Ethereum (ETH) is stuck in a long-term downtrend, bringing the world’s biggest altcoin below $3,000.

However, the presence of investors’ confidence and a potential breakout from a bullish pattern could be key to recovery.

Ethereum Investors Remain Optimistic

Ethereum’s price is already below the $3,000 mark, and any further decline could lead to the altcoin noting a two-month low. However, the chances of this happening are lowered as investors move away from causing further bearishness.

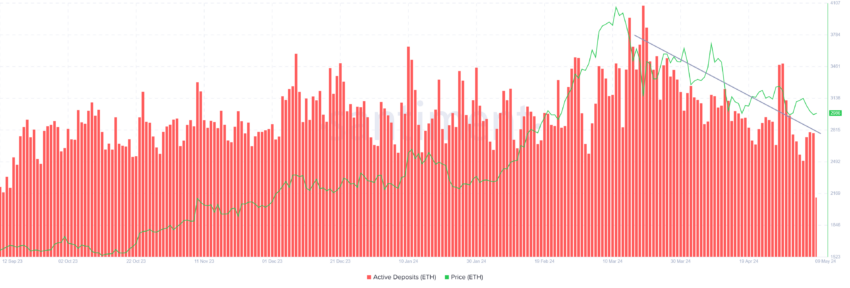

Evidence of this can be seen in their recent behavior, particularly the selling spree that has slowed down over the past few weeks. The active deposits measure the movement of coins into exchange wallets. Generally, a spike in this metric is an indication of potential selling.

In the case of ETH, these deposits have noted a decline, which suggests that the investors are likely moving away from selling. As a result, the altcoin could also witness a slowdown in the price drop.

Furthermore, upon distributing the active addresses by profitability, one can notice that the dominance of investors in profit has reduced. Their presence is a bearish sign that ETH holders are looking to sell.

These investors, however, only comprise 15% of all the investors conducting transactions on the network. On the other hand, investors in loss have noted a massive 15% increase in the past two months. This is a signal that selling is slowing down and HODLing is increasing.

Read More: How to Invest in Ethereum ETFs?

Those in losses anticipate a price rise and are active on the network, which translates to conviction and confidence. This is key in driving the potential recovery rally for ETH.

ETH Price Prediction: Escaping the Wedge

Ethereum’s price is currently in a descending wedge and is close to marking a breakout. This could happen with the support of the investors, based on the aforementioned factors.

A descending wedge is a bullish reversal pattern that hints at a potential rally following a breakout above the upper trend line. In the case of ETH, this breakout could result in a 28% rally, sending the altcoin to $4,000, the target set by the pattern.

However, a more realistic outlook would be reclaiming $3,000 again, pushing the price to flip $3,500 into support.

Read More: Ethereum (ETH) Price Prediction 2024/2025/2030

However, Ethereum’s price could fall below the lower trend line at $2,800 if the drawdown continues. This will extend the losses, potentially pushing ETH to $2,600, invalidating the bullish thesis.

beincrypto.com

beincrypto.com