- Ethereum faces sustained bearish pressure with declining market volume and volatility.

- Whales steadily accumulate ETH, indicating long-term bullish expectations.

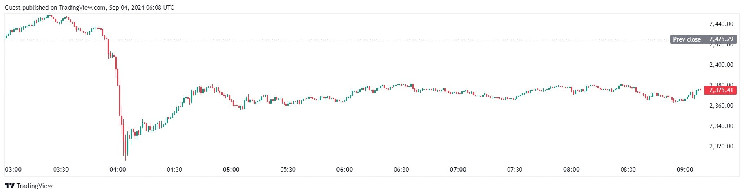

Ethereum, the leading altcoin, has experienced a sustained bearish trend, with a 14% decline in the past month. Currently trading at $2,353, the cryptocurrency saw a modest dip of 0.31% over the past 24 hours, while its trading volume plummeted by 30%. This comes with the overall market volume dropping by 19%.

According to Greeks.live, 127,000 ETH options are set to expire, with a Put Call Ratio of 0.73, a Max Pain point at $2,400, and a notional value of $298 million. Market volatility expectations are declining, as seen in the drop in major term implied volatilities. With the Federal Reserve expected to implement a 25 bps rate cut next week, the Max Pain point aligns closely with Ethereum’s price.

September has proven particularly weak for Ethereum, which continues to underperform. The ETH/BTC exchange rate fell below the long-term support level of 0.04, signalling that Bitcoin may remain the dominant force in the next bull market.

In addition, Ethereum network fees dropped to $3.1 million for the week ending August 31, the lowest level in over four years. Despite these challenges, whale investors have been steadily accumulating ETH, with their holdings approaching 48% of the circulating supply. A notable transaction saw 80,000 ETH, worth approximately $187.5 million, transferred from Binance to Binance Beacon Deposit.

Can ETH Bulls Give A Comeback?

The daily chart shows ETH entrenched in a bullish trend, with Ethereum facing critical resistance at $2,477 and $2,678. Should bearish sentiment persist, ETH could fall to $2,222, with potential support at $2,102.

As Ethereum navigates these key levels, its ability to sustain momentum will be pivotal in the coming days. Traders are closely watching for signs of strength or further declines.

thenewscrypto.com

thenewscrypto.com