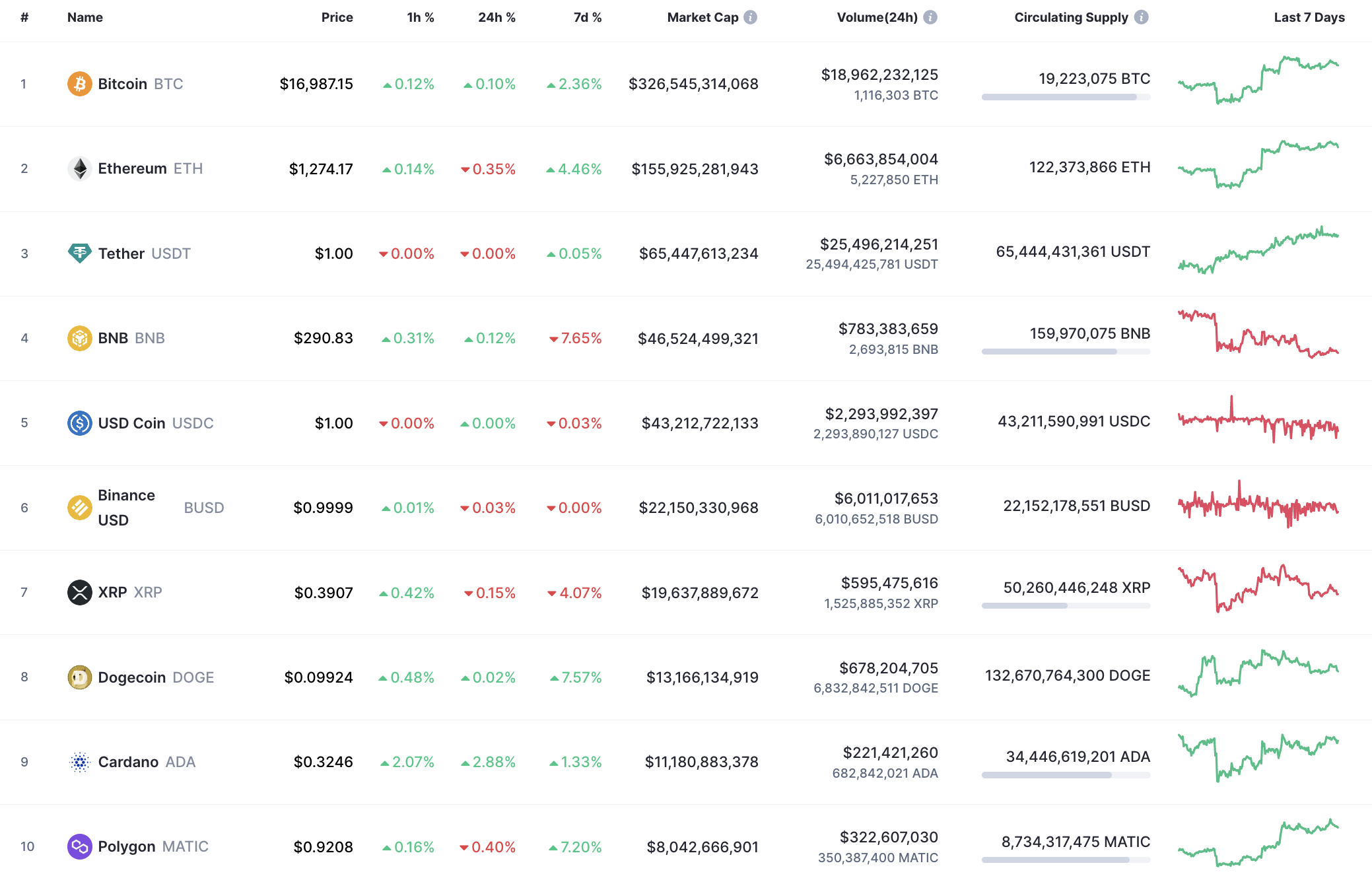

The cryptocurrency market is currently neutral as neither buyers nor sellers are controlling the situation.

ETH/USD

Ethereum (ETH) is looking worse than Bitcoin (BTC), going down by 0.35% since yesterday.

ETH/USD chart by TradingView" size="2074}" src="https://cnews24.ru/uploads/a63/a637c3d149a9062ab1ea502dba14cb709a09808d.png">

After the false breakout of the local support level at $1,267, the price of Ethereum (ETH) remains weak, which means that there is a high chance to see a retest.

If that happens, the fall may continue to the $1,250 zone.

ETH/USD chart by TradingView" size="3479}" src="https://cnews24.ru/uploads/d60/d60f1781dfa7af8c6d2784f022eb3df0ae170bd1.png">

The situation is similar on the daily chart, as Ethereum (ETH) is about to close below yesterday's low at $1,264. In this regard, there is a high probability to see a decline to the closest support at $1,233. Such a scenario is relevant until the end of the upcoming week.

ETH/USD chart by TradingView" size="4900}" src="https://cnews24.ru/uploads/85b/85b09b3bd7c769a2b1e70f27c948c7b9b5681f3a.png">

The weekly time frame gives traders hope for midterm growth. It can only occur if the bar closes near the $1,290 mark or above. All in all, the strength might be enough for a price blast to the $1,350-$1,400 area. Thus, the selling volume is low, confirming bears' weakness.

Ethereum is trading at $1,271 at press time.

u.today

u.today