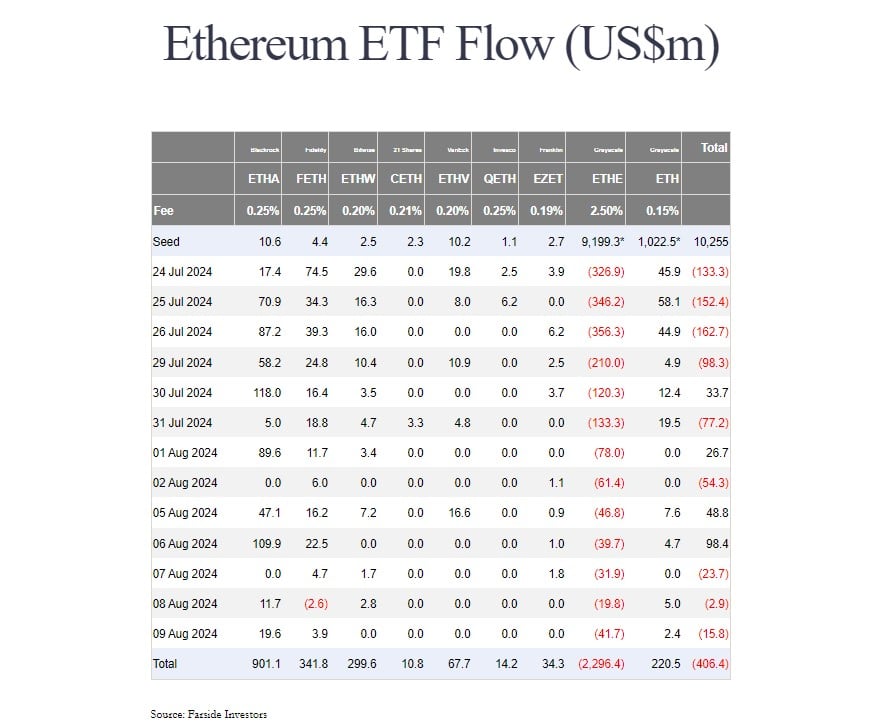

BlackRock’s Ethereum exchange-traded fund (ETF), the iShares Ethereum Trust, could become the first US spot Ethereum fund to hit $1 billion in net inflows. The ETF, trading under the ETHA ticker, has logged around $901 million in net capital just three weeks after its launch and is well on track to achieve the milestone, Farside Investors’ data shows.

Nate Geraci, the president of The ETF Store, is confident that ETHA will reach $1 billion in inflows this week, adding that it is one of the top six most successful ETF launches of the year.

iShares Ethereum ETF has taken in $900+mil in < 3 weeks…

Pretty much a lock to hit *$1bil* this week IMO.

As mentioned previously, ETHA already top 6 launch of 2024 (4 of 5 others are spot btc ETFs).

— Nate Geraci (@NateGeraci) August 12, 2024

BlackRock’s fund that offers direct exposure to Bitcoin (BTC), the iShares Bitcoin Trust or IBIT, was the first spot Bitcoin ETF to reach $1 billion in inflows. Thanks to consistent, massive inflows, it took the ETF only four days to cross the mark.

BlackRock’s ETF data indicates a slower accumulation rate for Ethereum compared to Bitcoin. The demand for Ethereum ETFs, while growing, has not yet matched the level of interest seen in Bitcoin ETFs. However, it’s not entirely unexpected.

Martin Leinweber, Director of Digital Asset Research & Strategy at MarketVector Indexes, previously said that he expected more modest inflows into Ethereum ETFs compared to the substantial inflows seen with Bitcoin ETFs, which have attracted billions in a short time.

Eric Balchunas, the popular Bloomberg ETF analyst, estimated that the demand for spot Ethereum ETFs may be around 15% to 20% of what is seen in Bitcoin ETFs. His projection came after the landmark approval of these products in May.

BlackRock’s ETHA could be the fastest-growing spot Ethereum ETF but Grayscale’s competing fund, the Grayscale Ethereum ETF (ETHE), still dominates managed assets despite enduring nearly $2.3 billion of outflows since it was converted from a trust.

ETHE currently holds $4,9 billion worth of Bitcoin while ETHA has over $761 million in assets under management (AUM). With the current accumulation speed, ETHA could soon surpass ETHA in AUM.

There’s a possibility that ETHA could top the Ethereum ETF market but more observations are needed, particularly when Grayscale has already offered its Ethereum Mini Trust.

The spin-off was seeded with 10% of the trust’s holdings and now has $935 million in AUM. Despite consistent capital into the low-cost fund, its net inflows are still modest compared to BlackRock’s ETHA inflows.

BlackRock’s IBIT has outpaced Grayscale’s Bitcoin ETF (GBTC) to become the largest spot Bitcoin fund in terms of Bitcoin holdings. As of today, the fund holds approximately 348,000 BTC, valued at around $21 billion.

cryptobriefing.com

cryptobriefing.com