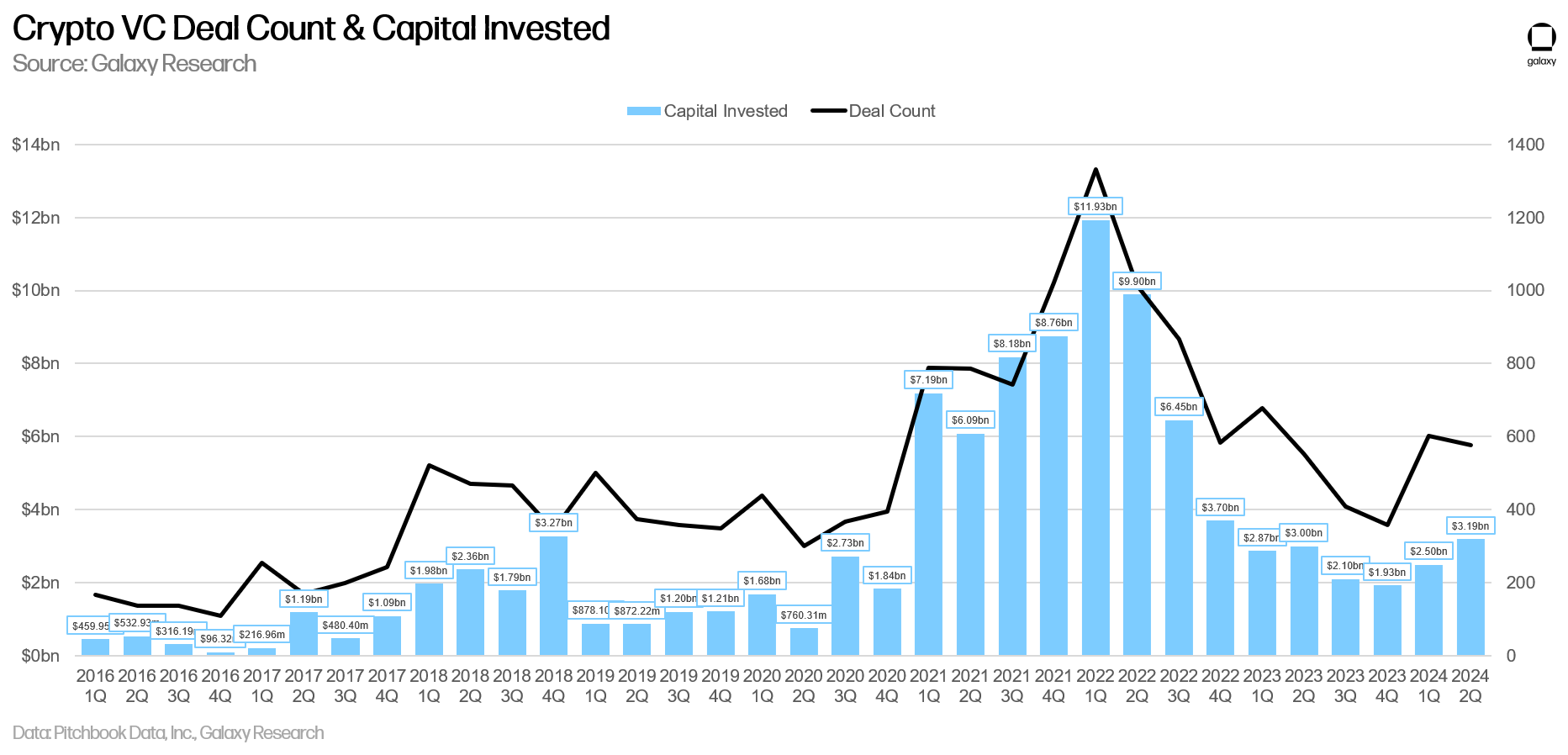

Venture capitalists pumped nearly $3.2 billion into the crypto sector in the second quarter of this year, according to Galaxy Digital.

Researchers at the crypto firm note in a new analysis that the digital asset venture capital market rebound that began in the first quarter continued through April, May and June.

“Deal count dipped slightly [quarter on quarter], decreasing from 603 in Q1 to 577 in Q2, while capital invested rose from $2.5 billion in Q1 to $3.2 billion in Q2. Median deal size increased slightly from $3 million to $3.2 million, but median pre-money valuation surged dramatically to near all-time highs, rising from $19 million to $37 million. This suggests that despite a lack of available investment capital compared to previous peaks, the resurgence of the crypto market over the past several quarters is leading to significant competition and a fear of missing out (FOMO) among investors.”

The Grayscale researchers note that overall venture capital interest in the sector remains low compared to Bitcoin’s (BTC) previous period trading above $60,000 in 2021-2022.

As a result, the researchers note there’s a weakening correlation between Bitcoin price and investment in crypto startups.

“Crypto-native catalysts, such as Bitcoin ETFs and emerging areas like restaking, modularity, Bitcoin L2s, along with pressures from crypto startup bankruptcies and regulatory challenges, combined with macroeconomic headwinds (rates), have contributed to this notable divergence. Allocators may be preparing to return in earnest due to the resurgence of liquid crypto, potentially leading to increased venture capital activity in the latter half of the year.”

Generated Image: Midjourney

dailyhodl.com

dailyhodl.com