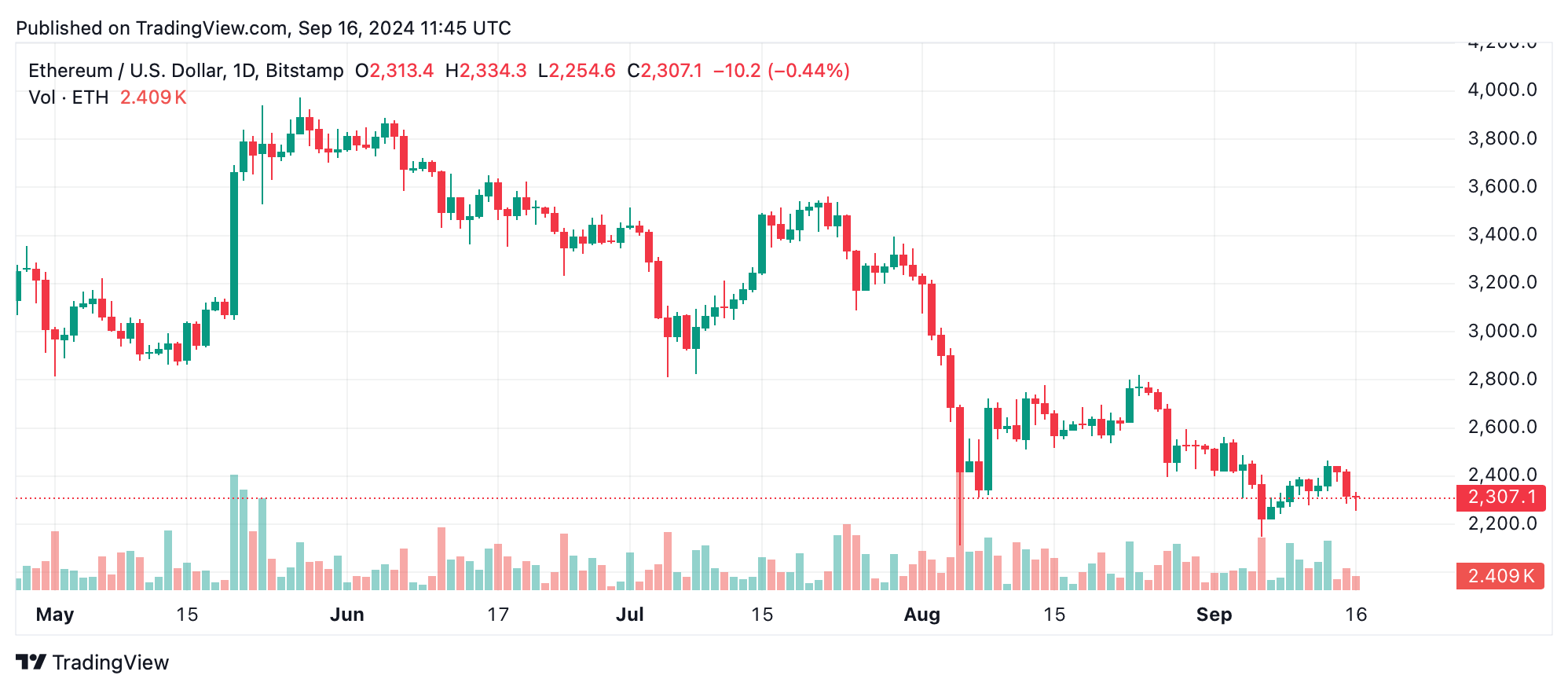

Ethereum is currently priced at $2,300 as of Sept. 16, 2024, fluctuating between $2,261 and $2,416 over the past day. With a market cap of $277 billion and a trading volume hitting $15.46 billion in the last 24 hours, ether is giving traders a mix of signals. Technical charts present a predominantly bearish outlook, but there are hints of potential short-term gains.

Ethereum

On the 1-hour chart, ethereum recently dropped from $2,428 to $2,251, then settled into a sideways pattern around $2,300. Notably, the trading volume spiked at the $2,251 level, hinting at the possibility of a short-term bottom. If the price pushes above $2,300 on strong volume, a quick-buy opportunity could arise.

Switching to the 4-hour chart, ethereum’s fall from $2,468 to $2,251 is sharper, though the price has since entered a brief consolidation. As selling pressure eases, there are signs of bullish momentum, suggesting that sellers may be running out of steam. If $2,251 holds as support, traders might consider entering a position.

Looking at the broader picture, the daily chart reveals a long downtrend, with ether dropping from its high of $2,823 to a low of $2,149. The $2,149 level stands as critical support, while resistance looms near $2,823. If ethereum revisits the $2,149 zone, traders may find an entry opportunity, though caution is still advised.

As for technical indicators, the readings are a mixed bag. The relative strength index (RSI) sits at 39.8, Stochastic at 47.8, and commodity channel index (CCI) at -92.4, all hovering in neutral territory. However, momentum at 79.9 and moving average convergence divergence (MACD) at -81.0 hint at a possible bullish signal. Moving averages (MAs), from the 10-day to the 200-day, point to a continuing bearish trend, with ether’s price still lagging below these key levels.

Bull Verdict:

Despite the prevailing bearish sentiment, ether’s recent consolidation around $2,300 offers hope for short-term bullish moves. If price breaks above key resistance levels at $2,300 and $2,350, alongside sustained volume, ethereum traders could see a potential upward trend toward $2,400. Indicators like momentum and the MACD hint at buying pressure, suggesting the possibility of a short-term reversal.

Bear Verdict:

Ethereum remains firmly in bearish territory, with multiple MAs and overall trend indicators reinforcing downward pressure. The failure to break through significant resistance levels, combined with low trading volume and a weak market structure, suggests that the current downtrend may persist. A retest of the $2,149 support level appears likely in the coming sessions, with further downside risk ahead.

news.bitcoin.com

news.bitcoin.com