Ethereum ($ETH) has been conquering traditional finance attention, especially among relevant institutional players. Now, Standard Chartered, a banking giant with over $822 billion in assets under management (AUM), has also made its move.

According to a Bloomberg report, Standard Chartered plans to offer Ether and Bitcoin (BTC) in a new crypto trading desk. If accomplished, the move will make StanChart the first major global bank to offer this service.

“We have been working closely with our regulators to support demand from our institutional clients to trade bitcoin and Ethereum, in line with our strategy to support clients across the wider digital asset ecosystem, from access and custody to tokenization and interoperability,” the bank said in a statement.

Furthermore, the bank already holds stakes in crypto-focused firms like Zodia Custody and Zodia Markets. Standard Chartered launched Libeara, a blockchain unit, to help institutions tokenize real-world assets, a use case leveraged by Ethereum’s network.

The bank remains bullish on the crypto sector, predicting Bitcoin will hit $150,000 in 2024, as reported by Finbold. In this context, we asked ChatGPT-4o for a price prediction on Ethereum, considering the recent support from Standard Chartered.

ChatGPT-4o Ethereum price prediction with Standard Chartered spot trading

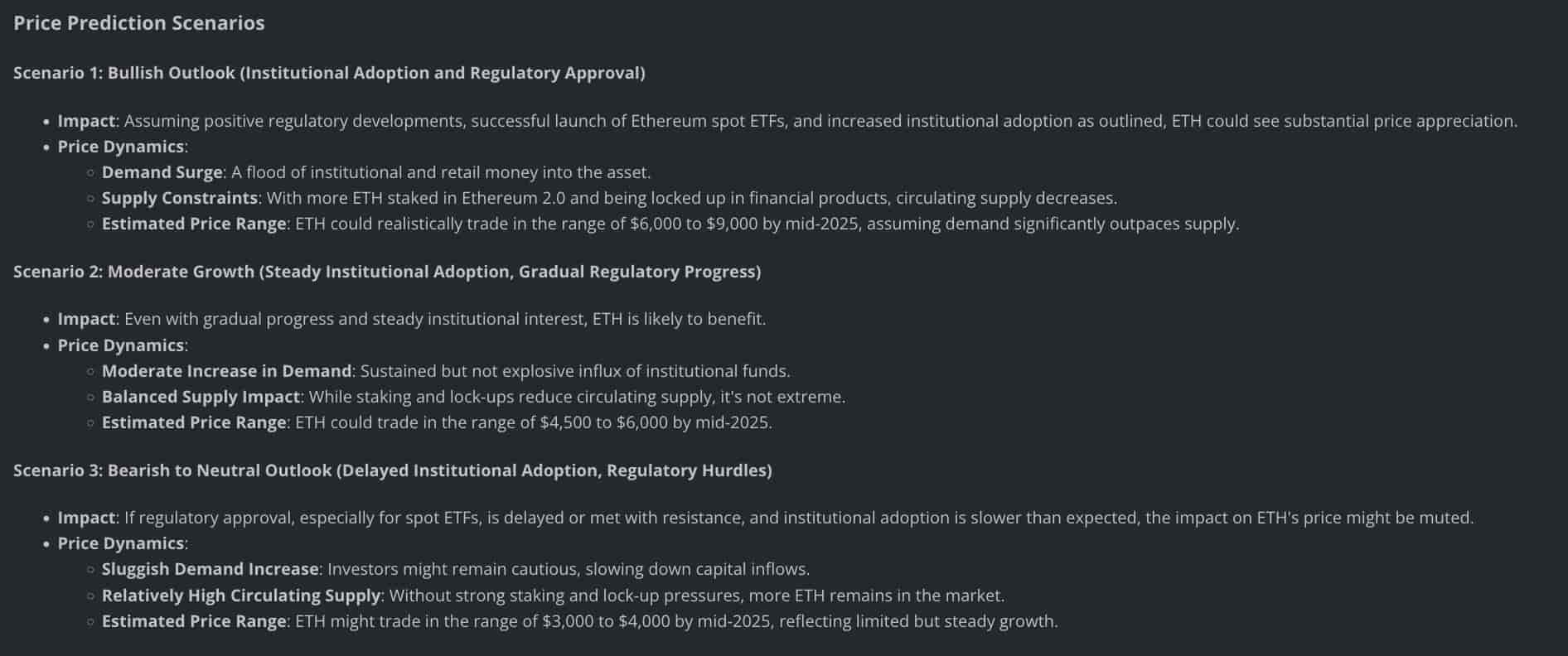

Notably, OpenAI‘s flagship product, ChatGPT-4o, mentioned that increased institutional adoption is a driving factor for Ethereum’s demand. The artificial intelligence (AI) chatbot provided three scenarios addressing a bullish, a moderate, and a bearish outlook.

First, ChatGPT forecasts $ETH to trade between $6,000 and $9,000 by mid-2025. This forecast assumes positive regulatory developments, successfully launched Ethereum spot ETFs, and increased institutional adoption.

A more moderate scenario puts Ether, the native token, between $4,500 to $6,000 by mid-2025, considering a sustained but not explosive influx of institutional funds. Meanwhile, Ethereum could remain at its current level between $3,000 to $4,000 if things do not play out as expected.

Ethereum ($ETH) price analysis

As of this writing, Ethereum trades at $3,496 per token, showing strong momentum in the one-year price chart. The leading Web3 cryptocurrency has gained 86% year-over-year, getting its launchpad ready for a significant surge if everything goes favorably.

A rally to the AI targets would result in up to 157% gains from current prices.

However, ChatGPT-4o can make mistakes, and $ETH’s success depends highly on the demand that its network can attract. Cryptocurrencies continue to be developed, some offering remarkable competitive advantages over Ethereum. Investors must be cautious and actively do their research to keep up-to-date with the market.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com