This article evaluates a strategy that is not very popular in the crypto market: mean-reverting.

The mean-reverting strategy applied to the crypto market

This statement stems from the fact that major crypto markets, perhaps due to their young age, tend to be very volatile and follow trends for quite some time before reversing them. In this context, a strategy that attempts “counter-trend” entries could present some problems.

That being said, wanting to understand whether these rumours are well-founded or not, we are going to perform a backtest on the leading cryptocurrency, Bitcoin. The aim is to better understand if there is no possibility of using reversal strategies on crypto, or if on the contrary there is some glimmer of hope.

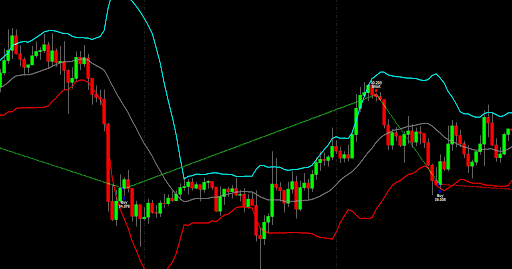

We therefore proceed to create an automatic, reversal strategy built on hourly bars that uses the well-known Bollinger Bands to identify market swing points. Bollinger Bands are calculated as the standard deviation of the average price. As volatility increases, the bands will tend to widen, while during low volatility they will be closer together.

Bollinger Bands, calculated at two standard deviations, include almost all prices (statistically speaking 95%). It can therefore be asserted that once the extremes of the bands are reached, a reversal is more likely.

The strategy is to sell BTC when the price on the upper band is reached, and to buy BTC when the price on the lower band is reached.

Examples of the entry pattern can be seen in Figure 1.

This is therefore a pattern whereby following an extended market decline buying takes place, expecting prices to rebound shortly thereafter. Vice versa for the short.

In addition, a precautionary stop loss is inserted, calculated as 5 times the value of the 10-period ATR (hourly time frame). This is because a reversal strategy without a stop loss could incur huge losses, putting a strain on the investor’s nerves and portfolio.

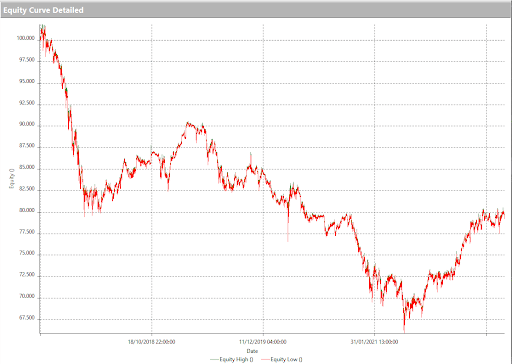

Testing this simple strategy from 2017, the year in which cleaner data for this market began to emerge, yields some truly bitter results.

The results of the backtest

The strategy loses, and it also does so fairly consistently over the years. After all, this was to be expected.

The results shown in Figure 2 confirm that this market is predominantly trend-following. Is there any way to improve the results? Is it possible to isolate only the best days on which it is worthwhile to operate with reversal logic?

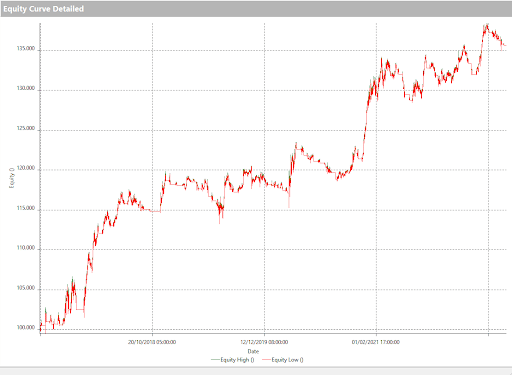

To answer these questions, we use the author’s proprietary patterns, i.e. a coded list of specific market conditions that will be used to identify the best situation in which it is convenient to operate.

It is certainly much more convenient to try to improve winning ideas than to improve losing ideas. In a didactic spirit, considering trading only after a week in which the “body” – the distance between the previous week’s open and close – is greater than 75% of the week’s total range – the distance between the weekly high and weekly low – leads to significant improvements (figure 3).

With this rule applied on both sides of the strategy, long and short, the system is forced to operate only in those weeks that follow a very “convincing”, “decisive” week. Essentially weeks in which the body of the weekly candle is very large, in which the market has shown a strong stance one way or the other, and is therefore more likely to see reversals in the following week.

The profit curve is now rising and the situation looks completely reversed from the previous strategy. Certainly, the mean-reverting strategy on a market like Bitcoin continues to be something of a minefield for systematic traders, but with proper care, it could hold some surprises.

What is certain is that with a view to diversifying a good portfolio of automatic strategies, it would certainly be smart to think of having a systems park with different logics within it, so as to take advantage of the different market phases that emerge for Bitcoin.

Happy trading!

en.cryptonomist.ch

en.cryptonomist.ch