Ethereum, the second-biggest cryptocurrency, has lagged behind Bitcoin this year amid slow growth of its exchange-traded funds and competition from other layer-1 and layer-2 blockchains.

Ethereum ($ETH) has rallied by less than 20% in 2024, while Bitcoin (BTC) has risen by over 50%.

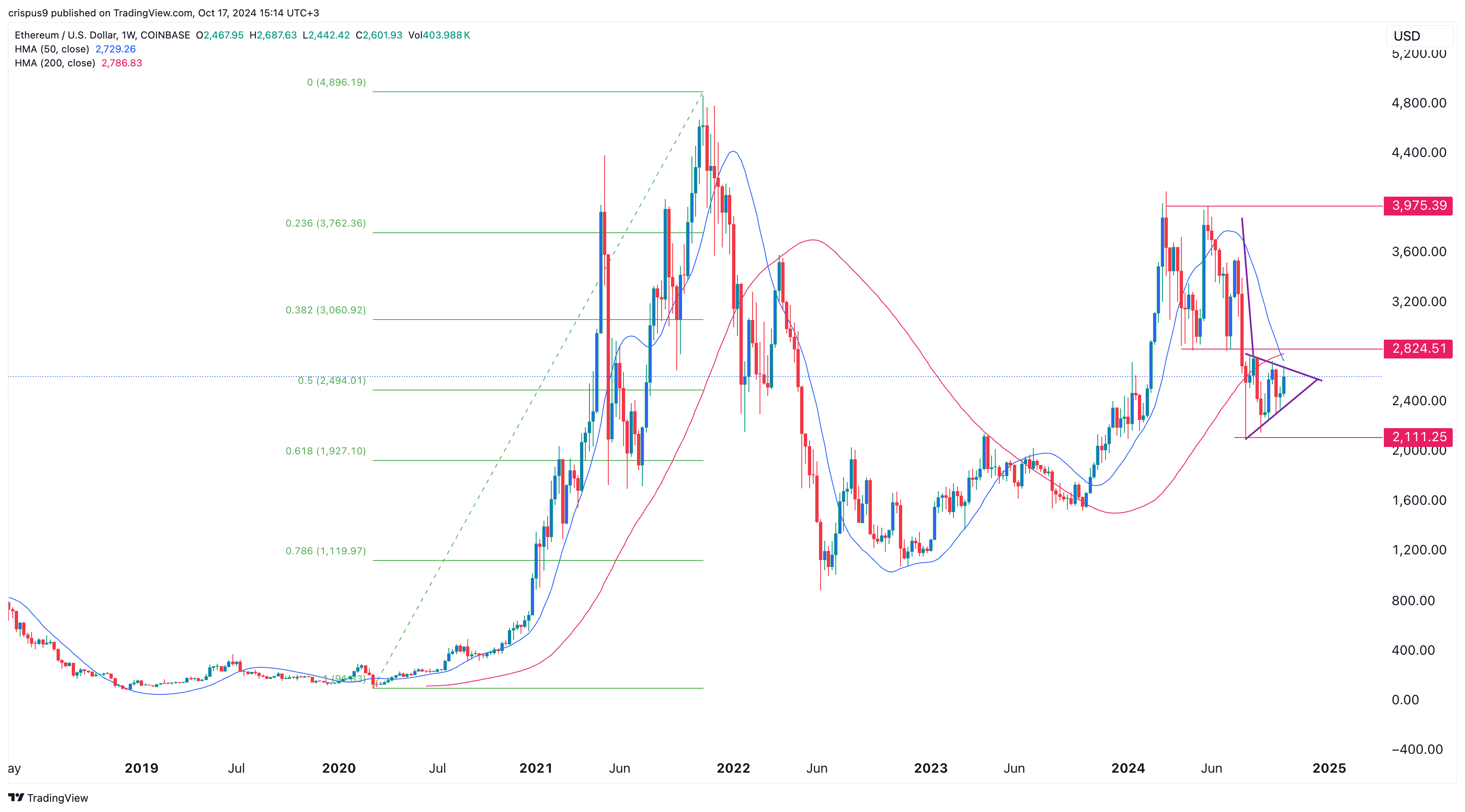

Technicals point to more Ether weakness in the coming months. On the weekly chart, the coin formed a double-top chart pattern around $4,000. It dropped below the neckline of this pattern at $2,824 in July, confirming the bearish breakout.

Ethereum has also formed a death cross pattern as the 200-day and 50-day Hull Moving Averages made a bearish crossover. The HMA reduces lag by using weighted moving averages to smooth out price data.

The last time Ethereum formed a death cross on the weekly chart was in March 2022, and the coin dropped by over 70% after that.

Ether has also formed a bearish pennant chart pattern, which is characterized by a long vertical line followed by a symmetrical triangle. Typically, an asset experiences a bearish breakout when the two lines of the triangle converge.

Additionally, this consolidation is happening at the 50% Fibonacci Retracement level. Therefore, there are increasing chances that the coin will have a strong bearish breakout in the near term, with the next target to watch being $2,111, its lowest point on Aug. 5.

Ethereum’s weak fundamentals

In addition to weak technicals, Ethereum is also battling significant fundamental challenges. First, Ether ETFs have not seen strong inflows a few months after launch.

According to SoSoValue, these funds have had cumulative outflows of over $530 million, primarily due to the Grayscale Ethereum Fund. In contrast, Bitcoin ETFs have crossed the $20 billion inflow level, pointing to higher demand from institutional investors.

Ethereum is also seeing intense competition in areas it used to dominate like DeFi and NFTs. Data by DeFi Llama shows that Solana has crossed Ethereum in terms of DEX volume in the last seven days. It handled $10.87 billion compared to Ethereum’s $9.69 billion.

If the trend continues, Solana may surpass Ethereum this month. Solana has handled $23.9 billion so far, compared to Ethereum’s $24 billion.

This performance is largely driven by the popularity of Solana (SOL) meme coins like Dogwifhat, Bonk, and Popcat have become popular among traders. All Solana meme coins have gained over $10 billion in market cap.

Additionally, some high-profile Ethereum whales, including Vitalik Buterin and the Ethereum Foundation, have sold thousands of coins recently.

A wallet related to #DiscusFish(@bitfish1) deposited 2,044 $ETH($5.45M) and 155,720 $LINK($1.85M) to #Binance 2 hours ago.

— Lookonchain (@lookonchain) October 15, 2024

The wallet has deposited a total of 12,347 $ETH($30.4M) to #Binance since Oct 2.https://t.co/niluIilTRi pic.twitter.com/ojHhveOtqq

Therefore, a combination of weak fundamentals and technicals could push Ether lower in the coming weeks.