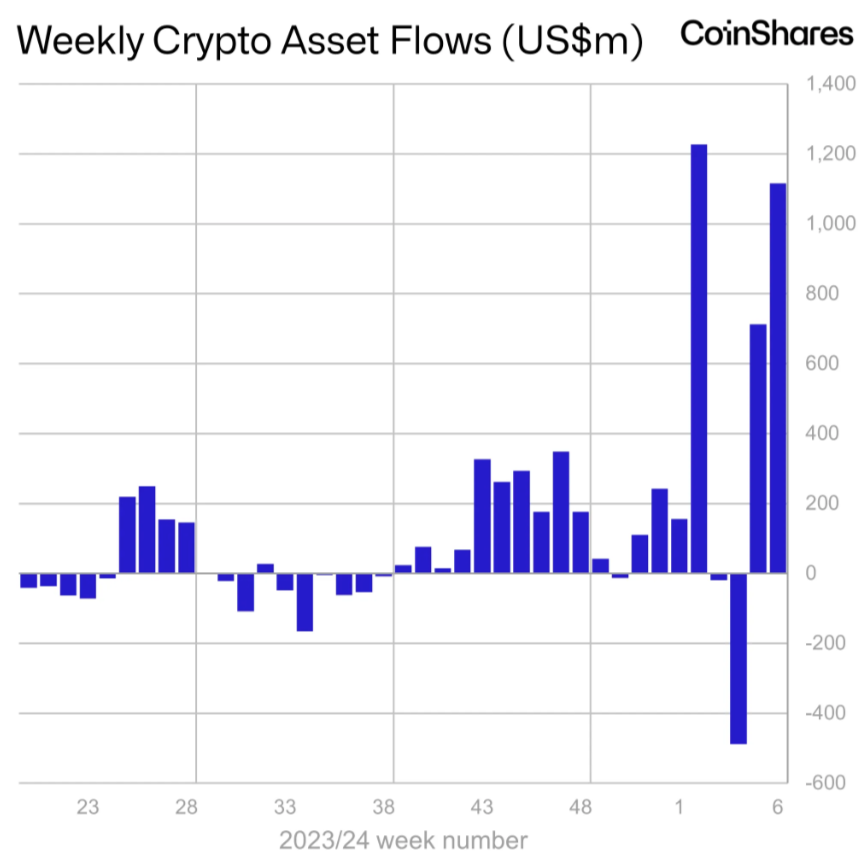

More than $1 billion flowed into the digital asset investment products, recording a substantial gain last week. Digital asset investment products received more than $1.1 billion in inflows last week, according to CoinShares’ latest report.

The increase in inflows coincides with the launch of spot Bitcoin ETFs in the United States, grabbing attention. Notably, Grayscale reported a weekly loss of $414 million despite this huge outflow. On the other hand, BlackRock’s Bitcoin ETF stands out, with inflows exceeding $693 million.

Spot Bitcoin ETFs launched on January 11th caused inflows as high as $2.8 billion. Last week, however, there was a slowed pace of outflows from Grayscale, despite ongoing outflows from Grayscale. Nonetheless, CoinShares commented that potential Genesis assets worth $1.6 billion being put up for sale could lead to even more outflows in the coming months.

In regional terms, Canada and Germany were both affected by outflows worth, respectively, $17 million and $10 million, while Switzerland saw an inflow of $35 million last week.

Bitcoin made up 98% of all inflows, followed by Ethereum and Cardano, with shares constituting 16% and 5%, respectively. Interestingly, ETH products got an influx valued at approximately $16.5 million, while ADA product garnered $6 million, which makes it second only to BTC among such funds in terms of flows within just one month after its launch In addition to these two coins, TRX saw an inflow of about $400,000 and XRP around $300,000 only.

Bitcoin, which experienced price stagnation after the launch of spot Bitcoin ETFs, witnessed a significant price surge at the end of last week, showing signs of revitalization. This resurgence successfully pushed the BTC price above $48,000 and marked the end of low volatility.

Despite this rise, the price of Bitcoin slowed down on Monday, dipping below $48,000. Currently, BTC is trading at $47,920, experiencing a 1% loss in the last 24 hours. The trading volume has settled above $20 billion with a 7% increase.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com