Ethereum addresses with at least 10,000 ETH ($37 million) as balance witness a remarkable spike in number amid a resurgence of accumulation among whales.

Notable on-chain analyst Ali Martinez first drew the public’s attention to this bullish trend, confirming that sentiments among whales have quickly flipped to the upside. This sudden switch comes despite Ethereum persistently battling the $3,800 price territory.

A Shift from Distribution to Accumulation

Citing data from Glassnode, Martinez showed that the mega-whale address count for Ethereum has recorded a remarkable shift, suggesting that the trend of distribution, which persisted since earlier this year, has concluded. Instead, mega whales have begun accumulating more tokens.

There’s been a notable increase in #Ethereum addresses holding 10,000+ $ETH, indicating a shift from distribution to accumulation! pic.twitter.com/afXTfpiK1I

— Ali (@ali_charts) May 30, 2024

The chart indicates that addresses holding at least 10,000 ETH ($37.8 million) had seen a drop since the first quarter of this year. This decline in number persisted until May 20, when they plummeted below 1,000. Now, these addresses have continued to increase, surpassing the 1,000 mark again and reaching levels last seen in mid-April.

Breakdown of Ethereum Whale Addresses

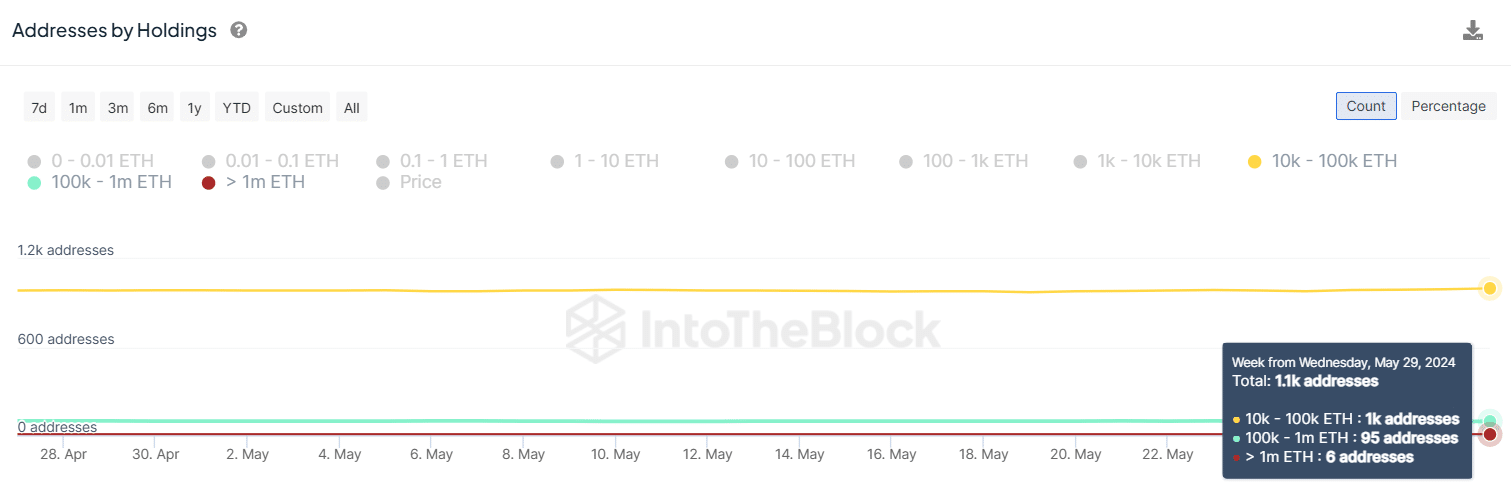

Data from IntoTheBlock shares more insights into these wallets. As detailed in the chart below, addresses holding between 10,000 and 100,000 ETH have increased to 1,000 in number. Notably, this number was 980 as of May 25, suggesting an addition of 20 more addresses in four days.

However, in a contrasting trend, those holding between 100,000 and 1 million ETH dropped from 98 on May 25 to the current figure of 95. Meanwhile, the number of wallets with balances greater than 1 million ETH ($3.8 billion) remains fixed at 6.

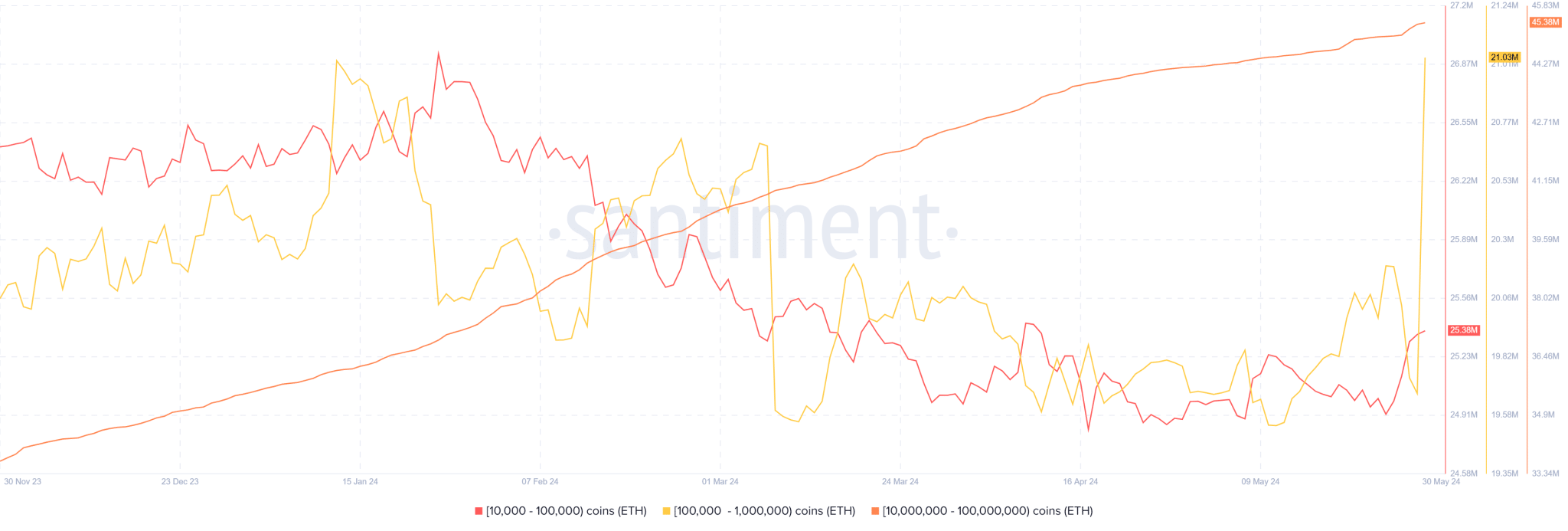

The contrast in this trend shows that while the bigger whales have reduced in number, the smaller ones have continued to increase at a greater pace. Interestingly, Santiment data confirms that despite the drop in wallets holding 100,000 to 1 million tokens, their cumulative balance has seen a sharp increase.

As of May 29, these addresses held 19.67 million ETH. Nonetheless, current data shows that they now hold 21.03 million Ethereum. This change indicates that these wallets accumulated 1.36 million ETH tokens worth $5.1 billion within a single day.

While addresses holding 10,000 to 100,000 ETH and those with 10,000,000 to 100,000,000 tokens have also amassed more tokens within the same timeframe, the increase in their balances is much lower than what was observed with addresses holding between 100,000 and 1 million ETH.

Whale Wallets Procure 1M ETH in 3 Weeks

As a result of this accumulation spree, wallets with at least 10,000 ETH as balance now hold 100.84 million tokens, representing 84% of Ethereum’s circulating supply. This figure was 99.8 million as of May 10, indicating that these addresses have cumulatively increased their balances by 1 million ETH in the last three weeks.

Meanwhile, Ethereum has failed to decisively tower above the $3,800 price threshold. The previous rally on the back of the spot ETF news saw it breach this level, but it faced resistance at the $3,900 zone. The ensuing retracement has brought it below $3,800, currently trading for $3,789 at the reporting time.

thecryptobasic.com

thecryptobasic.com