The pseudonymous crypto analyst who predicted the current Bitcoin (BTC) bear market says digital assets will present excellent trading opportunities in the coming days.

Crypto Capo tells his 406,500 Twitter followers that BTC will likely produce new lows before July, and for the first time in months he’s forecasting an opportunity for traders to enter the market.

“Charts remain bearish and we will probably see new lows these days. Those lows will give good buy opportunities.”

Capo next analyzes the Bitcoin dominance chart (BTC.D) using the Elliot Wave Theory. BTC.D tracks how much of the total crypto market cap belongs to Bitcoin. A bullish BTC.D suggests Bitcoin is rising faster than other crypto assets or altcoins are losing value while the leading crypto by market cap surges.

The Elliot Wave theory is a technical analysis tool predicting future price action by following crowd psychology manifested in waves. According to the theory, an asset goes through a five-wave cycle before a major trend reversal.

Looking at the BTC.D charts, Capo says Bitcoin’s dominance has reached a local bottom (wave 4) and is about to increase its market share (wave 5), which means altcoins trading against BTC will fall. When BTC.D reaches the wave 5 local peak, it should signal a local bottom for the altcoin markets.

“BTC.D (Bitcoin dominance) update Wave 4 completed. Wave 5 missing, where altcoins/BTC pairs should drop.”

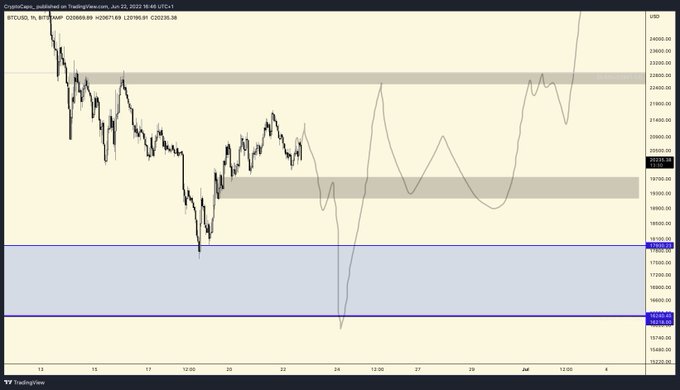

In concert with the BTC.D chart, Capo foresees BTC enjoying a short and steep run-up before dropping to the $16,000 range, only to explode exponentially afterward.

“BTC [low-time frame]

Local bottom formation between $16,000-$17,000.”

Bitcoin is trading for $20,290 at time of writing.

On the flipside of Bitcoin dominance are the altcoin markets, which suffer as BTC.D increases. Capo says many altcoins are stuck in bearish parabolas that usually end with upward corrections.

The trader looks at decentralized exchange token Sushi (SUSHI) as an example.

“One thing is clear:

Many altcoins are on a bearish parabola. Parabolas, when broken, cause large corrections (in this case upwards). The parabolas are not over yet though, but almost.”

dailyhodl.com

dailyhodl.com