An estimated $90 trillion transfer of wealth is now underway as baby boomers begin to give assets to their children – and a new survey shows a massive transfer of debt is happening at the same time.

A whopping 46% of Americans expect to pass on some form of debt when they pass away, according to a new survey by Policygenius.

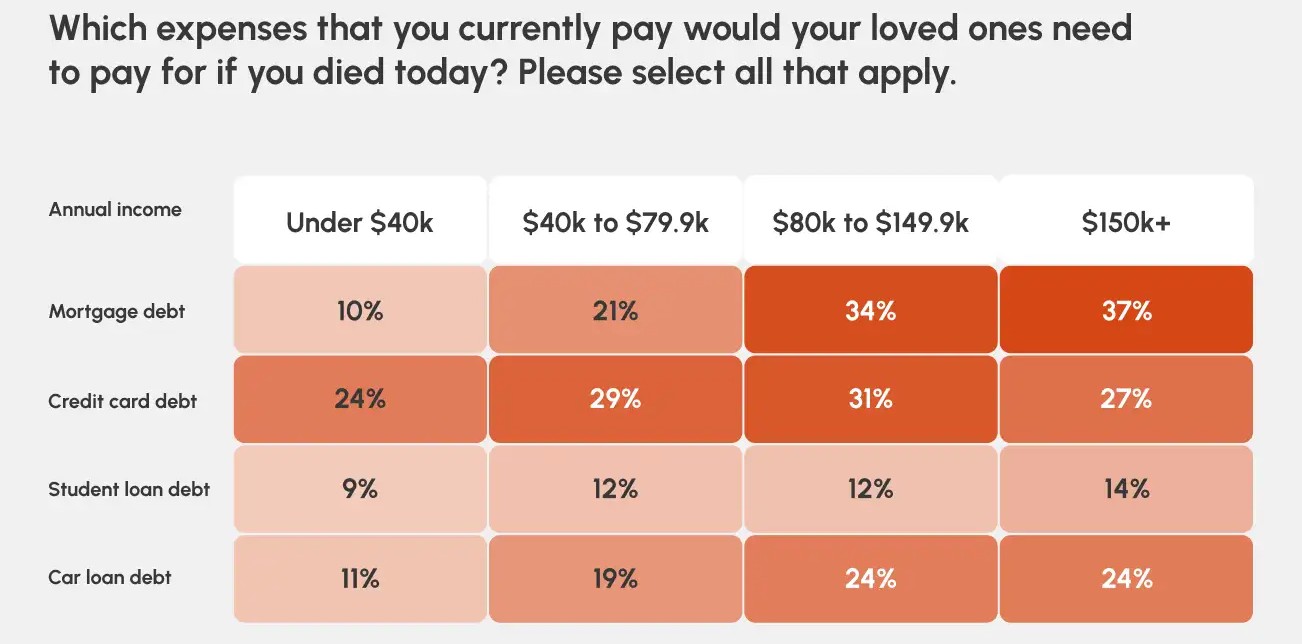

The survey shows 58% of people who earn at least $150,000 a year expect their loved ones to inherit their debts when they die.

For those who earn less than $150,000 per year, that number drops to 47%.

According to numbers compiled by Yahoo Finance, the average American household owes about $10,000 in credit card debt, $241,000 in mortgage debt, $59,000 in student loan debt and $22,000 in car loans.

And Policygenius says that among the pool of Americans who expect to leave debt behind, 21% do not have life insurance that would help pay it off.

Zooming out, a total of 43% of baby boomers say their loved ones would need to pay off debts if they passed away now, compared to 52% of millennials.

And 60% of Americans who are currently living with their kids say their loved ones would need to pay their debts if they died today, compared to just 38% of those who don’t live with their children.

Policygenius commissioned YouGov to conduct the survey, polling 4,063 Americans 18 or older with a margin of error at +/- 2%.

Generated Image: Midjourney

dailyhodl.com

dailyhodl.com