In the last few hours, an enormous sum in Ethers (ETH) was moved to derivatives exchanges. Typically, this is a signal of a downturn, or, at least, increased volatility, CryptoQuant's verified author says.

82,000 Ethers (ETH) on their way to exchanges, expect volatility

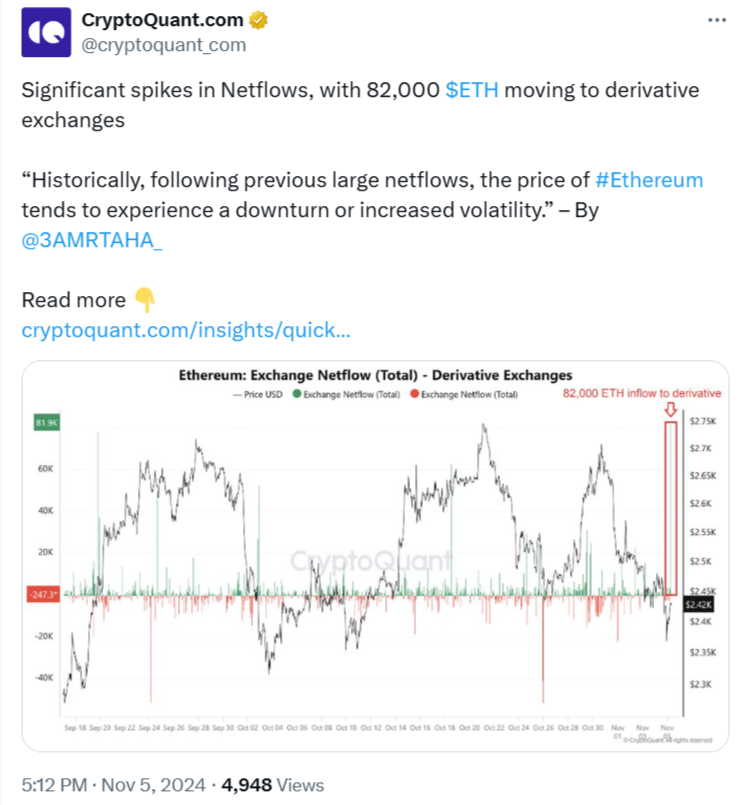

Ethereum (ETH), the second-largest cryptocurrency, witnesses a record-breaking inflow of liquidity into derivatives exchanges. Today, Nov. 5, 2024, over 82,000 Ethers (ETH) were moved to crypto contracts' trading services. Such estimations were shared by CryptoQuant's verified author, who goes by @3AMRTAHA_ on X.

In equivalent, this massive transfer is equal to over $200 million. This is the highest inflow for ETH to derivative exchanges in months, CryptoQuant data says.

The analyst recalls that previous large netflows made the price of Ethereum (ETH) experience a downturn or increased volatility.

Combined with the sentiment of the Ethereum (ETH) community, this inflow might be a signal of a potential downtrend.

As covered by U.Today previously, DOGE, SHIB and XRP are all experiencing an upsurge in whale transfers today. Such movements also signal potential volatility coming to the altcoin segment.

ETH/BTC routinely hits new low

In this cycle, Ethereum (ETH) is underperforming compared to Bitcoin (BTC), the largest cryptocurrency. While the orange coin is attempting to hit the levels compared to the March 2024 ATH, Ethereum (ETH) is still struggling with $2,500 levels.

Amid the current BTC spike over $70,000, the ETH/BTC ratio is seeking a new multi-year low. According to TradingView, it touched 0.035 today, which is the lowest since March 2021.

This crucial indicator for the Ethereum (ETH) price is down 58.3% from the peak observed in late Q4, 2021. Bitcoin (BTC) dominance, by contrast, is reaching new highs.

u.today

u.today