During this week’s crypto market crash, more than 27 million SOL tokens exited the Solana smart contract ecosystem. Solana’s DeFi TVL tanked by $840 million in just the last three days.

Solana, the Layer-1 competitor to the Ethereum blockchain network, has been under serious selling pressure. Amid the crypto market sell-off earlier this week, Solana (SOL) price corrected by a staggering 35% dropping all the way to $25. Solana has partially recovered since then and is currently trading above $30.

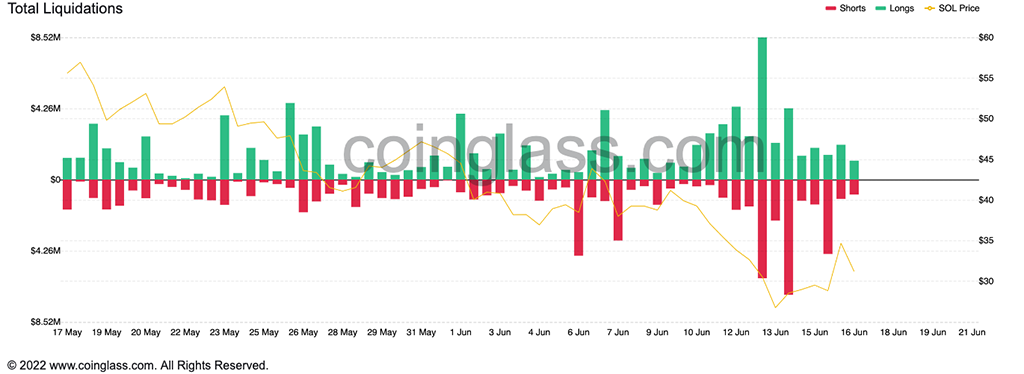

Solana faces intense selling pressure as the Fed announced 75 basis points jump in interest rates. As per data from Coinglass, Solana (SOL) faced liquidations to the tune of $10 million in the last 24 hours across multiple exchanges.

Since its peak of $267 last November 2021, Solana has seen a 90% erosion in its valuations. The recent fall comes amid the correction in the broader crypto space. The entire crypto market has been on a downward tailspin amid the fragile global macroeconomic conditions.

Major Liquidations in Solana Smart Contracts

Since the crypto market crash from June 13 until now, more than 27 million tokens have exited Solana’s smart contract ecosystem. On Thursday, June 16, the total value locked (TVL) on the Solana blockchain network dropped to 74.65 million SOL (~$2.25 billion).

In the last three days, there’s been a 27% crash in Solana DeFi TVL as per data on DeFi Llama. It means that the ninth-largest blockchain has seen smart contract withdrawals to the tune of $840 million in just three days.

These massive outflows suggest that investors aren’t willing to keep their SOL locked in DeFi protocols. This happens as there’s been a growing negative sentiment in the DeFi market recently after two major events, the Terra collapse last month and the Celsius Network liquidity crisis earlier this month.

Solana is likely to see more selling pressure going ahead without any major improvement in its macro or fundamentals. Solana has been dealing with a major problem of network outages recently. Over the last year, the Solana blockchain has faced nine major network outages and downturns.

Solana (SOL) Technical Charts

On the technical charts, Solana isn’t looking stronger either. On June 16, Solana (SOL) price retraced after facing resistance at $34. The cryptocurrency has formed an “ascending triangle” pattern on the technical charts.

Thus, breaking out of such a pattern in the bearish market can send prices further downside. If Solana breaks the downward trendline in the “ascending triangle” pattern, it can further see a price drop below $22.50.

coinspeaker.com

coinspeaker.com