Robert Leshner, the well-known creator of the DeFi lending platform Compound Finance, has resigned from his position as the CEO of the DeFi lending protocol.

Leshner recently announced his plan to launch Superstate Trust, a new business venture. The creation of a short-term government bond fund is the goal of this endeavor. Notably, Superstate Trust has already raised $4 million in startup money from a variety of DeFi investors.

Compound (COMP), the native token of Compound Finance, is still on the rise despite Leshner’s resignation. COMP, which is currently trading at $55.87, has experienced a spectacular rise in value of 22.47% over the last two days.

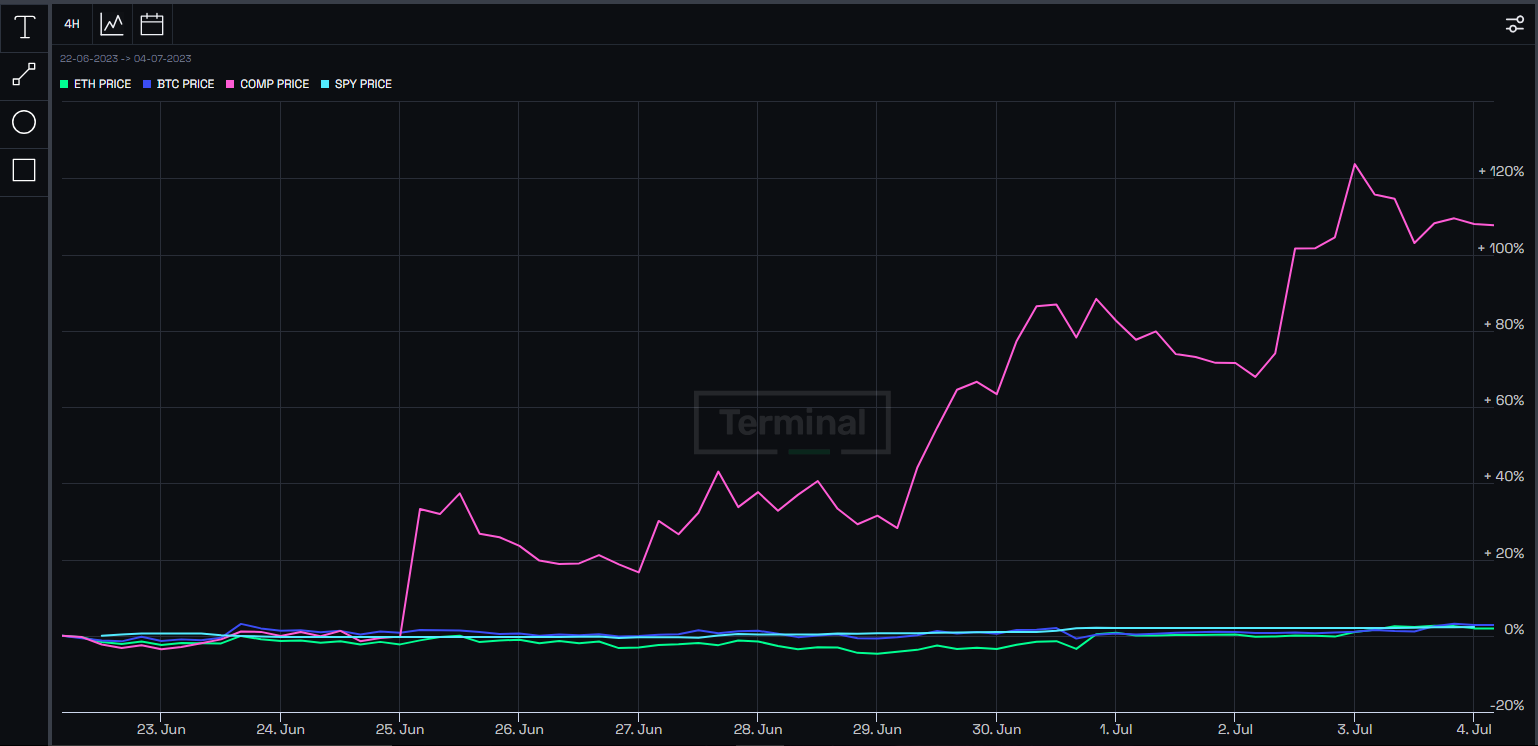

The Defiant Terminal reports that Compound Finance has $2 billion in assets and that its governance token COMP has increased by over 100% in the last week.

Significant digital assets including Bitcoin (BTC), Ethereum (ETH), and the S&P 500 have all increased by less than 3% during that time period.

This outstanding performance demonstrates Compound’s (COMP) robustness and adaptability in the face of organizational changes and reflects increased investor trust in the token’s potential.

Compound (COMP) token soars after CEO quits. Source: The Defiant Terminal

Compound supporters believe that recent significant cryptocurrency ownership outflows by important market participants are clear signs that the price of Compound (COMP) will continue to rise.

These backers are optimistic that Compound and its chances for future growth are looking good thanks to the withdrawals made by crypto whales, who own substantial sums of digital assets.

Bullish investors predict Compound may even surpass the remarkable valuation of about $80 in the upcoming weeks as a result. This upbeat attitude is based on the idea that these powerful players’ withdrawal activities reveal their trust and confidence in Compound’s long-term potential, acting as a catalyst for the stock’s upward trend.

COMP market cap currently at $431 million. Chart: TradingView.com

The Superstate assets will have the chance to be represented on the Ethereum blockchain, claims a prospectus filed with the Securities and Exchange Commission. The prospectus stressed the use of blockchain technology and the advantages of “operational efficiencies” that come with it.

On the Ethereum blockchain, Compound is a protocol for an algorithmic money market. In particular, the current DeFi craze is ascribed to this network for initiating it.

In the middle of the summer of 2020, Compound was the first platform to introduce yield farming to the market. In many ways, yield farming is comparable to staking cryptocurrency.

Leshner established one of DeFi’s earliest protocols to draw substantial asset contributions. Compound and a few other protocols, including MakerDAO, were among the first to demonstrate that blockchains might be used for purposes more than just transferring tokens.

The DeFi Summer liquidity mining boom began with COMP’s introduction in June 2020.

Meanwhile, rumors spreading across social media that COMP holders would get some form of airdrop from Superstate provide a potential reason for the price movement of COMP.

However, there has been no formal statement from Superstate stating that COMP will participate in the activities of the new company.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from InsideBitcoins

newsbtc.com

newsbtc.com