The Ethereum price has experienced significant volatility recently, rebounding from a low of $2,800 to the current critical level of $3,000. This recovery, marked by a +3% increase in the past 24 hours, comes amid broader market fluctuations and an 11% decline over the past week. With the crypto community closely monitoring the market, the key question is: What lies ahead for Ethereum? In this article, we will delve into the latest trends, provide an Ethereum price prediction, and discuss the implications of potential further declines or recoveries.

Ethereum Price Prediction: Current Status and Future Outlook

Ethereum Price Today: Overview and Analysis

As of today, the Ethereum price is hovering around $3,000, a crucial level that could determine its near-term direction. This price reflects a modest 24-hour performance increase of +3%, signaling a short-term recovery. However, the past week has been marked by a -11% decline, highlighting the underlying volatility and uncertainty in the market. These fluctuations are common in the cryptocurrency space, making it challenging to provide a definitive Ethereum price prediction.

Ethereum Price Prediction: What to Expect Next?

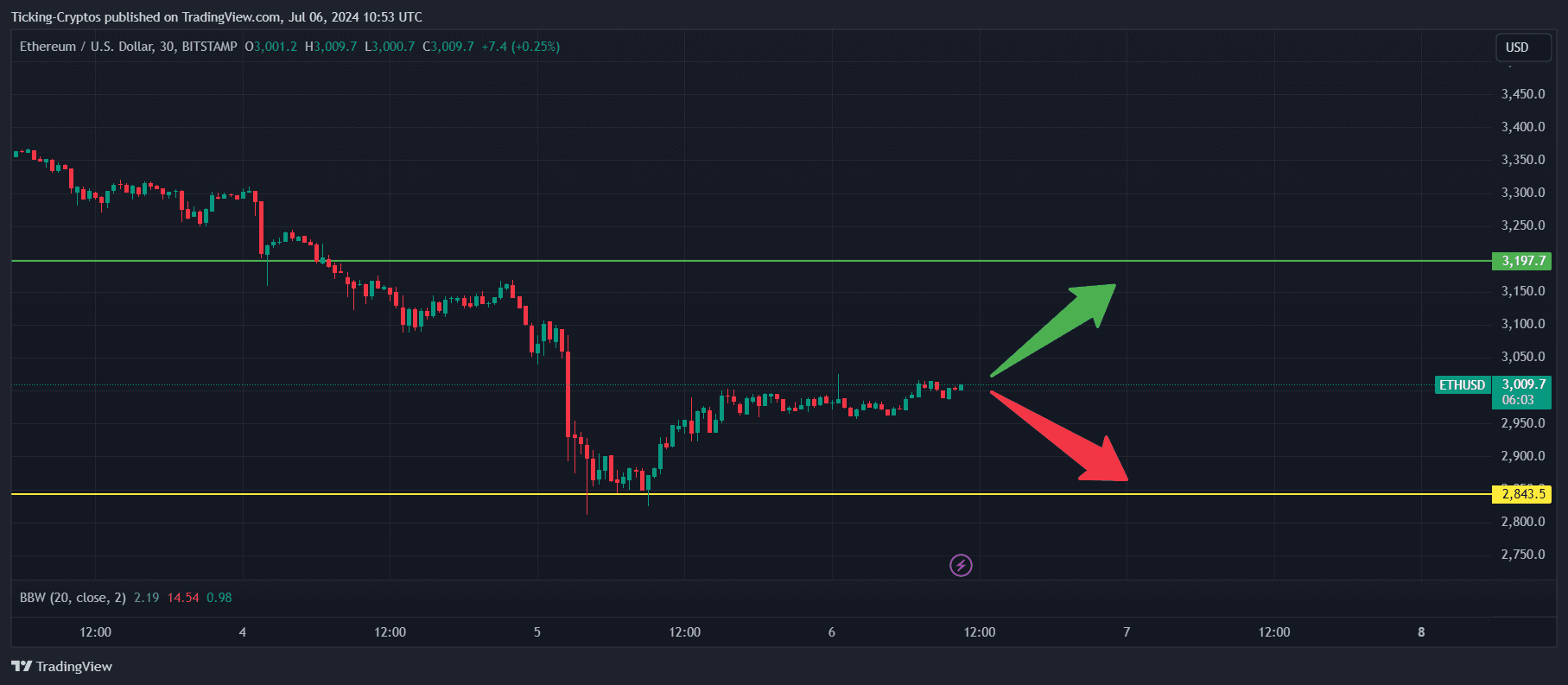

When looking at the future of Ethereum, there are two primary scenarios to consider:

Recovery to $3,500: If Ethereum manages to stabilize at $3,200 and continue its upward momentum, it could potentially breach the $3,500 mark. This would signal a strong recovery and could restore investor confidence, leading to further gains. In Euro terms, with a current exchange rate of 1 Euro = 1.08 USD, this would equate to approximately €3,240.

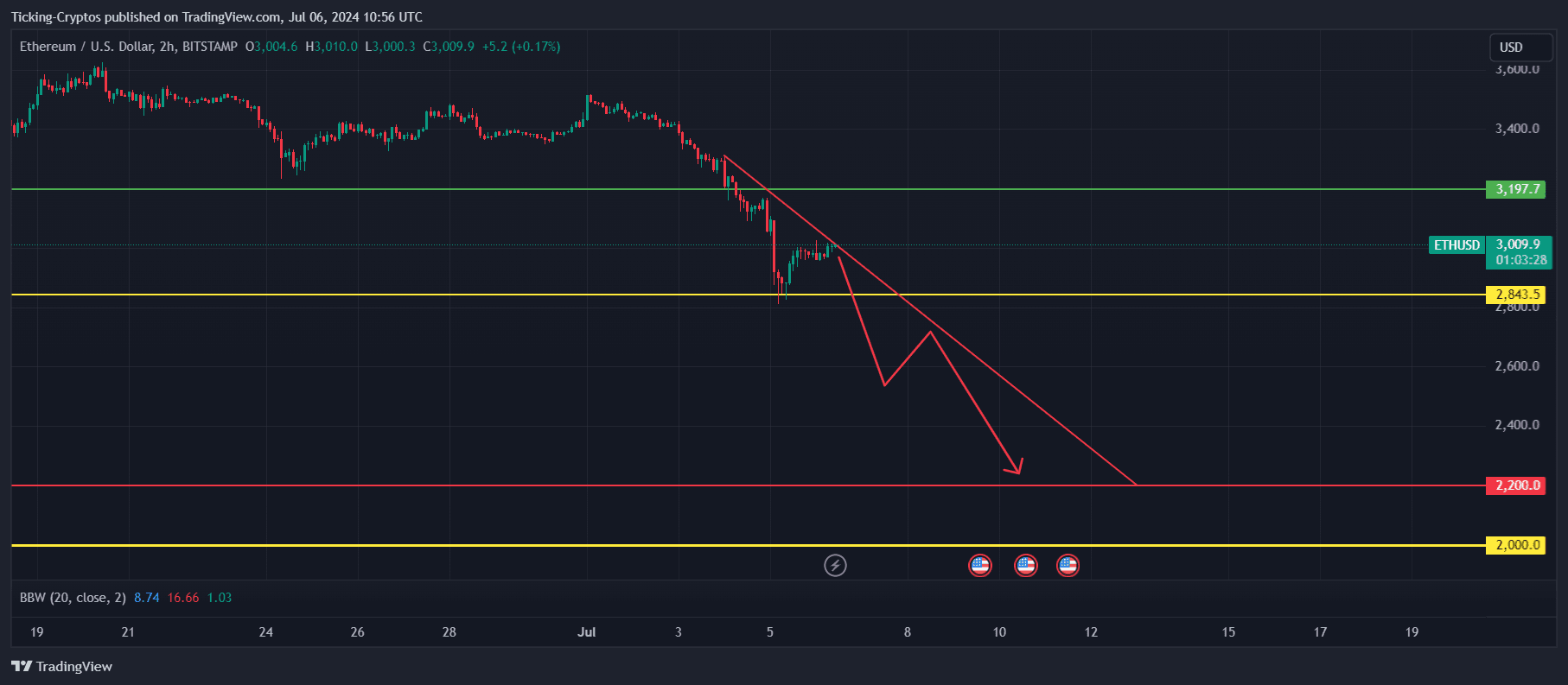

Decline to $2,000: On the other hand, if the Ethereum price fails to maintain the $3,000 level, it could fall back to $2,800 and possibly drop to $2,600. Should market conditions worsen, a further decline to $2,200 or even $2,000 is possible. These levels would be significant support zones that could either halt the decline or lead to more bearish sentiment.

Given these scenarios, the Ethereum price prediction remains uncertain and highly dependent on market trends and investor sentiment.

ETH/USD 30-mins chart - TradingView

Ethereum Price: Recent Performance and Trends

Over the past 24 hours, Ethereum has shown a +3% recovery, indicating some buying interest at lower levels. However, the overall 7-day performance reveals an 11% decline, reflecting broader market pressures and potential concerns among investors. This volatility underscores the need for careful analysis and monitoring of market conditions when considering the future direction of Ethereum.

Ethereum Price and News: Market Influences

The Ethereum price is influenced by a variety of factors, including broader market trends, investor sentiment, and news developments. Recent Ethereum news has highlighted the cryptocurrency's resilience despite market fluctuations. For example, Ethereum's recent rebound from $2,800 to $3,000 suggests that there is still strong support at lower levels, even as the market remains cautious. Additionally, news about regulatory changes, technological advancements, and market sentiment can significantly impact Ethereum's price and future outlook.

Ethereum Crash: Potential Risks and Concerns

Despite the recent recovery, there are still concerns about a potential Ethereum crash. If the market continues to face downward pressure, there is a risk that Ethereum could experience further declines. The key support levels to watch are $2,800 and $2,600, which, if breached, could lead to a more significant drop to $2,200 or even $2,000. Investors should be aware of these risks and consider them when making decisions about their Ethereum holdings.

ETH/USD 2-hours chart - TradingView

cryptoticker.io

cryptoticker.io