- Ethereum ETFs close to finish line, says Bitwise executive.

- Ethereum investors are buying the dip despite FUD from potential Golem selling spree.

- Ethereum bearish pressure has slowed, but key resistance could prove critical ahead of ETH ETF launch.

Ethereum (ETH) is up 2.3% on Wednesday as investors continue buying the dip in hopes of a rally following the launch of spot ETH ETFs. However, other key metrics like break-even prices and Golem sales provide a deeper understanding of what to expect as the launch draws nearer.

Daily digest market movers: Ethereum accumulation, Golem sales

With the potential launch of spot ETH ETFs drawing closer amid the wider market stagnancy, investors are readjusting their portfolios. Bitwise chief compliance officer Katherine Dowling confirmed that the launch is "close to the finish line."

"We're seeing in the S-1 amendments that there are fewer and fewer issues that are being vetted back and forth between issuers and the SEC," said Dowling in a Bloomberg interview.

"So that points all signs in the direction that we are close. We're close to the finish line on the launch," she added.

The Securities & Exchange Commission (SEC) approved spot ETH ETF issuers' 19b-4 filings in May, but the agency needs to greenlight their S-1s before the products can begin trading.

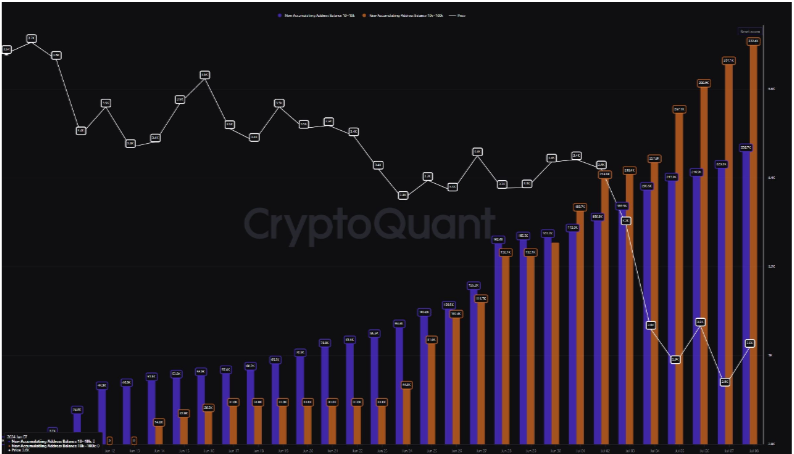

Ethereum's recent descent saw more investors accumulating the altcoin, as revealed in CryptoQuant's data. These investors are considering the dip as an opportunity to purchase ETH at a discount before ETH ETFs launch in tandem. The lower ETH goes, the more investors buy.

ETH New Accumulating Adresses Balance

Santiment data shows that some of these purchases have been flowing into staking platforms. The Ethereum 2.0 staking contract now holds 47.36 million ETH or about 34% of ETH's entire supply. Notably, the contract's holdings have more than tripled from just under 11% of ETH's supply it held in 2022.

ETH2 Beacon Deposit Contract

Meanwhile, Golem, which raised 820,000 ETH through an ICO in 2016, has been on a potential selling spree. After transferring 40,000 ETH to address "0x159a", the address deposited 3,000 ETH worth $9.3 million to Binance, Bitfinex and Coinbase in the past few hours, according to Lookonchain. Golem has deposited about 32,000 ETH to exchanges in the past six days.

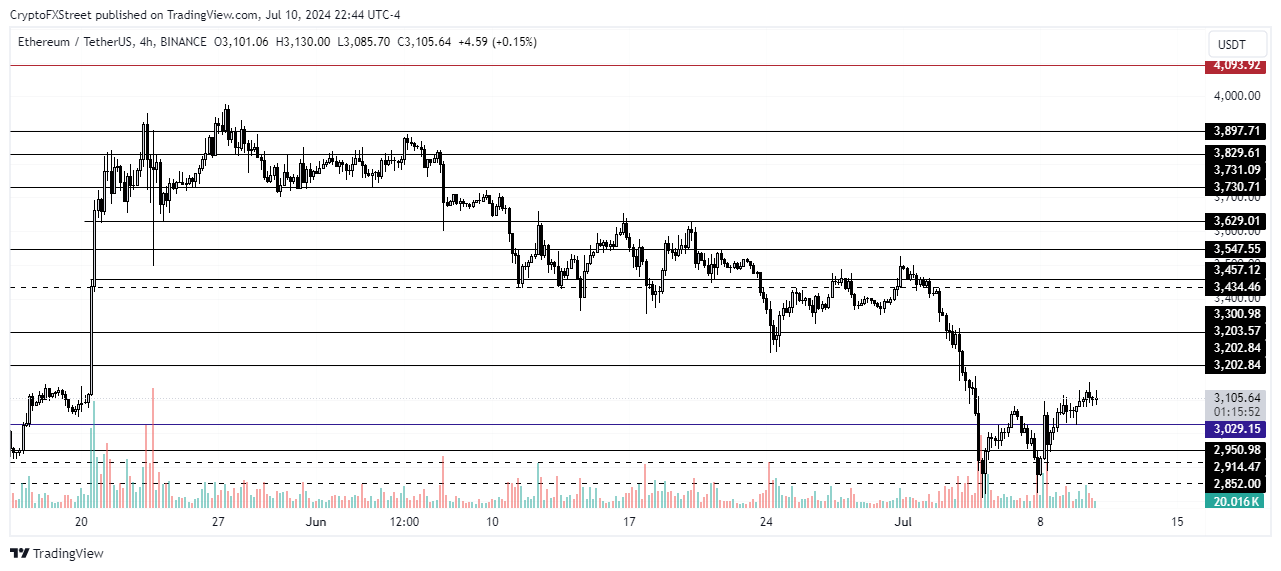

ETH technical analysis: Ethereum faces a key resistance at $3,200

Ethereum is trading around $3,130 on Wednesday, up 2.3% on the day. ETH's total liquidations in the past 24 hours are at $33.58 million, with long and short liquidations accounting for $23.18 million and $10.40 million, respectively, according to data from Coinglass.

ETH's long and short ratio shows traders are slowly reducing their bearish sentiment as the ratio has increased to 0.989. However, Ethereum's Fear and Greed Index is at number 30, indicating fear persists in the market despite increasing accumulation from whale addresses.

Into The Block's data shows that more than 5.6 million addresses broke even after ETH reached $3,000, a potential sell sign for these addresses.

It could be that whales bullish on the ETH ETF approval accumulated selling pressure from retail traders who potentially sold off their tokens after ETH reclaimed the $3,000 psychological level.

As ETH's price slowly tilts toward the upside, it may face a resistance at the $3,200 level. According to IntoTheBlock, approximately 2 million addresses that purchased ETH around this level could sell if they break even. However, a price catalyst like the ETH ETF going live can prevent such a move.

ETH/USDT 4-hour chart

On the downside, the $2,800 to $2,852 level remains a key support if the bearish pressure increases.In the short term, ETH could bounce off the $3,064 level, where $3.32 million ETH longs risk liquidation.

fxstreet.com

fxstreet.com