While still in the capitulation zone, history shows that Bitcoin is approaching levels at which it reaches its price bottom and begins to recover.

This would come as a relief to diamond-handed users who have held through the several months of price correction. Notably, $BTC has been in a 4-month downtrend, and all indications point to a fifth unless the momentum shifts dramatically before the end of February.

Key Points

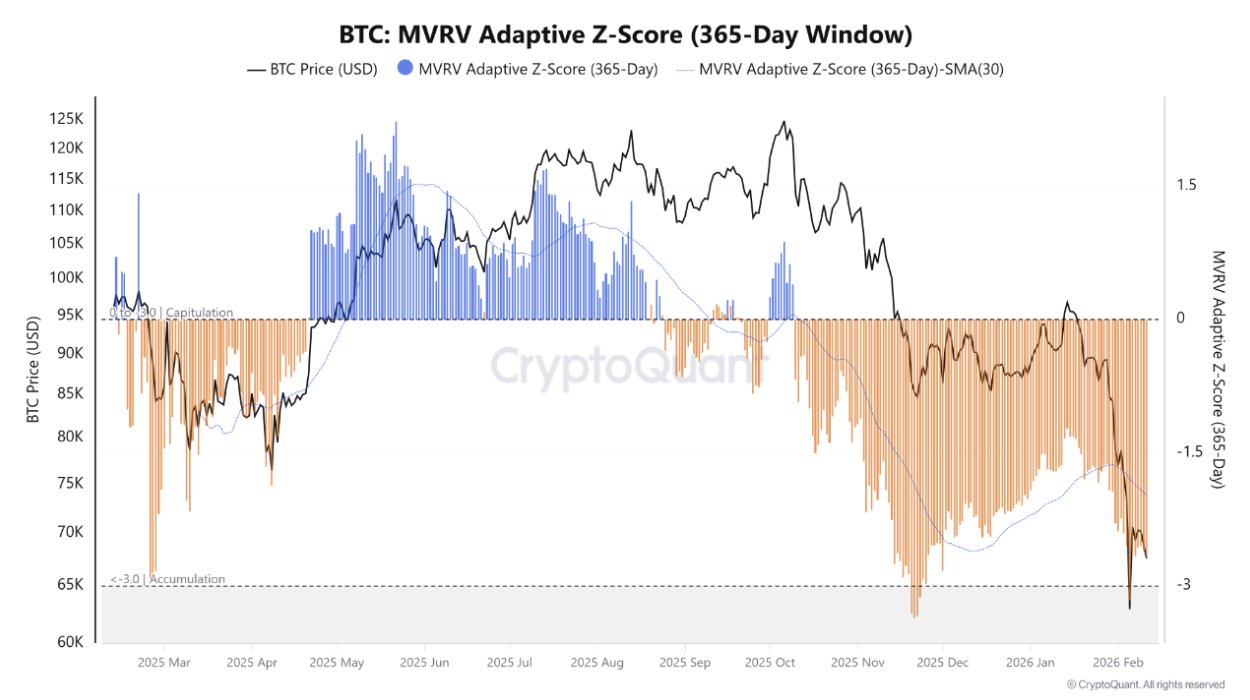

- The Bitcoin Market Value to Realized Value (MVRV) Adaptive Z-Score dictates that $BTC is in the capitulation phase.

- At the time of the analysis, this metric lies at -2.66, which is within the capitulation band.

- Despite this, the MVRV Adaptive Z-Score indicates we are approaching a historical accumulation phase, where Bitcoin bottoms.

- If true, this is a strong buying opportunity for Bitcoin, as a swing in momentum could spark a bullish price turnaround.

Bitcoin in the Capitulation Phase

A recent analysis from on-chain analytics provider CryptoQuant identified an optimistic development for $BTC as its correction persists. The analysis shared by verified author GugaOnChain uses the Bitcoin Market Value to Realized Value (MVRV) Adaptive Z-Score to dictate which phase the pioneering cryptocurrency is in the market cycle.

It identified that Bitcoin is in the capitulation phase, marked with intense volatility and a predominant bearish trend. Although it might see a relief rally at times, like the jump from $60,000 to $70,000 between February 5 and 6, the structure remains bearish.

Notably, the $BTC MVRV Adaptive Z-Score measures whether Bitcoin is undervalued or not. It compares the market value to the asset’s realized value, which reflects the last price at which users moved their bitcoins.

At the time of the report, this metric lies at -2.66, within the capitulation band. For the uninitiated, an MVRV score between 0 and -3.0 is capitulation, while a score less than -3.0 is accumulation.

$BTC MVRV Z-Score/CryptoQuant">

$BTC MVRV Z-Score/CryptoQuant">

But There is a Catch

The analysis highlighted that, while the capitulation zone remains in play, the MVRV Adaptive Z-Score indicates we are approaching a historical accumulation phase. In simple terms, Bitcoin is nearing its price bottom, signaling seller exhaustion.

Interestingly, this is a strong buying opportunity for Bitcoin, as a swing in momentum could spark a bullish price turnaround. During the accumulation phase, the sharp price correction ends, and buyers step in to reclaim control of the market.

Bitcoin Bottom, Really?

Although this might sound optimistic, several other analysts share a conflicting view. Recently, XWIN Research highlighted that Bitcoin is in an early bear market and the current retracement is not a short sideways trend in a bull market.

Other analysts also expect $BTC to slide further from the current levels. Veteran trader Peter Barndt sees the asset’s bottom around $42,000, citing his famous banana chart. Traders are also increasingly betting on a decline to $48,000 by the end of the year, according to Kalshi data.

The strong arguments from both sides of the camp further add to the uncertainty in the crypto market. Meanwhile, the next direction $BTC will take will become clearer in the coming days.

thecryptobasic.com

thecryptobasic.com