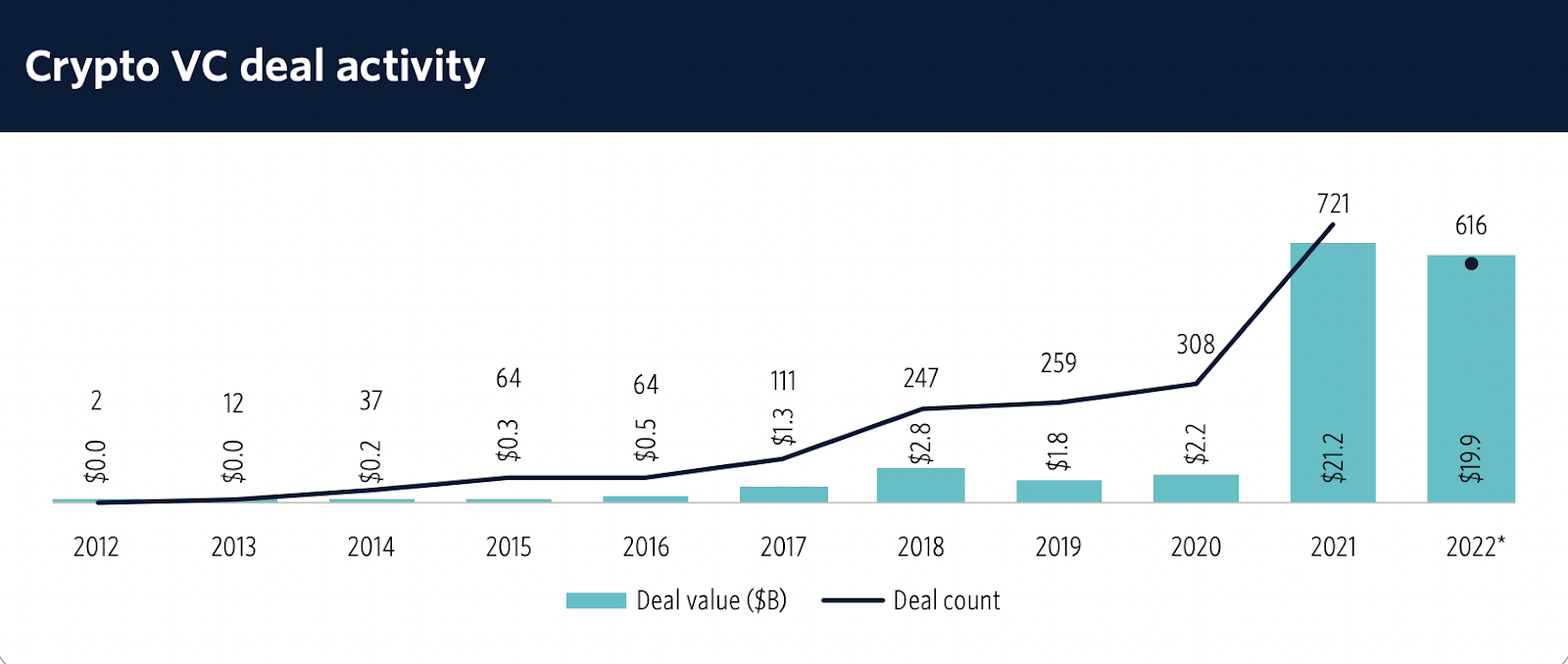

Crypto venture funding has remained relatively strong this year — despite difficult macro conditions, the collapse of Terra, and FTX’s fallout, which decimated spot digital asset markets.

Crypto startups gathered nearly $20 billion of capital across 616 deals through the first three quarters of 2022, 41% more than they attracted in the same period last year, according to new data from Pitchbook this week.

One explanation? Investors with ample dry powder have deployed their venture dollars into startups with beaten-up valuations, especially considering the sector’s overall youth.

But last year, deployed capital increased with each consecutive quarter. The picture is different for 2022.

Only $4 billion in investments were made in the third quarter, good for a 38.3% quarter-over-quarter slide. Still, Pitchbook expects investments to recover their pace once crypto prices trend upward.

The average funding for seed and early-stage crypto startups this year jumped to between $5 million and $20 million, from $3 million and $11.7 million in 2021. Meanwhile, capital deployed for late-stage startups has remained essentially flat at $30 million.

Investors poured $1.5 billion into Web3-oriented projects, marking a 44% jump sequentially in deal value, data showed.

“The long and short of it is crypto is far from done,” Pitchbook said in its report.

Outlook for the crypto industry weakened this year, led by a series of bankruptcies, including Three Arrows Capital, Celsius and Voyager.

More recently, crypto exchange FTX’s disintegration has further impacted the industry’s capacity to develop and design viable use cases. Against this backdrop of uncertainty, promising crypto startups are expected to become even more important to ensure the continuity of the industry.

Robert Le, a crypto analyst at Pitchbook, said mainstream adoption in the crypto industry is unlikely to take place until regulations improve and guidelines are established.

Crypto investment firm Galaxy Digital, meanwhile, found that funding for crypto startups hit a year-low in the third quarter. Investors gave only $5.5 billion to crypto projects, a drop from some $8 billion in the prior quarter.

This markdown began in the second quarter, when venture interest dwindled amid plummeting crypto prices triggered by TerraUSD’s crash and a meltdown in the crypto lending space.

Big name players are now hunting for bargain opportunities while valuations are low.

Goldman Sachs is reportedly looking to spend millions of dollars to buy or invest in distressed crypto companies. The bank is already conducting due diligence on its targets of interest. CEO David Solomon wrote in a Wall Street Journal op-ed this week that he still sees promise in blockchain “if allowed to innovate under the right conditions.”

BlackRock CEO Larry Fink also remains bullish on underlying blockchain technology — despite the industry taking a beating.

blockworks.co

blockworks.co