Cryptocurrency Investors Move from Centralized Finance (CeFi) to Decentralized Finance (DeFi) in Wake of Recent Market Crashes

A prominent crypto investment firm is exploring four cutting-edge technologies that have the potential to revolutionize the digital asset industry: NFTs, on-chain derivative platforms, decentralized stablecoins, and Ethereum Layer 2s.

These technologies could transform the way we interact with digital assets, and the firm aims to capitalize on the opportunities they present. By making the right investments, the firm could be well-positioned to benefit from the rapidly evolving crypto landscape.

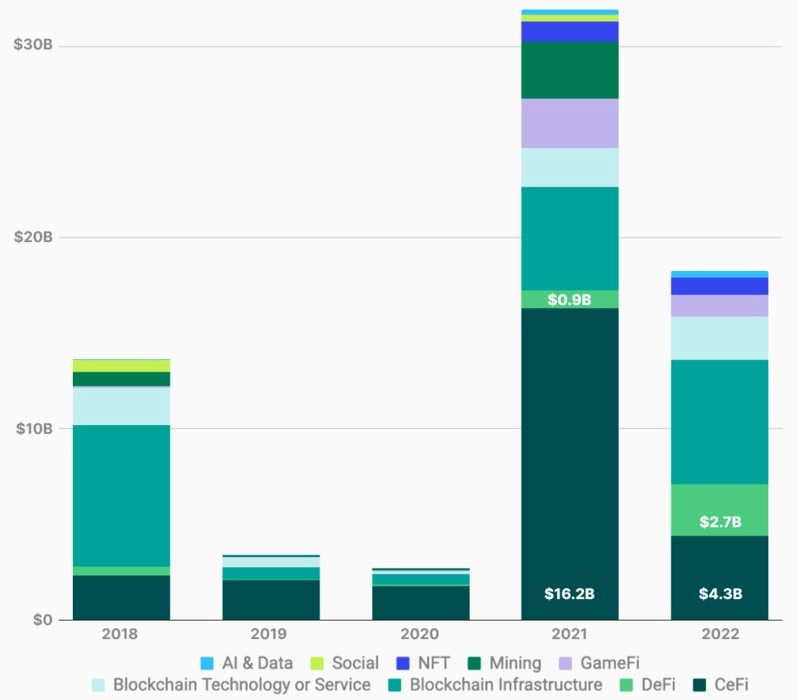

Investment firms poured an astonishing $2.7 billion into decentralized finance (DeFi) projects in 2022, representing a remarkable 190% increase from the previous year. This surge in DeFi funding indicates a shift in the market from bull to bear.

Conversely, investments into centralized finance (CeFi) projects plummeted 73% to $4.3 billion over the same timeframe, suggesting that the sector is reaching saturation.

The investment company is focusing on four sub-sectors of the cryptocurrency market, one of which is NFTfi, the combination of DeFi and NFTs. They include, but are not limited to, long-trade NFT projects and short-trade NFT projects, as well as additional NFT projects that leverage DeFi to implement various trading methods for earning passive income.

On-chain derivative platforms such as GMX, SNX, and LYRA are also gaining popularity, along with decentralized stablecoins like LUSD/LQTY, which have benefited from the current regulatory climate.

Ethereum-based layer-2 networks are another area of interest for the investment firm. Optimism (OP) tokens have been particularly successful recently, with the launch of Coinbase's 'Base' testnet, which is powered by Optimism. The firm has invested in GMX, SNX, LYRA, LQTY and OP.

Despite challenging market conditions, the crypto space remains a highly attractive investment opportunity for those willing to take the risk. Venture capital investments in the cryptocurrency sector have declined for the past three quarters, but DeFi funding is on the rise, indicating that it is the new high-growth area for the crypto industry.

Cryptocurrency analyst Miles Deutscher predicts that zero-knowledge rollup tokens, liquid staking derivative tokens, AI tokens, perpetual DEX tokens, “real yield” tokens, GambleFi tokens, decentralized stablecoins, and Chinese coins are likely to be heavily funded and perform well in 2023.

The investment firm is closely examining four innovative technologies within the crypto space that could revolutionize the digital asset industry. While the market conditions are challenging, DeFi funding is on the rise, indicating that it is a high-growth area for the crypto industry.

As such, the crypto space remains an attractive investment opportunity for those willing to take the risk.

Also, read - Secret Service: Bitcoin ATM Company Involved in Unlicensed Kiosks and Crypto Scams