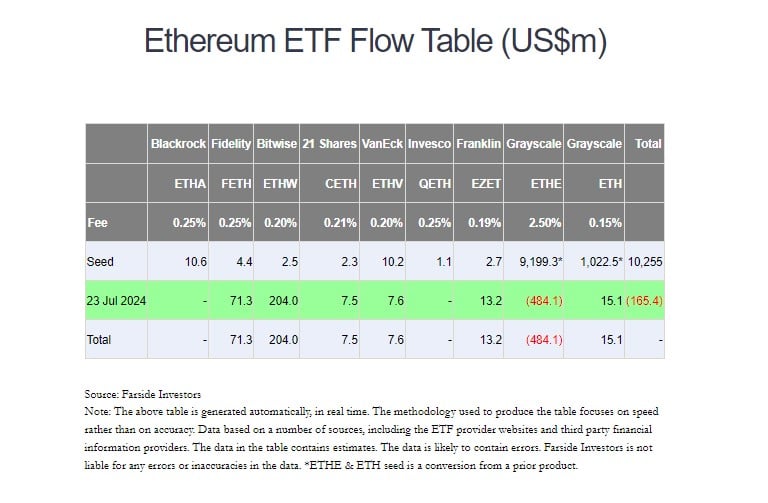

Investors pulled $484 million from the Grayscale Ethereum Trust (ETHE), now trading as an ETF, on its first day of trading, data from Farside reveals.

As reported by Crypto Briefing, $458 million worth of ETHE shares changed hands on the first day. The outflows now indicate significant selling activity. Bloomberg ETF analyst Eric Balchunas estimates the outflows representing around 5% of the fund’s total value.

“Not sure The Eight newbies can offset [with] inflows at this magnitude. On flip side maybe its for best to just get it over with fast, like ripping a band aid off,” Balchunas stated.

Grayscale has been a dominant player in the Ethereum investment market. Its Ethereum Trust is a leading option for regulated Ethereum investing, with over $9 billion in assets as of July 2024.

With other issuers now coming to market, there may be some rotation to these new products, particularly since Grayscale’s Ethereum ETF is considered more costly than others.

Similar to the experience with Grayscale’s Bitcoin Trust, outflows from the Grayscale Ethereum Trust are not entirely unexpected. With an expense ratio of 2.5%, ETHE is the most expensive US ETF that invests directly in Ethereum.

In contrast, the Grayscale Ethereum Mini Trust (ETH), the firm’s newly introduced product, is one of the lowest-cost spot Ethereum funds in the US market.

The management fee for the fund is 0.15% of the net asset value (NAV) of the trust. The 0.15% fee is waived for the first 6 months of trading or up to a maximum of $2 billion in assets under management (AUM).

ETH’s 0.15% fee undercuts competing spot Ethereum ETFs from providers like BlackRock, Fidelity, and Invesco which have fees ranging from 0.19% to 0.25%, as reported by Crypto Briefing.

cryptobriefing.com

cryptobriefing.com