The cryptocurrency options market continues to get bigger and bigger.

Last month, an average of $1.4 billion in notional amounts changed hands every day at the largest options exchange, Deribit. This represents a 13-fold increase from last year. Institutional investors represent some 80% of flows on Deribit.

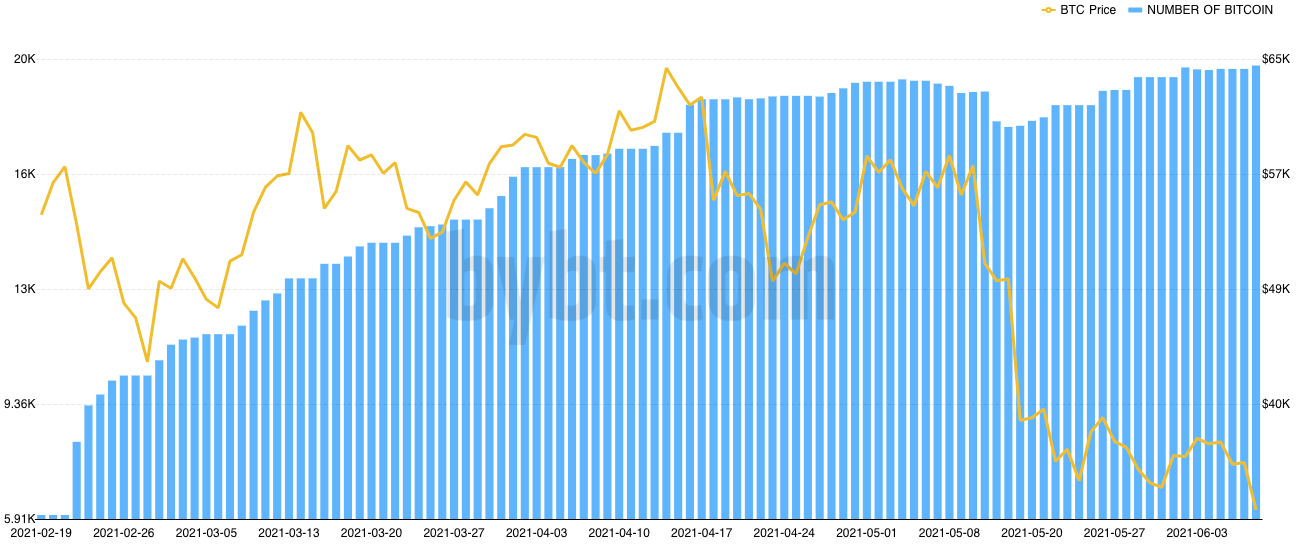

Open interest in Bitcoin totals $6.1 billion, 186.6k BTC, as of writing. Deribit accounts for 85.42% of this OI. OI on Bitcoin options has increased from less than $2 billion a year back but is down from an all-time high of $14.77 billion on March 18.

OKEx, CME, LedgerX, and FTX all have less than 4% market share, while Huobi has only 0.2%.

When it comes to Ethereum, Deribit has a 92.61% share of its OI market at 1.42 million ETH out of the total 1.53 million ETH. OKEx, Bit.com, and Huobi have a market share of 4.18%, 3.14%, and 0.05%, respectively.

ETH options market had come a long way over the past year when the OI was a mere $170 million, which climbed to a peak of $7.4 billion on May 12.

As we reported, even Goldman Sachs is now moving into Ether derivatives.

This growth of the options market has money managers and retail traders selling crypto options for yield, a common strategy in mainstream assets, and a sign that the industry is growing up fast.

In this trend, options are sold for yield in a wager that crypto price swings will be lower than the market has priced in, similar to earning premiums on an insurance policy.

“In the absence of interesting yields for these alternatives, option strategies become more relevant,” said Deribit chief commercial officer Luuk Strijers.

Hedge fund manager Shiliang Tang of $130 million LedgerPrime has earned a 78% return this year on his flagship fund in the options market and running systematic strategies like price arbitrage and momentum across exchanges.

“Option flow can definitely drive some of the shorter-term price action,” Tang said. “Longer-term, it’s still supply and demand.”

[top_coins]

ETH options market had come a long way over the past year when the OI was a mere $170 million, which climbed to a peak of $7.4 billion on May 12.

As we reported, even Goldman Sachs is now moving into Ether derivatives.

This growth of the options market has money managers and retail traders selling crypto options for yield, a common strategy in mainstream assets, and a sign that the industry is growing up fast.

In this trend, options are sold for yield in a wager that crypto price swings will be lower than the market has priced in, similar to earning premiums on an insurance policy.

“In the absence of interesting yields for these alternatives, option strategies become more relevant,” said Deribit chief commercial officer Luuk Strijers.

Hedge fund manager Shiliang Tang of $130 million LedgerPrime has earned a 78% return this year on his flagship fund in the options market and running systematic strategies like price arbitrage and momentum across exchanges.

“Option flow can definitely drive some of the shorter-term price action,” Tang said. “Longer-term, it’s still supply and demand.”

[top_coins]

Bitcoin and Ether Options Market Experiences a Boom

bitcoinexchangeguide.com

22 June 2021 13:05, UTC

bitcoinexchangeguide.com

22 June 2021 13:05, UTC