Ethereum is on the brink of a crucial test as recent data indicates a potential continuation of its downward trend.

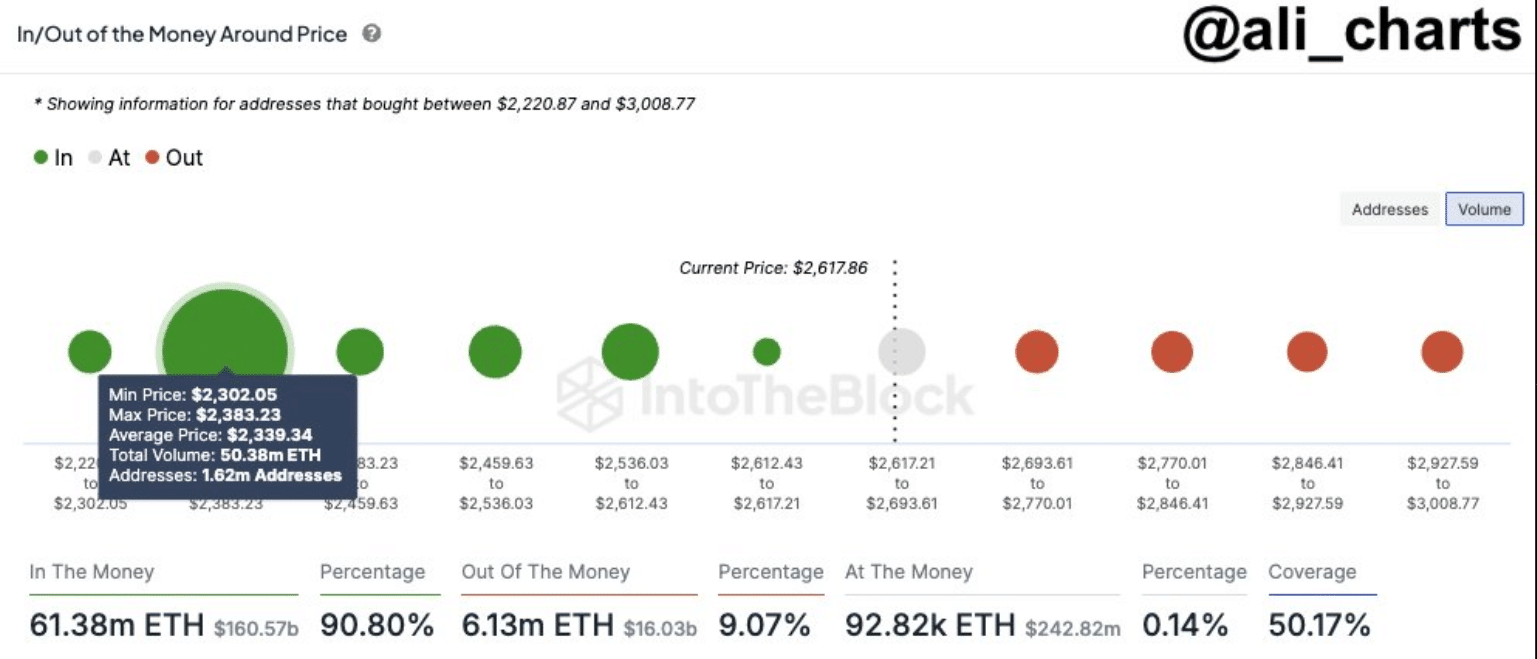

In a recent update, crypto analyst Ali Martinez highlighted a key support zone between $2,300 and $2,380 for Ethereum. The analyst revealed that within this range, approximately 1.62 million addresses collectively held 50.38 million $ETH at the time of the update.

The significance of this support zone lies in the large volume of $ETH held by these addresses. It represents the largest cluster of buyers who entered the Ethereum market after the $2,200 level to $3,000.

For comparison, in the $2,430 to $2,507 range, 1.4 million addresses hold only 3.74 million $ETH, whereas in the $2,278 to $2,340 range, 1.89 million wallets hold 50.4 million $ETH.

This concentration suggests that bearish market pressure will likely be more strongly defended around the $2,300 level, making it a critical point for market watchers.

Most Ethereum Investors In Profit

With Ethereum’s price at $2,617, over 61 million accumulated $ETH tokens are “in the money,” meaning investors are holding them at a profit. These tokens represent 90.80% of all Ethereum tokens purchased within the $2,220 to $3,000 price range, indicating that most $ETH holders are still in profit.

Additionally, according to Martinez’s chart, there’s an “At the Money” price range between $2,617.21 and $2,693.61. In this range, 92.82k addresses hold $242.82 million worth of $ETH, where investors are neither in profit nor at a loss.

This range reflects a current equilibrium point, providing insight into the ongoing struggle between buyers and sellers. However, Ethereum’s price must stay above these levels to avoid further bearish momentum.

Bearish Patterns Highlighted by Market Veteran

Renowned market veteran Peter Brandt recently contributed to the bearish sentiment surrounding Ethereum. Brandt highlighted a rising wedge formation on a four-hour chart, a pattern often seen as a precursor to a bearish reversal.

This week, Ethereum’s price retested a breakout point, briefly spiking above $2,700, but the momentum quickly faded. Brandt also observed that the 18-period simple moving average (SMA) acts as resistance at the wedge’s upper boundary, further weakening the upward trend.

Additionally, the declining average directional index (ADX) indicates a lack of strong directional movement in the market, reinforcing the likelihood of a downward breakout.

$ETH Long-Term Projections

Amid the current market uncertainty, some analysts remain optimistic about Ethereum’s long-term potential. A recent CoinGecko study presents varying price predictions, with estimates ranging from $4,400 to $166,000. Cathie Wood of Ark Invest offers the most bullish forecast, projecting a rise to $166,000 by 2032.

Meanwhile, other analysts suggest more modest short-term gains, with predictions ranging between $6,000 and $8,000. As Ethereum hovers near crucial support, these projections highlight the contrasting views on its future trajectory, making this a pivotal moment for $ETH holders.

thecryptobasic.com

thecryptobasic.com