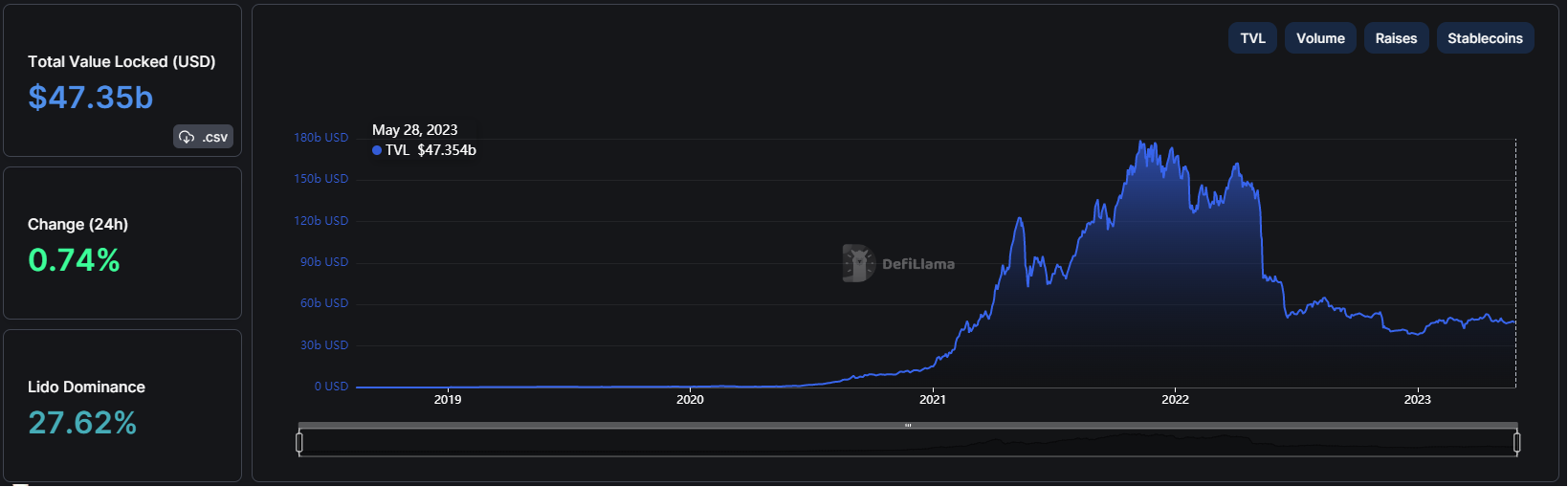

Executive Summary: Yield farming propelled the DeFi sector to a $150 billion market in the span of just 18 months. What does the space look like after the recent crypto winter?

In this new sector report, we’ll look at the top yield farming companies in DeFi. We’ll also cover our investment thesis on this sector, to help you identify the top opportunities.

Industry Overview

Yield farming has been variously described as the lifeblood or rocket fuel of the DeFi ecosystem.

It first emerged as an investing strategy in 2020, with “liquidity mining” on the Compound protocol. Investors deposited crypto assets into Compound to earn interest or “yield.” In just two months, the Total Value Locked (TVL) in DeFi went up by $2 billion.

Yield farming provided high returns, at a time when traditional banks were offering extremely low interest rates. Over the next two years, yield farming attracted over $150 billion into DeFi protocols, firmly establishing it as the “next big thing” in crypto. According to Nansen, the growth in the field between 2020 and 2022 was over 6,900%.

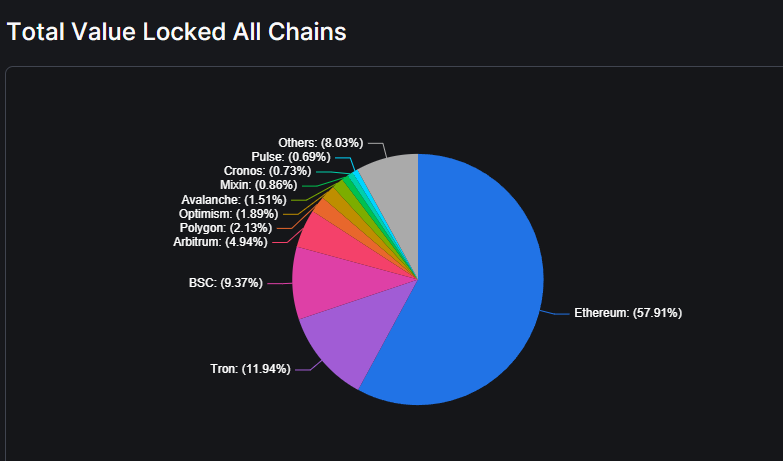

Although there has been a 76% decline in DeFi protocols since 2022, the sector is still valued at $47.3 billion in TVL. The Ethereum blockchain hosts more than 57% of all DeFi yield farming activity, followed by Tron (11.94%) and Binance Smart Chain (9.37%).

Among the top protocols, there is considerable diversity. Decentralized exchanges are the most dominant platforms for yield farming, led by Uniswap and Curve Finance. DeFi lending is another hotbed of activity, mainly centered on protocols like Aave.

Stablecoins continue to play a decisive role in the evolution of DeFi and yield farming. Given their low volatility, coins like USDC and USDT have emerged as popular farming and staking options.

Capitalizing on this trend, many DeFi protocols are in the process of launching native stablecoins. Curve Finance was the first to achieve this milestone with the issuance of crvUSD on the Ethereum mainnet in May 2023.

In a time of rising traditional yields, does yield farming and the wider DeFi scene still retain any value for investors? To address this question, let’s take a closer look at the top six yield farming companies in DeFi.

Top Yield Farming Companies

| Company | Ticker | Market Cap | TVL | Fees (annualized) | Median APY |

| Uniswap | UNI | $3.83b | $4.12b | $457.57m | 6.01% (V3)

1.66% (V2) |

| Aave | AAVE | $929.48m | $3.83b | $65.18m | 0.96% (V2)

1.40% (V3) |

| Synthetix Network | SNX | $744m | $415.22m | $46.42m | N/A |

| Curve Finance | CRV | $673.64m | $4.22b | $6.55m | 0.99% |

| PancakeSwap | CAKE | $331.55m | $1.94b | $234.24m | 14.81% (V3)

4.93% (V1) |

| yearn.finance | YFI | $215.93m | $449.24m | N/A | 3.23% |

Investment Thesis

As long as investors are holding crypto, there will be a demand to earn interest on that crypto. Many investors will want to put their crypto to work with the companies listed above, similar to putting your money to work in a traditional savings account.

These yield farming companies take in money from liquidity providers (LPs), who provide the capital to make their products work. While becoming an LP is one strategy to make money through yield farming — and there are many others — we think the simplest investing approach is to buy and hold the tokens of top yield farming companies.

We believe that investing in the tokens themselves (buying and holding UNI, for example), is like making a traditional investment in a company’s stock. If the company does well over the long term, we expect the token price (like a stock) to appreciate in value.

Here’s why we are still bullish on yield farming as an asset class:

The Promise of High APY

Yield farming rewards can sometimes cross absurd levels, reaching as high as 3,000% APY. This is a major factor that pulls in many investors despite the steep risks involved in staking funds across highly volatile cryptos and other derivatives. (Our rule of thumb: if an APY seems too good to be true, it usually is.)

Efficient Utilization of Idle Capital

At Bitcoin Market Journal, we encourage a long-term, buy-and-hold approach. Yield farming allows investors to put their crypto to good use, instead of letting them sit idle in a cold wallet. The DeFi marketplace has both higher-risk and lower-risk staking options. This allows you to pick opportunities that match your risk tolerance.

The Perks of Holding Governance Tokens

Most DeFi protocols reward LPs with their own tokens. Some of these “governance tokens” come with special perks and additional benefits. On a well-established company with high TVL, governance rights can grant access to additional revenues from trading fees. Voting rights also grant you the power to have a say in the future trajectory of the companies.

Benefits of Diversification and Market Exposure

Diversification and risk mitigation are equally important in both traditional and cryptocurrency investing. Yield farming allows you to increase your exposure to exciting new DeFi projects and tokens. It could give early access to an innovative new company and unlock massive ROI. Spreading your funds across multiple companies and farming pools is also a great way to diversify.

A Potential Hedge Against Market Volatility

DeFi protocols have shown remarkable resilience in the ongoing crypto winter. Even as centralized exchanges collapse, DEXs continue smooth operations with minimal hiccups. Many yield farming companies continue to offer APYs that are well above what you would find at traditional savings accounts and treasury bonds. For investors who are comfortable with crypto markets, yield farming offers a smart way to beat high inflation.

Who’s Investing: Institutional Backing

Cryptocurrency enthusiasts and developers hail DeFi as the future of finance. Even major organizations like the OECD and IMF acknowledge its potential to revolutionize the modern financial system. And based on recent investment trends in the space, it seems as if institutional investors and VCs agree with that assessment.

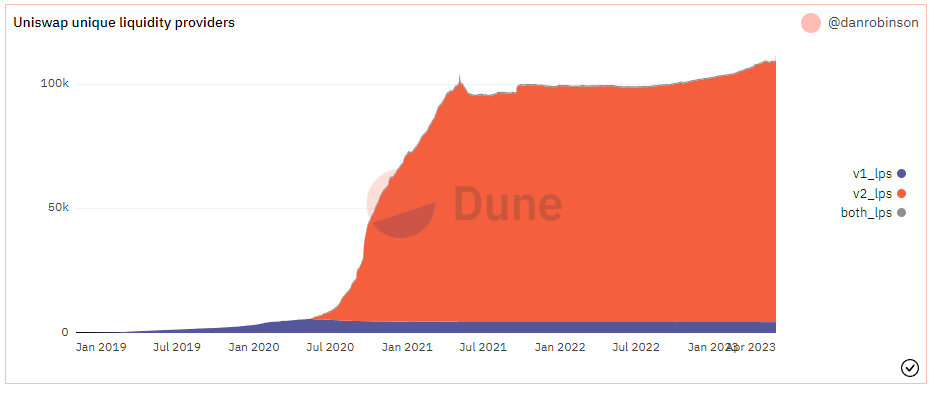

Uniswap, the largest DEX offering yield farming and staking services, has received over $176 million in total funding. The funding was led by Polychain Capital and Andreessen Horowitz across two rounds and included other investors like Paradigm, SV Angel, and Variant.

Likewise, Aave has been quite busy in the fundraising circuit over the years with 9 funding rounds yielding $49 million from investors like Blockchain Capital, Three Arrows Capital, and Standard Crypto.

Remember our thesis: you too can “invest” in these platforms simply by buying and holding their native tokens.

Top Yield Farming Platforms

Uniswap (UNI)

Uniswap (UNI)

TVL: $4.12b

UNI Price: $5.04

Daily Active Users (30-day avg): 83.45k

Trading Volume (annualized): $400.95b

Twitter Followers: 1m

Uniswap is one of the most popular decentralized exchanges on the Ethereum blockchain. Founded and launched in 2018 by Hayden Adams, the DEX has attracted investment from Paradigm, USV, and Andreessen Horowitz (a16z).

Uniswap is designed for trading/exchanging ERC-20 tokens, and decentralized lending. There is no buying or selling involved. The protocol governance is handled by holders of the UNI token. Uniswap rewards LPs with a share of the trading fees generated on the platform.

As one of the largest DEX platforms with a TVL of $4 billion, Uniswap is a highly attractive platform for yield farming. In terms of sheer size, median APY, and market position, it is hard to argue against the long-term potential of Uniswap.

However, the lack of any kind of KYC process does raise some concerns in the current climate. Regulators are getting actively involved in the crypto ecosystem and tend to have a dim view of privacy-oriented platforms like Uniswap.

Aave (AAVE)

Aave (AAVE)

TVL: $3.83b

AAVE Price: $64.41

Daily Active Users (30-day avg): 1.81k

Active Loans (annualized): $2.56b

Twitter Followers: 534k

Aave is a decentralized platform dedicated to the lending and borrowing of cryptocurrency. Although it was originally launched on the Ethereum blockchain, Aave has since expanded its presence to other blockchains like Avalanche and Harmony.

The Aave project was launched in 2017 under the name ETHLend by Stani Kulechov, a Finnish law student. In 2018, it was rebranded as Aave, which means “ghost” in Finnish. Here, the LPs are lenders who earn interest income in the form of “aTokens.”

The protocol also has a native governance token called AAVE. Loans on Aave are overcollateralized to reduce the risk of defaults. To get a loan, borrowers have to pledge other crypto assets worth more than the loaned amount.

Aave is easily one of the top 10 DeFi platforms in terms of total value locked. And it serves a clear purpose in the crypto ecosystem. It allows holders a chance to temporarily pawn their holdings to gain exposure to another token without having to sell.

But this kind of activity has limited use outside the world of DeFi. And like all other DeFi projects, there is considerable risk of regulatory action due to the decentralized nature of the protocol’s operations.

Synthetix Network (SNX)

Synthetix Network (SNX)

TVL: $415.22m

SNX Price: $2.34

Daily Active Users (30-day avg): 452

Trading Volume (annualized): $59.14b

Twitter Followers: 230.2k

Synthetix is a non-custodial exchange protocol built on Ethereum’s layer-2 scaling solution called Optimism. The DeFi protocol was launched by Australian cryptocurrency enthusiast Kain Warwick in 2016. It was called Havven before rebranding to Synthetix Network in 2018.

Synthetix is a highly innovative DeFi platform that functions like a derivatives market in traditional finance. Users can trade indirectly in a wide range of commodities, coins, and fiat currencies without directly holding them.

These derivatives on the network are called Synths. They track the value of the underlying asset, which could be gold, US dollars, or even bitcoin. The protocols that track these prices are called Oracles. The native token on the platform is called SNX.

Due to its first-mover status in the derivatives side of crypto, Synthetix Network certainly has plenty of staying power in the long term. Its main allure is its ability to provide exposure to new assets without ownership.

Crypto users also have a chance to hedge against volatility in adverse market conditions by holding short positions on synths. We saw this in action in 2022, as the network racked up $1m in daily fees and a 100% surge in SNX value due to massive trading volumes.

Curve Finance (CRV)

Curve Finance (CRV)

TVL: $4.22b

CRV Price: $0.818

Daily Active Users (30-day avg): NA

Trading Volume (annualized): NA

Twitter Followers: 345k

Curve Finance is the second largest DEX platform by volume after Uniswap. Launched in 2020 by Michael Egorov, Curve is a non-custodial exchange protocol focusing heavily on stablecoin liquidity pools.

The protocol launched on the Ethereum blockchain at a time when stablecoins like Tether and USDC were already surging in popularity. With its promise of low fees, low risk of slippage, and efficient stablecoin trading opportunities, Curve rapidly attracted LPs.

Apart from stablecoins, the liquidity pools on Curve also follow wrapped versions of popular cryptocurrencies. This combination allows Curve to stay ahead of other DEXs in terms of fees and efficiency while still reducing the risk of volatility.

The native token on the platform is called CRV. It is both the governance token and the reward for yield farming. Since stablecoins continue to play a critical role in the crypto space, Curve seems to have more growth and lasting potential than other DEX alternatives.

PancakeSwap (CAKE)

PancakeSwap (CAKE)

TVL: $1.94b

CAKE Price: $1.63

Daily Active Users (30-day avg): 142k

Trading Volume (annualized): $65.9b

Twitter Followers: 1.6m

PancakeSwap is a decentralized exchange that shares its DNA with Uniswap. Originally a fork of Uniswap, the new protocol was adopted and deployed on the Binance Smart Chain (BSC). Although it is a Uniswap fork, PancakeSwap exists independently on the BSC.

The high gas fees and slow transactions that plagued the old Ethereum network in 2020 prompted the development team to make the switch to Binance. This allowed PancakeSwap to attract more users with its efficient and cost-effective solutions.

The native token on the platform is called CAKE. PancakeSwap functions as a straightforward DEX where LPs earn rewards for staking and yield farming. The protocol pays a percentage of trading fees to LPs in CAKE.

The only major limitation of PancakeSwap is its absence from other popular blockchains like Ethereum. Being on the BSC has some major disadvantages, like the inability to trade in any tokens that are not BEP-20.

However, in terms of size, available features, and reliability, PancakeSwap is one of the better options out there. With its presence on Binance, the protocol has excellent growth opportunities ahead of it.

yearn.finance (YFI)

yearn.finance (YFI)

TVL: $449.24m

YFI Price: $6472.27

Daily Active Users (30-day avg): NA

Trading Volume (annualized): NA

Twitter Followers: N/A

yearn.finance is a group of four different protocols that run on the Ethereum blockchain. The project was launched in 2020 by an independent developer from South Africa called Andre Cronje. The protocol was launched and released without any outside assistance.

Apart from the Ethereum blockchain, the protocols also support smart contracts on DeFi platforms like Curve and Balancer. It is also available on Fantom and Arbitrum. Cronje created yearn to make yield farming and DeFi lending easier and more accessible for everyone.

The main yield farming protocol on yearn.finance is called “Vaults.” Other products include yCRV, veYFI, and yBribe. The latter is an innovative tool that allows YFI holders to sell their vote in the DAO to the highest bidder.

As a beginner-friendly DeFi platform, yearn.finance could play a critical role in the future. However, its fortunes are tied to the wider market conditions. In a sustained bear market, yearn fails to offer any exceptional rewards. It is also one of the smaller DeFi protocols by TVL, further increasing the risk to those using its vaults.

Investor Takeaway

The yield farming space has certainly lost some of its sheen in the crypto market crash of 2022. However, it is not all doom and gloom: the collapse of centralized exchanges like FTX, and the ongoing SEC lawsuits against Binance and Coinbase, could make DeFi more attractive to investors worldwide.

And the continued smooth functioning of major DEX platforms and protocols is a testament to the resilience of this model. Despite a two-thirds decline in TVL, yield farming in DeFi still retains considerable investor interest. Close to $50 billion is still locked away in liquidity pools across a wide array of protocols on Ethereum and other major blockchains.

However, uncertainty persists across the DeFi space due to the impending arrival of new regulations. From the EU to North America, regulators are taking an ever closer look at the entire crypto ecosystem, and DeFi could be next.

With so much variability and uncertainty in the system, we advise caution and due diligence for any newcomers to the scene. A good rule of thumb is to narrow your investment considerations to the tokens with the most users and highest TVL.

bitcoinmarketjournal.com

bitcoinmarketjournal.com