Bitcoin has achieved a 1.3 trillion dollar market cap and boasts hundreds of millions of users, but it is still met by some with skepticism, fear, and even disdain. Detractors label it a tool for criminals or speculative gamble with no real future in the global financial system.

Even today, remnants of that narrative persist among those who serve as a mouthpiece for big banks and deny its transformative potential. However, over the past 15 years, bitcoin has transitioned from being primarily a grassroots movement among individuals to gaining rapid adoption within institutional finance.

Bitcoin's early detractors were not unjustified. In its initial stages, the project could well have failed. However, now that it has demonstrated its staying power, major financial institutions, hedge funds, and even sovereign entities have begun to explore bitcoin as a store of value.

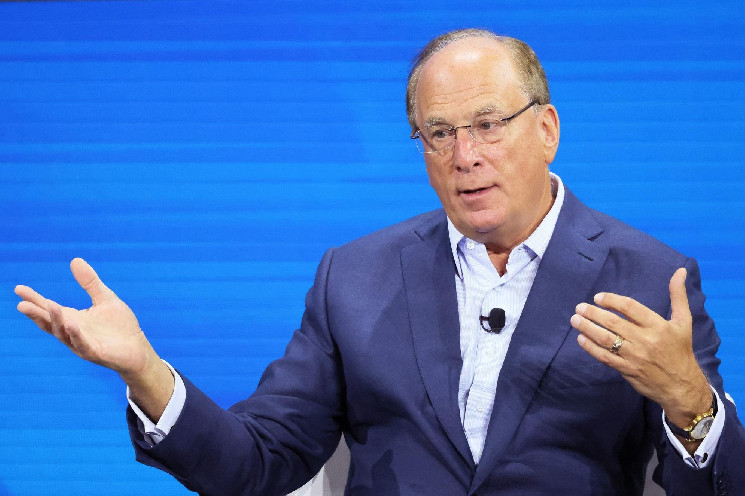

Larry Fink, CEO of BlackRock, has recently positioned himself as a prominent advocate. Once a skeptic, Fink now believes bitcoin is on the path to becoming a standalone asset class, comparable to other financial innovations that began slowly and later scaled, such as the mortgage and high-yield bond markets. He dismisses the notion that Bbitcoin’s trajectory depends on political outcomes, stating that neither U.S. presidential candidate will significantly alter its growth.

This bullish stance is underscored by the success of BlackRock’s spot bitcoin ETF, which launched in January 2024 and has already amassed over $23 billion in assets. The record-breaking inflows into bitcoin ETFs signal a growing institutional appetite, outpacing even gold-based products in terms of capital inflows. In just ten months, bitcoin ETFs have attracted nearly $20 billion, compared to gold ETFs, which have only drawn $1.4 billion despite reaching record highs 30 times this year.

This divergence highlights bitcoin’s growing recognition as a store of value and hedge against economic instability. As Standard Chartered predicts bitcoin could reach $200,000 by 2025, regardless of U.S. election outcomes, it is clear that institutional money is increasingly flowing into Bitcoin, solidifying its role as a financial powerhouse in the global investment landscape.

MicroStrategy's Infinite Money Glitch

A pivotal moment in this shift occurred when publicly traded companies began accumulating bitcoin on their balance sheets not merely as an investment but as part of a broader treasury strategy. MicroStrategy in particular has become a key player in this trend, demonstrating how bitcoin can serve as a strategic asset in the unusual time period in which we live – when an entirely new form of base money is coming into existence.

In 2020, MicroStrategy's CEO, Michael Saylor, made headlines when the company announced it had converted its cash reserves into bitcoin, citing the long-term devaluation of fiat currencies and the need for a harder asset to preserve wealth. This decision was not just an isolated bet on bitcoin's future value but part of a larger strategy to capitalize on the unique properties of bitcoin as both a store of value and a strategic financial asset.

Unpacking MicroStrategy’s bitcoin initiative, which is now colloquially called the “MicroStrategy playbook” and is being copied by other companies such as Metaplanet, will help illustrate why bitcoin is set to disrupt corporate finance.

At the core of MicroStrategy’s approach is the use of convertible debt to fund the purchase of bitcoin on an ongoing basis. By issuing convertible notes at low interest rates and using the proceeds to buy bitcoin, MicroStrategy has effectively become long on “global carry” – borrowing at low interest rates while investing in an asset that has the potential to appreciate significantly over time. At the same time, holding bitcoin itself positions the company short on global carry because bitcoin is inherently deflationary – its supply remains predictable as global liquidity increases, leaving only its price to respond to increasing demand.

This dual position – being long and short on global carry simultaneously – is unique. It turns MicroStrategy into what could be described as a modern version of a 60/40 portfolio, with the key difference being that both positions (long and short) are embedded within the same asset. Saylor has created a scenario where MicroStrategy is capitalizing on both global liquidity and bitcoin’s scarcity to create what some have dubbed an infinite money glitch. It's a remarkable demonstration of financial engineering that could only happen in these early days of bitcoin’s monetization.

The Fading Wisdom Of 60/40

For decades, the 60/40 portfolio – a mix of 60% equities and 40% bonds – was the gold standard for conservative investors. The theory behind it was simple: equities would provide growth, while bonds would provide stability and income, balancing risk and reward.

However, in an economic environment marked by low interest rates and rampant money printing, this traditional model does not work as well as it used to. Bonds are now risky, and the performance of the stock market is tied to a tiny handful of companies that are monopolistic and highly regulated.

The outsized performance of a select few companies – the so-called "Magnificent Seven" – has skewed overall market returns, masking weaker performances elsewhere. By mid-2024, this group, including giants like Apple, Microsoft, and Tesla, delivered an average return of 57% over the previous year, more than double the 25% return of the broader S&P 500. Without these seven mega-cap stocks, which now make up 31% of the S&P 500 by weight, the index’s returns would have been significantly weaker. In fact, if they were excluded, the S&P 500's year-to-date gain of 18.1% as of July 2024 would be reduced to just 9%. This disparity illustrates how concentrated market performance has become.

The decision by companies like MicroStrategy to adopt bitcoin is not simply a bet on price appreciation; it represents a fundamental shift in how businesses view treasury management in an increasingly unstable economic landscape. For decades, corporations have relied on cash reserves, bonds, and other fiat-based assets to manage their balance sheets. However, as central banks and regulators around the world now constantly intervene in the economy to achieve political ends, these traditional assets are losing their ability to preserve value.

Bitcoin, by contrast, offers a flexible, low-maintenance store of value that has virtually no maintenance costs, and is immune to inflationary devaluation. Moreover, as bitcoin becomes more widely adopted, its liquidity and market infrastructure continue to improve, making it easier for institutions to buy, sell, and hold large quantities without disrupting the market.

MicroStrategy’s move to adopt bitcoin as a core treasury asset highlights the growing realization that bitcoin’s potential is far greater than many initially believed. The company’s innovative approach to leveraging both global liquidity and Bitcoin’s scarcity has not only outperformed traditional financial strategies but also demonstrated how Bitcoin can provide a strategic advantage in an inflationary fiat environment.

Bitcoin’s $100 Trillion Potential

At the time of writing, bitcoin’s market capitalization hovers around $1.3 trillion, roughly a tenth of gold’s $13 trillion. While bitcoin has already proven itself as one of the best-performing assets of the past decade, the potential for future growth is enormous. If bitcoin continues to be adopted by institutions, governments, and corporations, it could easily rival or surpass gold’s market cap, and even one day become a $100 trillion asset class.

MicroStrategy’s bold moves are just the beginning of what could be a massive shift in corporate finance. If more companies recognize this unique moment for what it is, they too could take advantage of MicroStrategy’s infinite money glitch. It now appears that the next wave of bitcoin adoption will come by way of corporate balance sheets, marking the beginning of a new chapter in this fascinating story.

forbes.com

forbes.com