MicroStrategy has been a regular favorite stock for short-sellers looking for big drawdowns. Indeed, as of yesterday, the US-based software firm was listed as the eleventh most-shorted stock. Interestingly, just ahead of it in tenth spot is crypto bank, Silvergate Capital Corporation which, in March, lent MicroStrategy $205 million, collateralized with bitcoin, to purchase around 4,000 more bitcoin.

The interest rate for this loan was never published and, bizarrely, MicroStrategy chief Michael Saylor once claimed that the firm holds custody of all of its bitcoin, implying that Silvergate may not have access to the assets against which Saylor borrowed his money.

Why Silvergate?

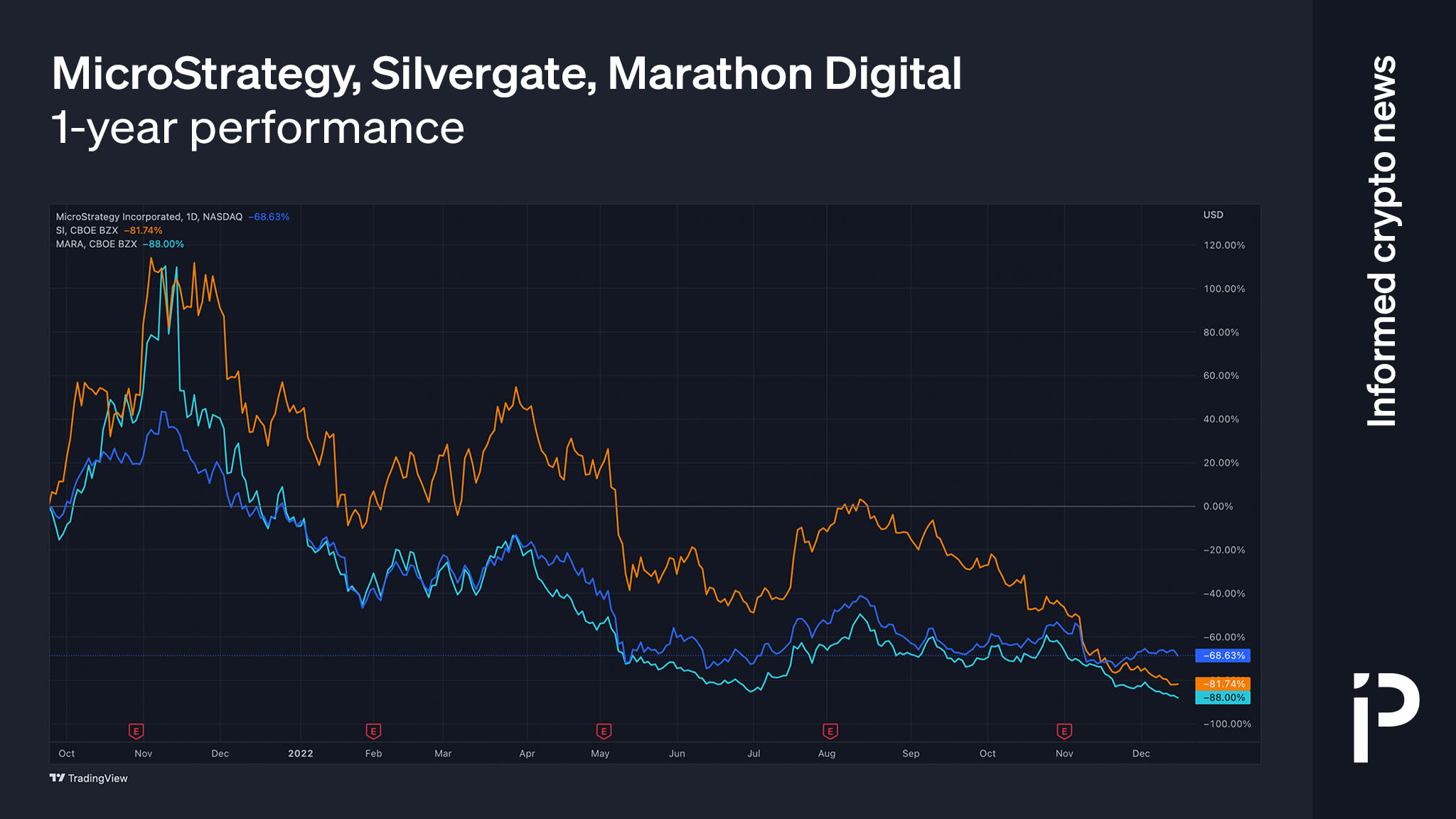

Silvergate Capital, which is down 87% from the start of the year, has never been as frequent in the most-shorted listed as MicroStrategy. However, it has received increased attention since FTX imploded in November. Silvergate was one of the main banking partners to FTX and Alameda Research and held up to $1 billion in crypto deposits at FTX.

The company’s CEO Alan Lane has claimed that “speculation” and “misinformation” is being spread by short-sellers and added that the firm had always done due diligence when sending payments to Alameda Research.

“When Silvergate received payments directed to Alameda Research and credited it to the account of the same name, this was consistent with the instructions from the sender of the wire and industry practice,” Lane said.

Some of Silvergate’s investors are suing it over losses caused by its failure to detect money laundering by its clients. The lawsuit claims that up to $425 million was laundered through the company. However, Silvergate’s woes didn’t start with the FTX fallout. At the end of its third quarter, the firm had reported a loss of $90.55 million and a total loss of $403 million for the year.

Read more: Is crypto outperforming the market?

Miners still in crisis

There seems to be no relief for bitcoin miners as publicly-listed mining stocks are still being hammered. The next most shorted stock after MicroStrategy is, in fact, Marathon Digital Holdings, a bitcoin miner headquartered in Las Vegas. Marathon is down 86% from the start of the year.

Protos has been covering the Bitcoin miner crisis, revealing that miners have sold record amounts of bitcoin just to keep afloat over the past few months. Adding to the general pressure from the market, earlier this year Marathon Digital was also hit with some bad luck when a storm damaged its main mining facility.

Read more: Place your bets: How many bitcoin miners will survive winter?

Not a trader’s paradise

With a hawkish Fed and pending structural risks in the bitcoin and crypto markets, short-sellers may feel confident they can short the weakest links in the crypto industry. However, even if short-selling MicroStrategy looked very profitable, it’s definitely not the case.

Making money by shorting is much more difficult than being on the long side due to the higher volatility that the downside brings. Indeed, some short-sellers still manage to get it wrong despite a seemingly clear direction. One particular case in point would be Granite, which got wrecked shorting MicroStrategy.

protos.com

protos.com