What's happening?

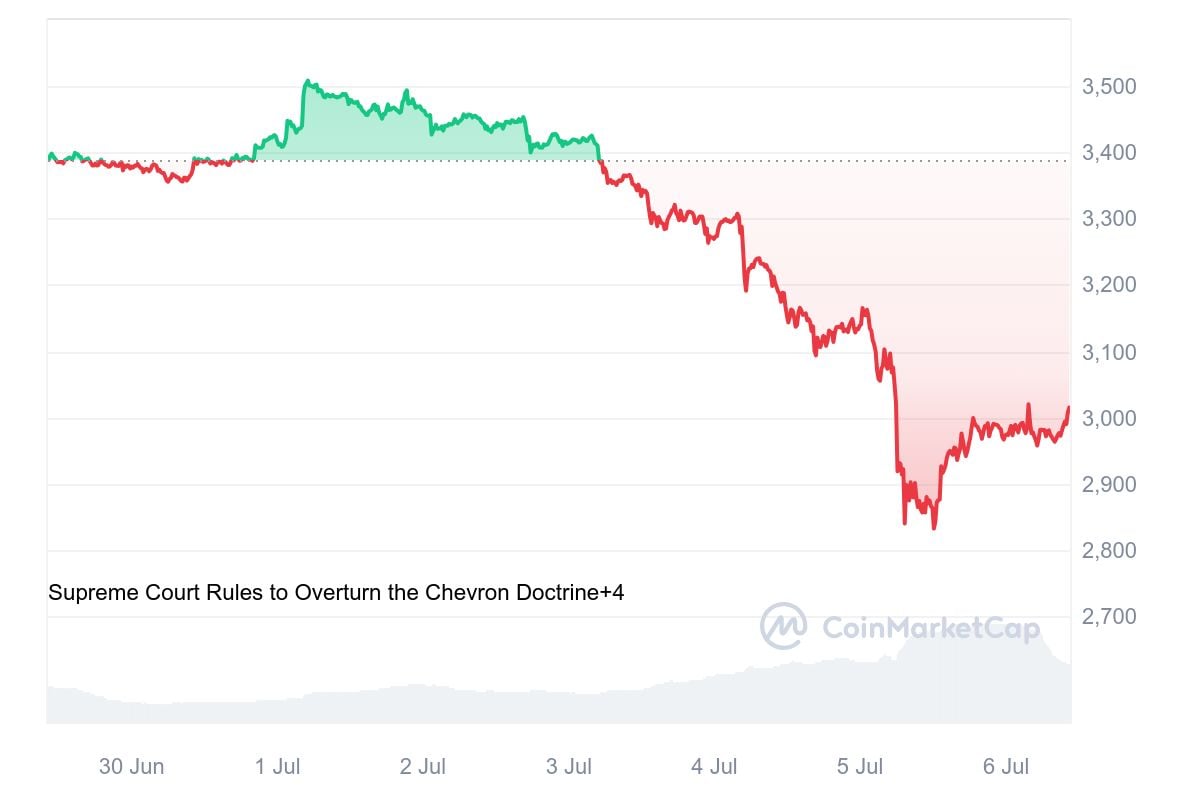

This past week Ethereum has witnessed a massive sell-off crisis, with the price dropping below $2,900.

A recent report by CoinShares highlights that Ethereum has experienced a massive capital outflow, the largest since August 2022, with total losses amounting to $119 million over the last couple of weeks.

This cointinues a trend from a week ago, when Ethereum's price dropped from a high of $3887 to a low of $3232, marking a 16.9% loss. Even though ETH's price may be stagnating at the moment, a surge in staking indicates that existing users believe in the long-term potential of ETH.

In the wake of ETF launch

According to Bloomberg, multiple applicants are supposed to submit their amended S-1 forms before July 8. This could mean that the final approval of S-1 forms is expected to take place by July 12, while the launch could happen somewhere the following week.

Asset managers are optimistic that the SEC will approve the first US ETFs that invest directly in Ether by mid-July. There was earlier market speculation that approval would come during the July 4 holiday week.

However, the SEC has informed Ether exchange-traded fund applicants that they have until July 8 to submit updated paperwork. There might be another round of filings after this date.

Some experts, such as Eric Balchunas, point out to an unnecessary pause on the SEC part.

No one really knows why the SEC is taking their sweet time with these, given how light comments were, these could have easily been trading by now. Could be one 'problem' issuer slowing down process or just summertime lazy/ppl on vaca. Not sure. That said, all indications launch…

— Eric Balchunas (@EricBalchunas) July 3, 2024

The SEC’s feedback to issuers consisted of minor questions that are now being addressed. In May, the SEC approved a proposal by exchanges to list these products, but a separate approval is needed before they can be launched.

Galaxy Digital’s head of asset management believes that spot Ether ETFs will be approved in “weeks” rather than days but agrees the decision will come sometime in July.

Who's joining In?

Asset manager Bitwise has filed an amended S-1 form for an Ethereum exchange-traded fund ahead of its July 8 deadline, indicating the products are nearly ready for launch. Other firms, including BlackRock Inc., Fidelity Investments, 21Shares, and Invesco, also have filings waiting for approval.

Many issuers have yet to disclose the fees on their respective funds, which is necessary before trading can begin.

Will the price follow?

Ether has underperformed relative to Bitcoin for over a year, with Bitcoin posting significant gains bolstered by over $14 billion in flows to its spot ETFs in 2024.

The anticipated launch of ETH ETFs on July 8 could be a "golden egg" for Ether's price action. However, Bitcoin is expected to face sell pressure as $8.5 billion worth is returned to creditors of the collapsed exchange Mt. Gox starting this week, according to a report by K33 analysts.

The 100 EMA frequently serves as a reliable gauge of the general trend, and a break below it could trigger a large sell-off. Having currently regained the critical $3,000 level, Ether now needs to reclaim the 3,360 support level before July 8. If it fails, the short-term rally might be paused for good.

u.today

u.today