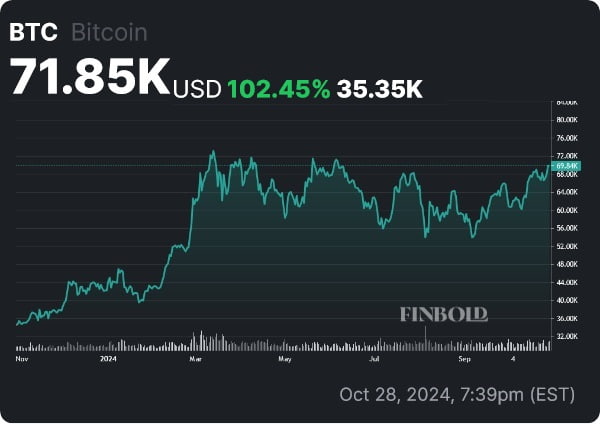

At the tail end of a month that saw numerous false breakouts, Bitcoin ($BTC) has finally surged above the psychologically important $70,000 level — for the first time since June.

The pioneering cryptocurrency is trading at $71,850 at the time of publication — having rallied by 102.45% compared to this time last year.

Several key technical indicators are suggesting that this could be the start of a prolonged rally.

With just two days left to go, it’s beginning to look like ‘Uptober’ could end on an even higher note.

Bullish signals abound as $BTC breaks resistance

Bitcoin has been struggling to decisively break through the $70,000 price point for almost six months at the time of writing.

This latest move to the upside will almost certainly reignite the confidence of traders and investors — $BTC has seen 15 green days over the course of the last month, and this latest breakthrough comes at a price point that is near both the all-time high and the cycle high.

In fact, the leading digital asset has managed to not only outperform its closest comparison, Ethereum (ETH) — it has also outperformed 59% of the top 100 crypto assets when looking at a 1-year chart.

Institutional adoption has also been a key factor that has enabled this surge — with exchange-traded funds (ETFs) like iShares Bitcoin Trust ETF (NASDAQ: IBIT) going a long way in making $BTC more accessible to regular retail investors and securing higher liquidity through inflows.

This could prove to be a significant catalyst going forward — VanEck, one of the most notable institutional investors, sees the cryptocurrency becoming a global reserve asset that could reach prices as high as $3 million by 2050.

Investors and traders should exercise caution amid $BTC surge

While there are plenty of reasons for optimism, readers should note that that is, in turn, no reason to abandon proper risk management. At press time, a key technical indicator, the relative strength index (RSI), is at 70 — signaling that the asset has entered overbought territory.

This does not mean that a correction or retracement will follow — however, as pointed out by crypto expert Alan Santana, additional confirmation is needed before the veracity of the bull run can be determined.

To boot, testing both cycle highs and all-time highs is a tall order — and before that happens, traders should keep an eye out for a resistance level at $72,625.90 and a support level at $69,307.20, as identified by Finbold.

Should Bitcoin surpass that level of resistance, the all-time high at $73,750 will remain as the final obstacle that will confirm or deny a prolonged upswing.

Featured Image:

ViewFinder nilsophon — December 25, 2019. Digital Image. Shutterstock.

finbold.com

finbold.com