After the 25 bps rate hikes announced by the Fed on March 22, the markets, including bitcoin, crypto, and stocks, reacted negatively.

Fed 25 bps rate hike

The Fed chair Jerome Powell, after the FOMC meeting on March 22, announced that the Fed hiked the interest rates by 25 points. The new rate hike moved the interest rates to a bracket of 4.75% to 5%. This is up 25 points from the initial 4.5% to 4.75% rate target set on Feb. 2.

Powell reiterated a couple of times in his speech that the FED is committed to curtailing the inflation rates to their acceptable range of 2% in the coming years. However, he noted that these inflation drops will take not just months but probably till around 2025.

The general expectation from the community was that the FOMC would increase the rates by 25 bps. Hence, the recent move didn’t get the customers in huge dismay.

Considering the inflation highs last year, Powell noted that the CPI had reduced relatively in recent months. The FOMC is committed to ensuring that inflation reduces to the 2% bracket and price stability is fully attained.

He noted that other economic builders, like the housing market, remain weak with high mortgage rates. Unemployment rates have declined.

Bitcoin and crypto react

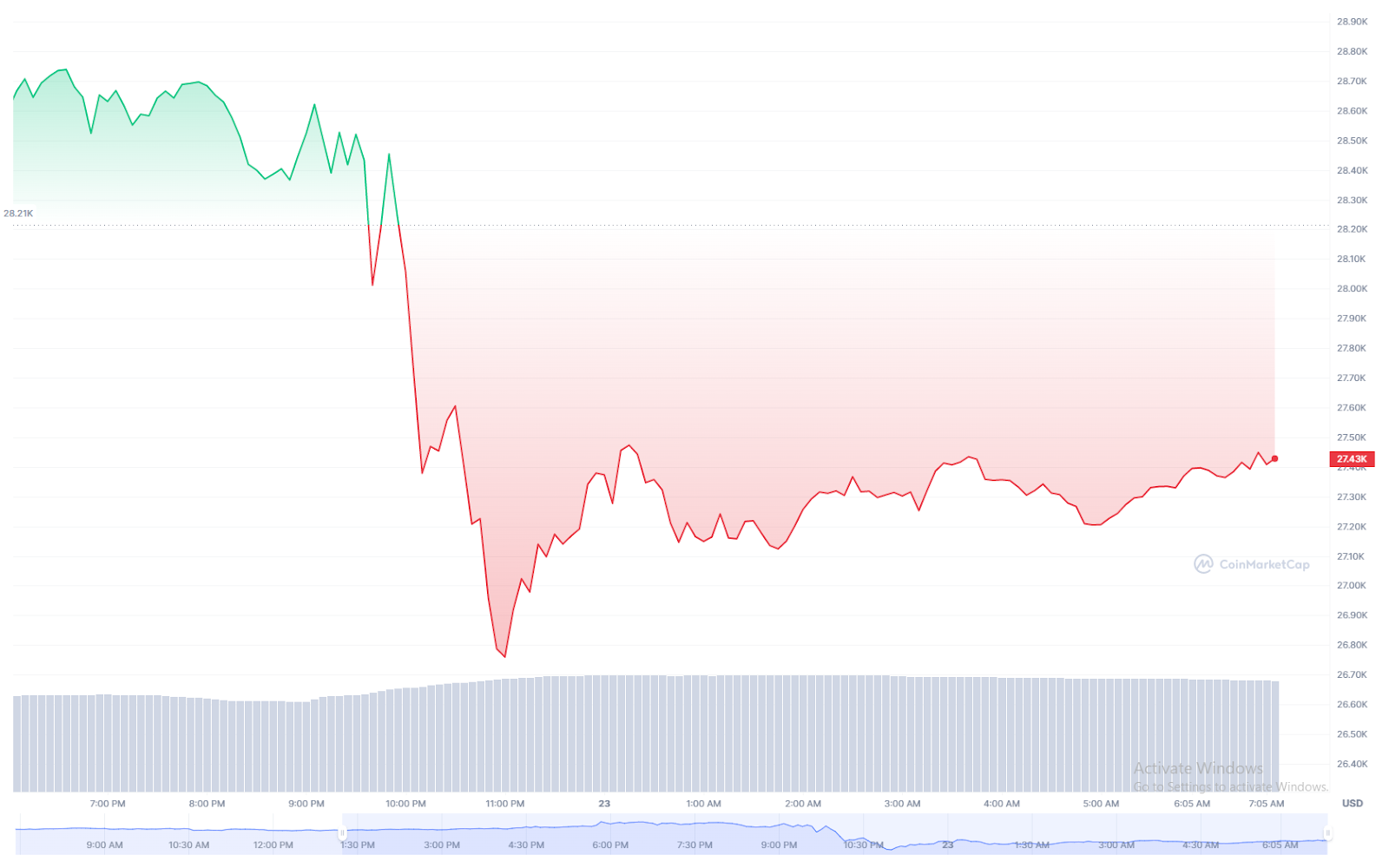

Before the announcement, bitcoin traded in the $28,500 range and seemed poised for $30,000.

However, based on charts, after Powell announced, bitcoin (BTC) dropped to about $28,000 and later to $26,700. The BTC market reacted negatively, losing about 6% in less than 2 hours.

While bitcoin is still trading in the red, it has recovered slightly and currently trades at $27,400.

While this is still a huge drop, bitcoin’s demeanor indicates a possible strong recovery. The next few hours and days are key to determining if bitcoin will surge past $30,000 as investors continue to contemplate what the Fed said.

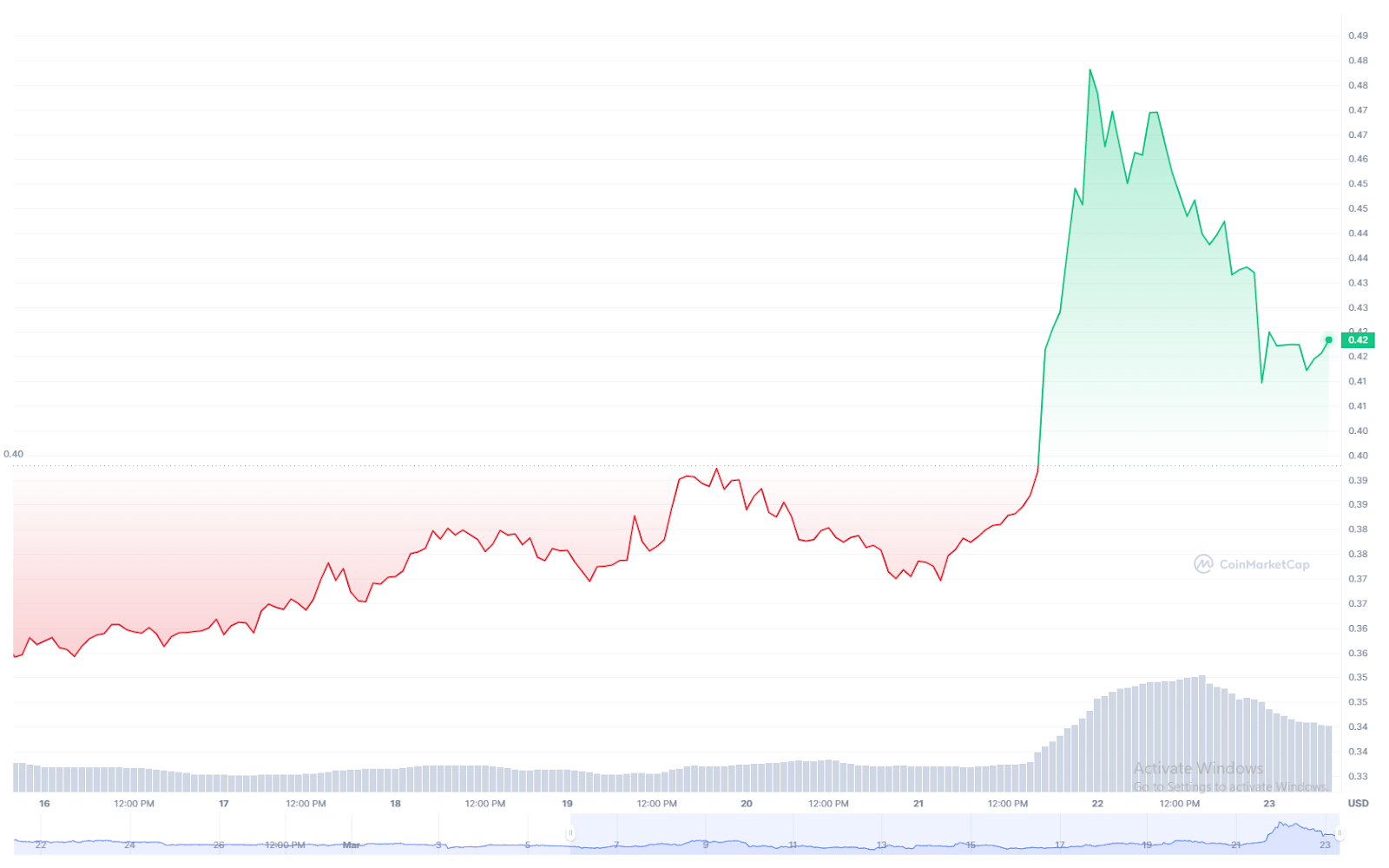

XRP looks like one of the biggest losers, having plunged over 9% since the Fed’s announcement a few hours ago. The coin is trading at $0.42, a huge decline after recording a surge of about 34% in the seven days heading into the Fed’s announcement.

The Fed’s tone

Before the announcement, many investors noted that the Fed’s tone would be the critical determinant of market reaction. Since people expected the 25 bps hike, it would not primarily affect sellers and buyers.

25 bps has been priced in for today’s FOMC

— Game of Trades (@GameofTrades_) March 22, 2023

Powell’s tone is going to be key

If the Fed maintains its “higher for longer” rhetoric, it won’t end well for stocks pic.twitter.com/92PiCAXnc0

The Fed’s tone at the time, however, seemed quite harsh. Despite the ongoing bank crisis, the Fed highlighted that the financial conditions have tightened, more than displayed by markets.

Many people initially anticipated that the next FOMC announcement in mid-year would cut rates after the recent rate hike. Powell noted that rate cuts are not likely to occur this year.

However, he also noted that they would make their next decision based on incoming data. The current market reaction could indicate investors lack confidence, after the rate hikes, despite ongoing recession fears.