Solend users vote to limit a whale to avoid major liquidation. USDC tops USDT in the daily number of transactions but not in volume. Bancor pauses impermanent loss protection.

Key Takeaways

- Solend users, a Solana (SOL)-based DeFi platform, voted to limit the platform’s largest whale account to avoid a major liquidation event.

- USDC surpassed USDT‘s daily transactions on Ethereum (ETH). However, USDT maintained a significantly greater trading volume of US$55 billion against USDC‘s US$5.7 billion.

- Bancor (BNT) protocol paused its impermanent loss protection mechanism citing adverse market conditions.

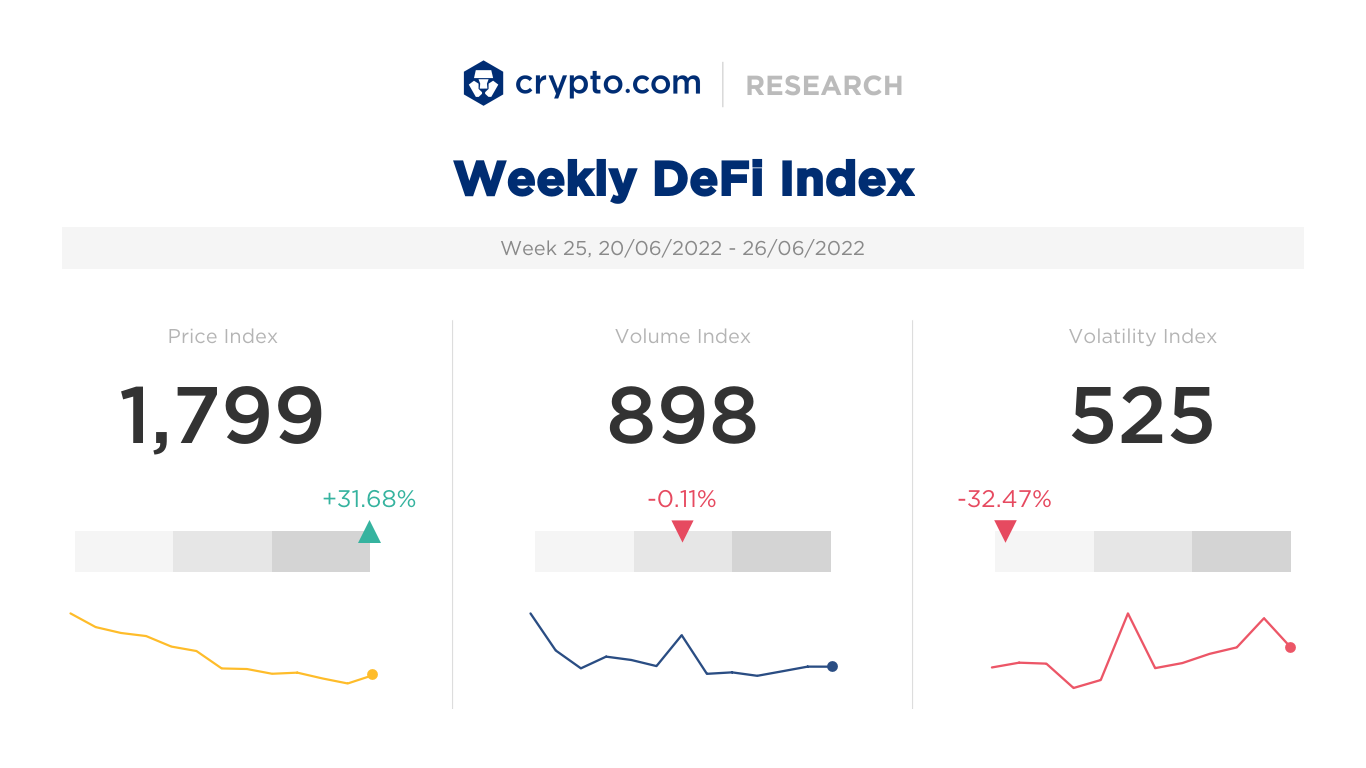

- This week’s price index was positive at +31.68%, while the volume and volatility indices were negative at -0.11% and -32.47%, respectively.

Highlights

- Celsius (CEL) recovery plan proposed amid community-led short-squeeze attempt

- Goldman Sachs leading investor group to buy Celsius assets: Sources

- Nexo threatens legal action against anonymous Twitter account

- Lido DAO (LDO) begins voting on whether to limit its Ethereum staking dominance

- Curve staking platform Convex suffers DNS hijacking

- Crypto broker Voyager lowers daily withdrawal limits from $25K to $10K

- Tether launches stablecoin pegged to the British Pound Sterling

- Tether (USDT) to undertake full audit by top 12 firm for transparency over USDT reserves

- MakerDAO pauses AAVE lending activities

- Uniswap (UNI) tops Ethereum in terms of daily fees

- DeFi moves into real estate with Tower Fund and Teller Protocol partnership

Check the latest prices on Crypto.com/Price

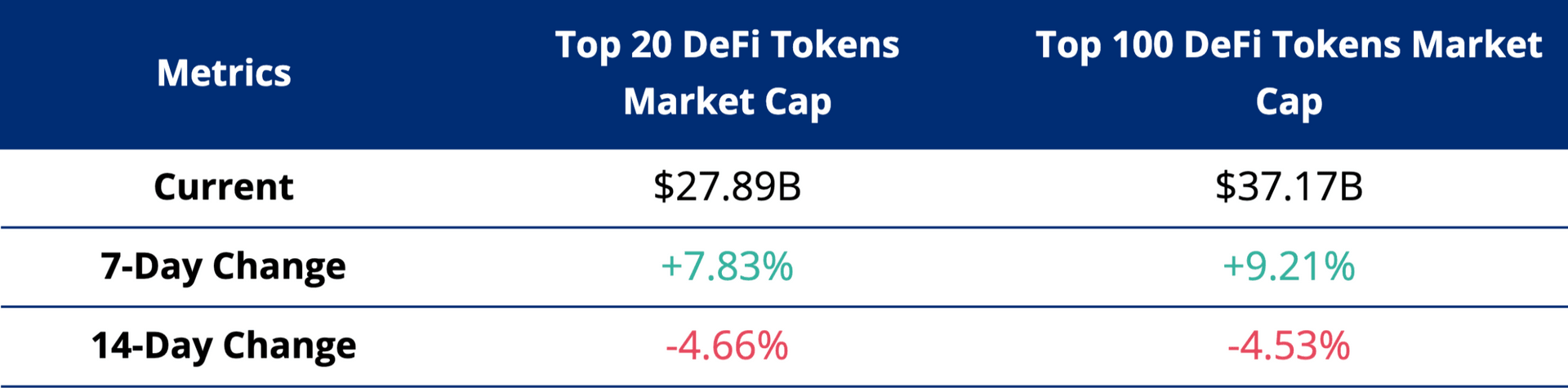

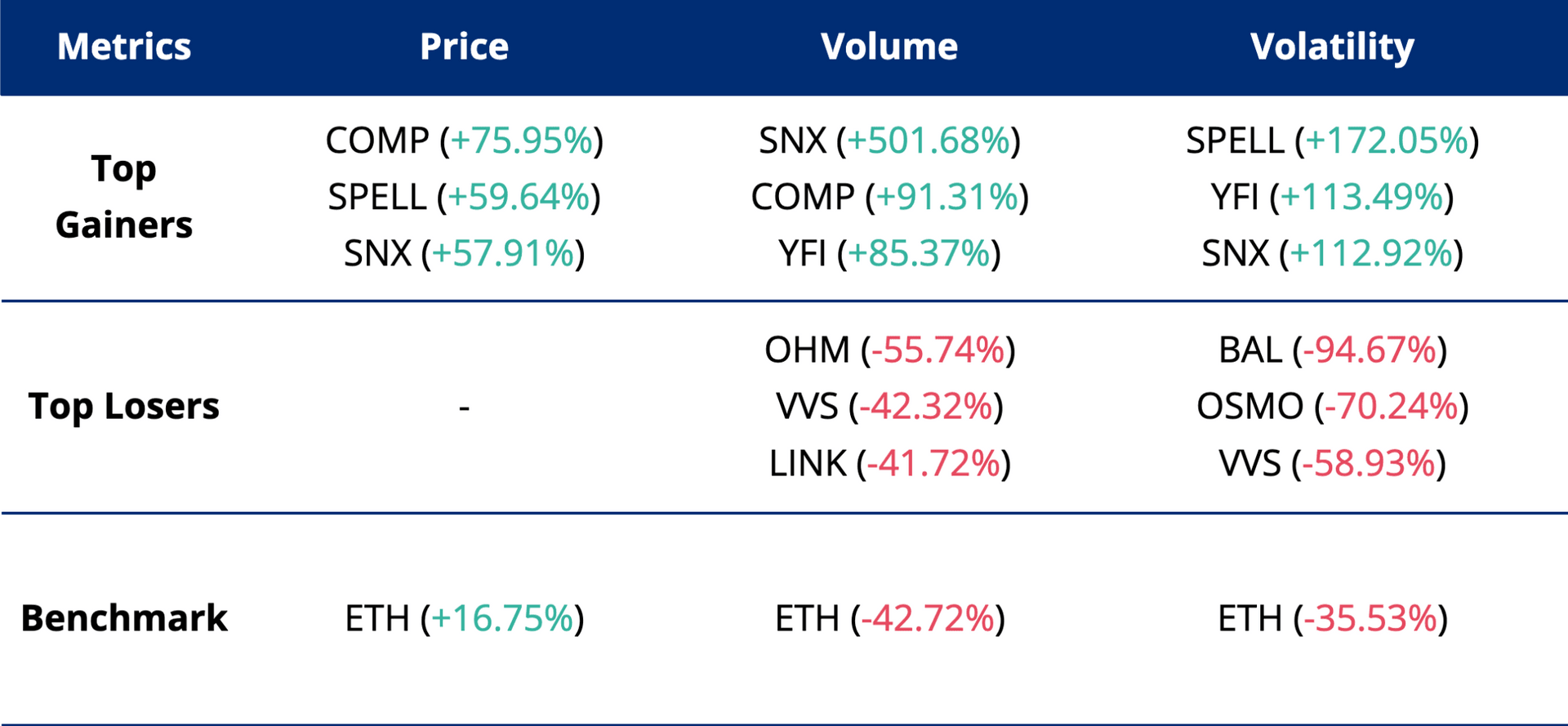

Top Token Metrics

DeFi Index Tokens

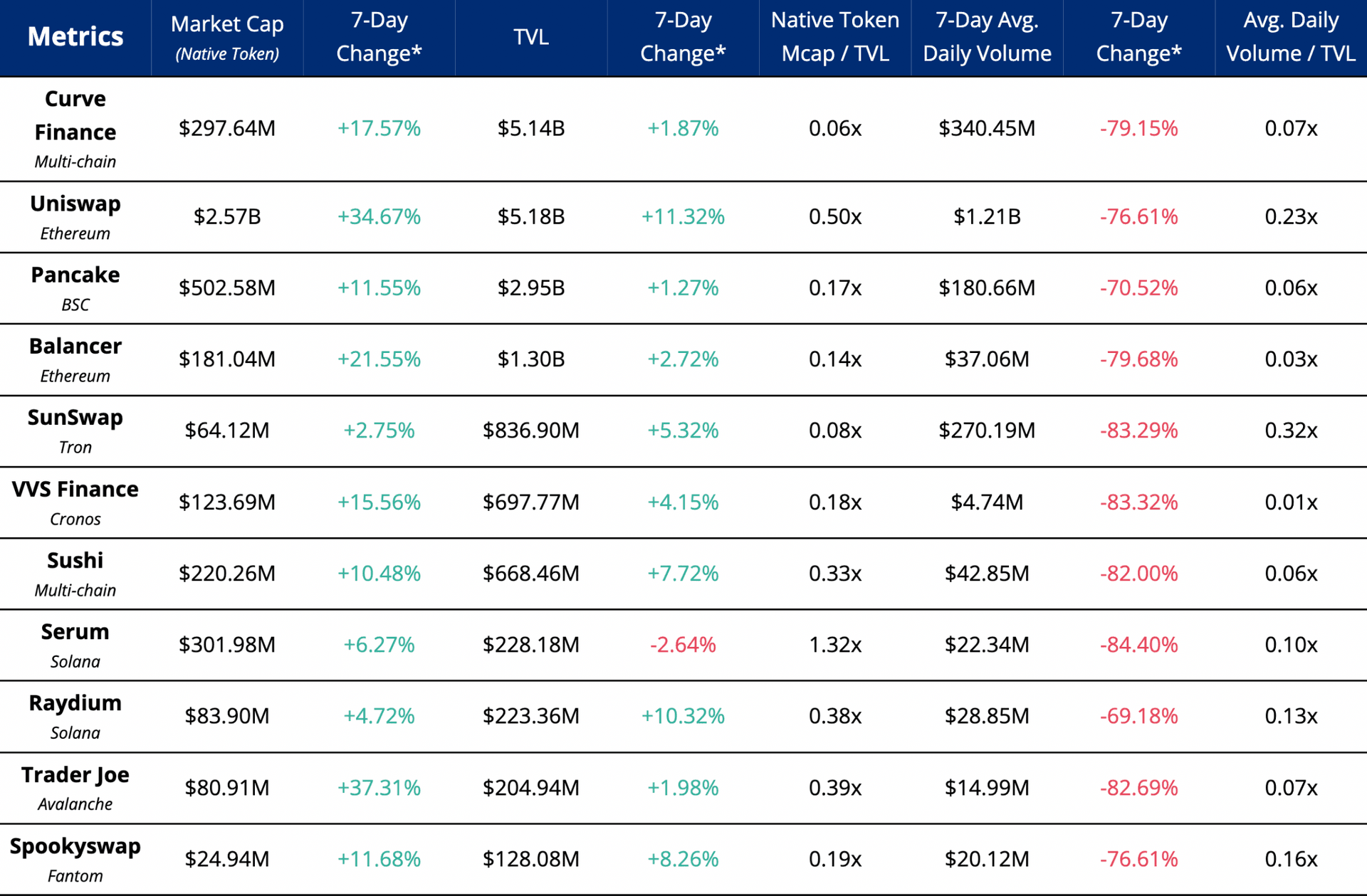

Dex Metrics

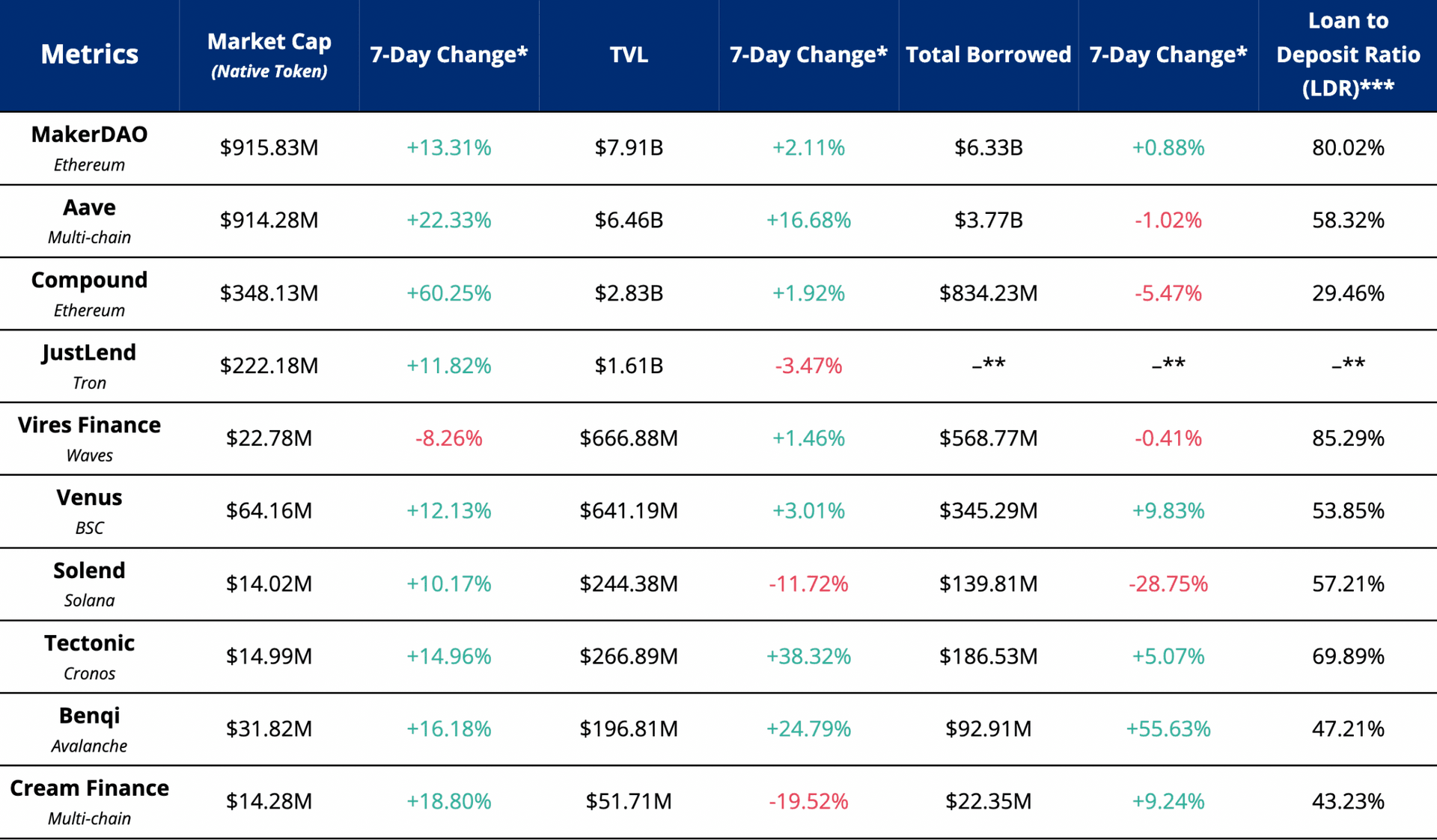

Lending Protocol Metrics

fxmag.com

fxmag.com