Ether (ETH) has turned deflationary for the first time since the token's parent blockchain Ethereum changed how it processes transactions nearly two months ago.

Data from ultrasound.money shows the second-largest cryptocurrency's net issuance, or the annualized inflation rate, has dropped to 0.029%, indicating that the leading smart contract blockchain is now burning more ether than what's being minted.

The negative inflation rate means ether's net supply has declined by 5,598 since Ethereum transitioned to a proof-of-stake (PoS) consensus mechanism of verifying transactions from a proof-of-work (PoW) mechanism on Sept. 15. Ether's supply would have increased by nearly 670,000 had Ethereum continued to use the PoW mechanism.

The upgrade, dubbed Merge, put ether on the path to becoming a deflationary asset by replacing miners with validators as entities responsible for running the blockchain and causing a drastic reduction in the newly minted ETH. Ether's annualized inflation rate crashed from over 3.5% to nearly zero following the Merge.

The deflationary milestone, however, remained elusive for nearly two months before finally being reached, with the recent increase in the Ethereum network activity prompting an uptick in the amount of ether burned. That's a sign that ether's prospects as a deflationary asset heavily depend on the degree of network usage.

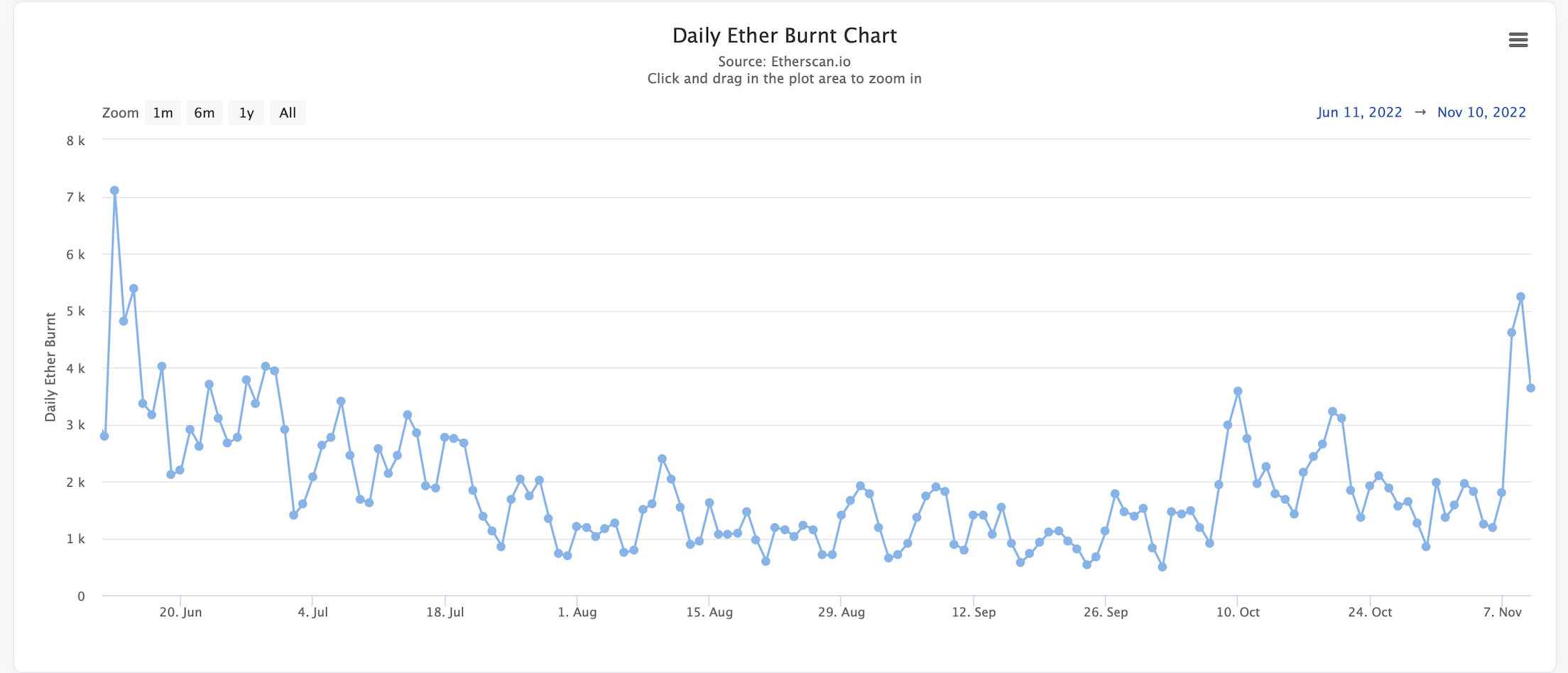

On Wednesday, more than 5,000 ETH was burned, the highest single-day tally since June, according to Etherscan. More than 13,000 ETH have been burned in the past three days alone. The Ethereum Improvement Proposal (EIP)-1559, implemented in August last year, introduced a mechanism to burn a portion of fees paid by users. The EIP is essentially tied the amount of ether burned with the network usage.

The amount of ether burned rose to a five-month high on Wednesday, indicating increased network usage. (Etherscan)

The latest increase in network usage could be attributed to market volatility triggered by the collapse of the cryptocurrency exchange FTX. Millions of dollars worth of crypto funds have been moved on-chain ever since FTX's liquidity woes became public. On Thursday, FTX's select customers were allowed to withdraw funds through Ethereum.

The positive change in ether's tokenomics could help the cryptocurrency outperform bitcoin and the wider market once the FTX-induced panic subsides.

At press time, ether changed hands at $1,270, representing a 1.7% decline on the day, according to CoinDesk data.

coindesk.com

coindesk.com