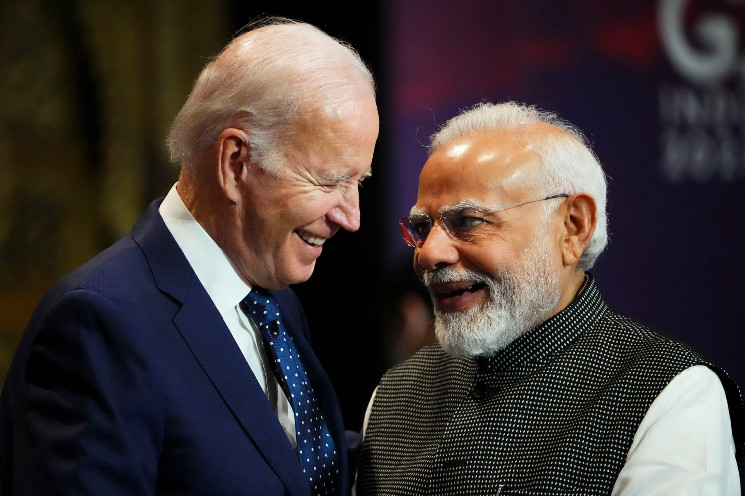

India is especially skeptical of China’s intentions. They think China is using BRICS to push its own agenda of global dominance.

India also believes Russia is trying to use BRICS to get back at the US for the sanctions on its economy. In India’s view, the 2024 expansion is just a cover for China and Russia’s bigger plans.

“India wants BRICS to keep its original spirit of equal partnership,” a source said. India is suggesting a five-year gap before letting more countries in. They argue this time is needed to get everything running smoothly with the new members.

This point has been brought up in recent meetings of senior officials and sherpas. While these debates are happening, the financial situation isn’t looking all that great.

The US dollar has been beating up on the Indian rupee recently. The rupee hit a low of 83.63 in June 2024, recovered a bit, but then fell back to 83.62.

This isn’t just an issue for the rupee. The dollar has been outperforming 22 out of 23 major Asian currencies this month. Only the Hong Kong dollar has managed to hold its ground.

The Chinese yuan has dropped to its lowest since December 2023, and the Japanese yen has hit its weakest point since the 1990s. Foreign institutional investors (FIIs) have also contributed to the rupee’s fall.

Earlier this month, they pulled out $2.6 billion from the Indian stock market. This big outflow added pressure on the rupee, causing it to drop further against the dollar.

cryptopolitan.com

cryptopolitan.com