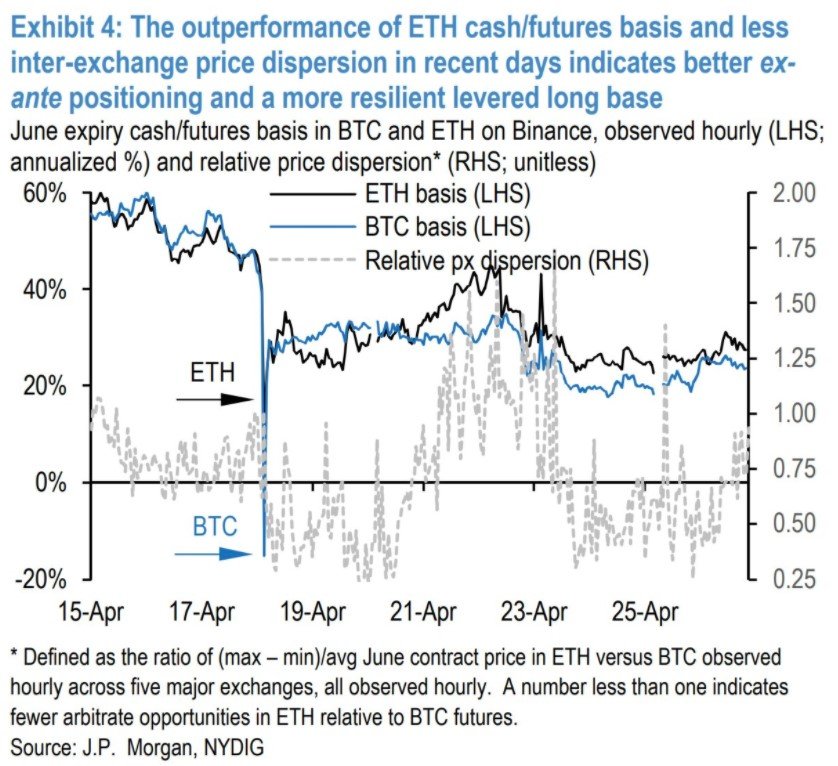

JPMorgan has taken notice of Ethereum, and its latest crypto report addresses “Why is ETH outperforming?” ETH is hitting new all-time highs almost every day; lately, just today, we went even higher to hit $2,775. As BTC continues to trade around $55,000, ETH rallied to 0.05100 BTC. [coin_stats_table symbol="BTC"] eToro market analyst Simon Peters attributes this uptrend to demand from institutional investors as “Ethereum is the natural next pick” after Bitcoin. According to the banking giant, the second-largest cryptocurrency may be less dependent on demand from leveraged traders than for Bitcoin, which can work in Ethereum’s favor. The analyst wrote,

“Both BTC and ETH markets experienced comparable liquidity shocks earlier this month, which triggered a comparable de-leveraging of their respective derivatives markets in subsequent days."After the recent market sell-off, the report notes that Ether’s spot market recovered quicker than bitcoin’s. The bank suggests better liquidity conditions in ETH futures as well while pointing to open interest data suggesting “that the other side of these trades were easier to source.” [caption id="attachment_288968" align="alignnone" width="838"]

Source: JPMorgan[/caption]

As we reported, after over a million traders lost more than $10 billion in liquidation during the recent sell-off, the funding on the futures exchanges remains extremely low despite the ongoing strength in the price.

“Ether is actually less leveraged and less vulnerable to a downtrend via a major long liquidation cascade,” noted trader CL.

“The cash in the ecosystem isn't capital-efficient enough in just arbing the futures' curve,” commented SplitCapital as a potential reason for the same.

According to JPMorgan, a large number of tokens on its blockchain, which can be considered highly liquid, may have blunt the impact of futures liquidations, allowing for a rapid recovery. The analysts wrote,

Source: JPMorgan[/caption]

As we reported, after over a million traders lost more than $10 billion in liquidation during the recent sell-off, the funding on the futures exchanges remains extremely low despite the ongoing strength in the price.

“Ether is actually less leveraged and less vulnerable to a downtrend via a major long liquidation cascade,” noted trader CL.

“The cash in the ecosystem isn't capital-efficient enough in just arbing the futures' curve,” commented SplitCapital as a potential reason for the same.

According to JPMorgan, a large number of tokens on its blockchain, which can be considered highly liquid, may have blunt the impact of futures liquidations, allowing for a rapid recovery. The analysts wrote,

“In combination with the continued growth for DeFi and other components of the Ethereum-based economy, this suggests some technical but occasionally important bullish tailwinds versus bitcoin."[deco-beg-single-coin-widget coin="ETH"]

bitcoinexchangeguide.com

bitcoinexchangeguide.com