Celsius pauses withdrawals, swaps, and transfers due to market conditions. Tron DAO boosts USDD reserves with $50M in crypto, while USDT and USDC announce new launches on Tezos and Polygon.

Key Takeaways

- Celsius (CEL) paused withdrawals, swaps, and transfers due to market conditions.

- Tron DAO bought US$50 million in Bitcoin (BTC) and Tron (TRX) to overcollateralise USDD. Meanwhile, Tether (USDT) and Circle (USDC) announced launches to Tezos and Polygon, respectively.

- JPMorgan announced plans for a blockchain-based settlement system and institutional-friendly DeFi liquidity pools.

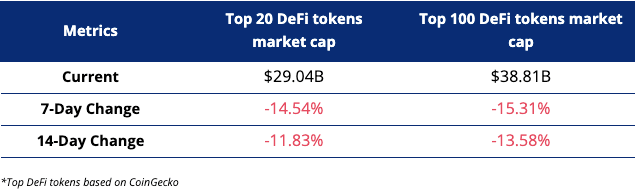

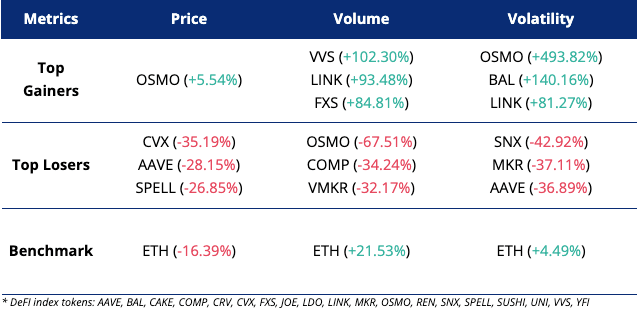

- This week’s volume index and volatility indices were positive at +13.55% and +11.63%, respectively, while the price index was negative at -15.79%.

Highlights

- ApeCoin DAO officially favours remaining within Ethereum ecosystem

- Lido-staked ETH (stETH) prices slip due to liquidity issues

- Algorithmic stablecoin unveils new ways to preserve its peg to U.S. dollar

- Number of DAOs increases 8x along with spike in votes and proposals

- Suspected exploit shuts down Elrond’s Maiar DEX

- DeFi convertible bond offering ‘a huge step forward for DAOs‘

- Terra Classic (LUNC) holders increase 500% in a month as investors bet on LUNC recovery

- GYM Network protocol hacked, US$2.1 million stolen: Here’s how

- Galaxy Digital leads US$20 million funding round in DeFi firm Skolem

- Osmosis (OSMO) chain halted after US$5 million exchange exploit

- Multicoin Capital leads US$60 million round in ‘Data DAO’ Delphia

- DeversiFi launches cross-chain swaps for bridgeless DeFi transactions

- Ripple and Stellar to help launch AUDC stablecoin for Novatti Group

- ApolloX completes new funding round, gets hacked of US$2.8 million APX tokens

Check the latest prices on Crypto.com/Price

Top Token Metrics

Source: CoinGecko

DeFi Index Tokens

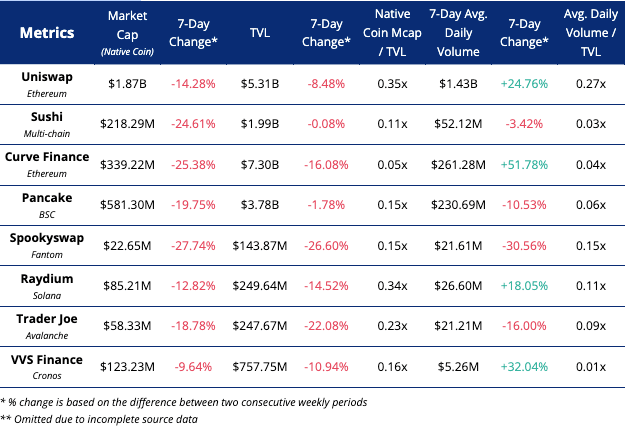

DEX Metrics

Sources: CoinGecko, DeFi Llama, Nomics

fxmag.com

fxmag.com