Much has happened in a relatively short period of time. In the past seven days alone, Bitcoin’s price exploded to a 3-month high, tapping levels that we hadn’t seen since January 2nd.

This adds to a total increase of around 14% as Bitcoin traded above $47,000 earlier today. The entire cryptocurrency market cap surged by a whopping $120 billion in the past 24 hours, and we take a closer look at three potential reasons for the recent gains.

Terra Buying Bitcoin

It goes without saying that Do Kwon’s Terra seems to be the primary catalyst for the recent increase in Bitcoin’s price as their BTC buys keep coming in.

As CryptoPotato reported earlier last week, Do Kwon – the co-founder and CEO at Terraform Labs – the company behind the Terra protocol – revealed intentions to buy a whopping $10 billion worth of Bitcoin over time. While many didn’t take this seriously, Kwon also said that they “have $3B funds ready to seed this reserve.”

$UST with $10B+ in $BTC reserves will open a new monetary era of the Bitcoin standard.

P2P electronic cash that is easier to spend and more attractive to hold #btc

— Do Kwon 🌕 (@stablekwon) March 14, 2022

Not a few days later and the Bitcoin buys started rolling in. Terra has been buying in batches of $125 million, prompting some analysts to believe that there’s an incoming supply shock.

This brings us to reason number two.

Supply is Getting Thinner

Commenting on the above was popular cryptocurrency proponent, and industry commentator Pentoshi, who outlined the following in relation to Terra’s Bitcoin buys:

2.5-3k BTC per day of supply removed over a long period of time = huge impact. Those who are short have to cover higher at some point as supply itself dissipates. What is scarce, becomes more so. This clip can bring back the apes, in which Do Kwon is the lord of the Apes.

In essence, what the analyst is talking about is the concept of a supply shock where the demand heavily outweighs the supply, essentially squeezing the price up.

In addition, market data showed that bears were underprepared for this move. As we reported earlier today, Bitcoin’s volatility wiped over $410 million worth of liquidations in the past 24 hours, and about 80% of these were short positions.

Overall Market Sentiment Turned Positive

Bitcoin, as well as the entire cryptocurrency market by extension – remain largely correlated with Wall Street, as much as native proponents would like to detach.

Over the past five days, some of the largest indices in the US – including the S&P 500, Nasdaq, and the Dow Jones Industrial Average – are all trading in the green.

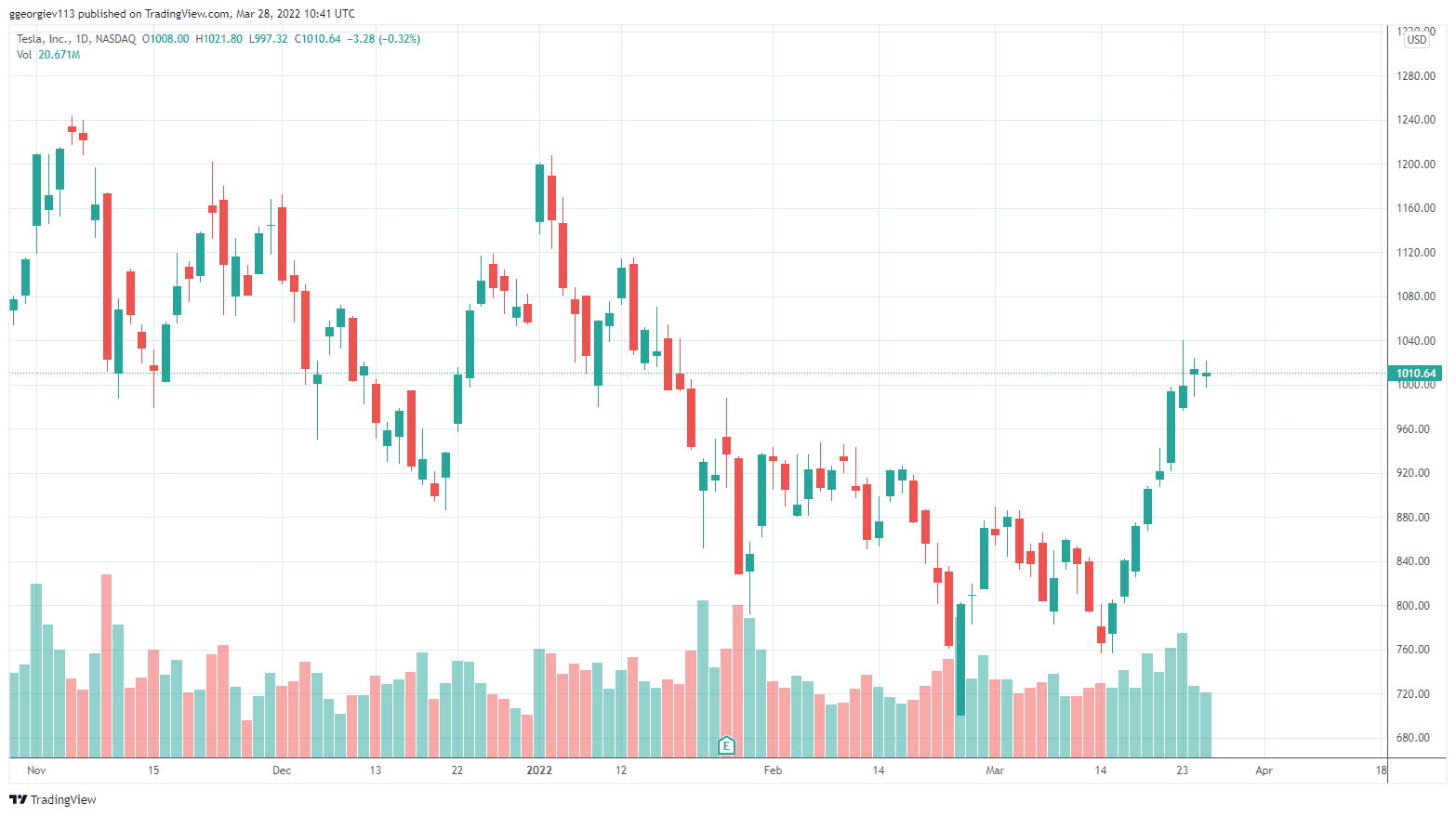

What is more, tech companies like Tesla are also charting considerable gains. TSLA stock is up for the 9th consecutive day, increasing by a whopping 35% in the same period.

This might mean that investors become more prone to the risk-on trade, and Bitcoin fits right into the definition.

All in all, it’s important to remain very careful as the price currently hovers around the yearly close, and last time it was unable to come through, although it came pretty close.

cryptopotato.com

cryptopotato.com