Bitcoin faces selling pressure as $5.64B in realized profits is recorded, with bearish institutional sentiment.

Bitcoin experienced a tough Wednesday, opening above $62,000 before dropping to a low of $60,300 as of this writing. This marked a 2.33% price decline within 24 hours, adding to an overall negative weekly performance, affirming the world’s largest crypto remains in a bearish trend.

Meanwhile, recent data indicates that a significant portion of investors have capitalized on their holdings, leading to billions in realized profits.

Billions in Realized Profits

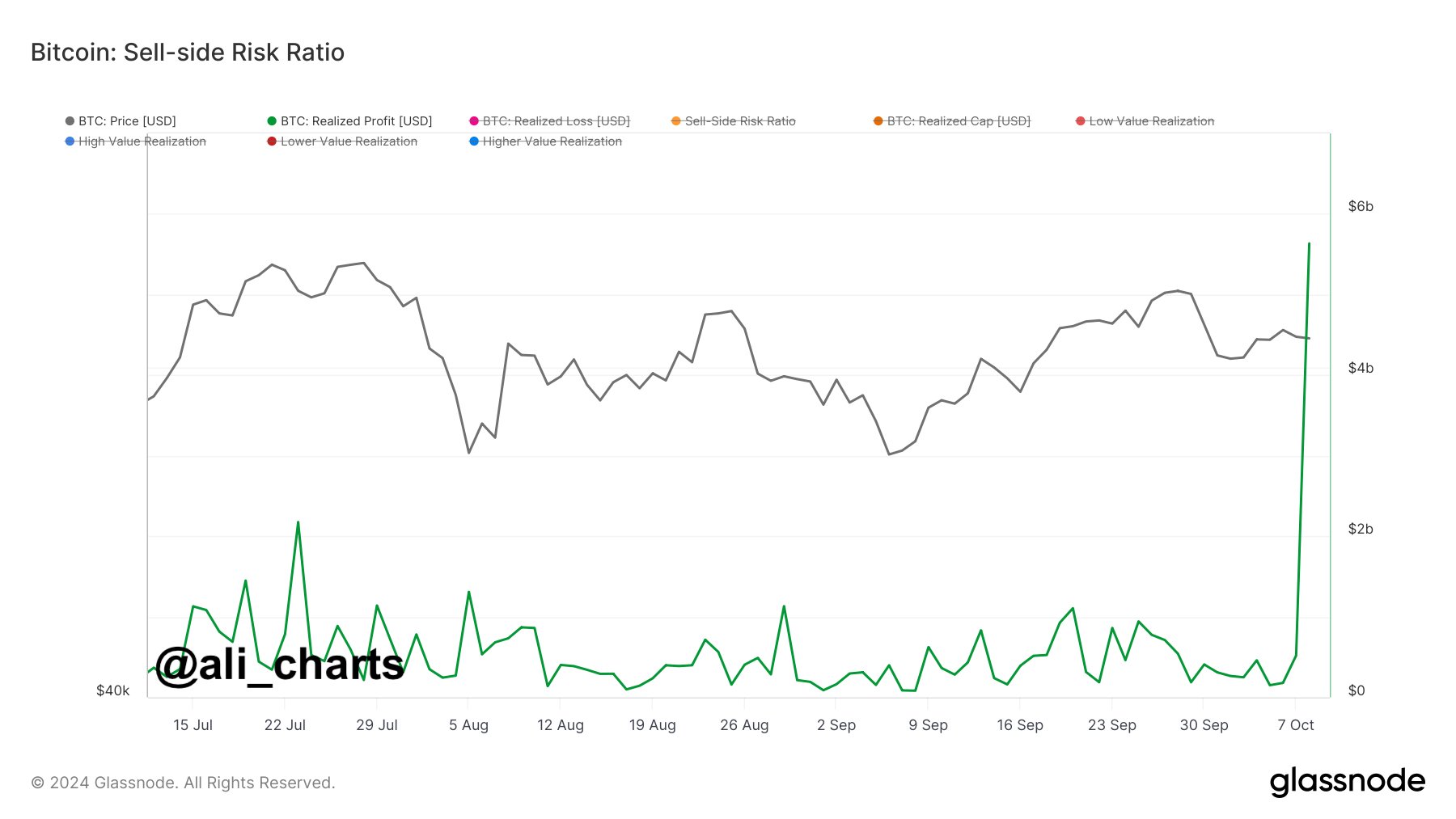

Recent insights from on-chain data, shared by expert Ali Martinez, reveal that $5.64 billion in Bitcoin realized profits were recorded in the last 24 hours. This profit-taking behavior typically leads to selling pressure, which can drive prices lower or lead to short-term consolidation.

Notably, whenever there is a significant spike in realized profits, as shown on Martinez’s chart, Bitcoin’s price tends to either stabilize or decline. This relationship between profit-taking and market corrections has been observed repeatedly.

Additionally, the trading volume for Bitcoin dropped by 17% during the same period. This lower trading volume suggests decreased activity compared to previous days.

Bearish Institutional Sentiment

Another critical indicator pointing to sustained selling pressure for the largest crypto is the Coinbase Premium Index. This index tracks the price difference between Bitcoin on Coinbase, which is predominantly used by U.S. institutions, and Binance, popular among global retail traders.

A negative reading on the Coinbase Premium Index suggests stronger selling pressure from U.S. institutions. According to data from CryptoQuant, the Coinbase Premium has dropped to -41, marking a significant sell-off by institutional investors in the U.S.

For context, the U.S. apex court recently granted approval for the sale of $4.38 billion Bitcoin from Silk Road held by the U.S. government.

The Coinbase Premium has fallen to -$41, signaling strong selling pressure from U.S. institutions 😬 pic.twitter.com/mjKcfIaJ0s

— Maartunn (@JA_Maartun) October 8, 2024

Throughout October, the Coinbase Premium Index has consistently stayed in negative territory, indicating a preference for selling Bitcoin on Coinbase over other platforms. Historically, negative readings on this index have preceded further price declines for Bitcoin.

Upside Projections Despite Bearish Sentiment

Despite the prevailing bearish sentiment, analysts still see long-term potential for Bitcoin. Technical analysis indicates that Bitcoin is outperforming traditional assets like gold.

Veteran chartist Peter Brandt has highlighted the BTC/GLD ratio, which measures Bitcoin’s value relative to gold, showing an uptrend. This ratio suggests that Bitcoin has consistently outperformed gold in recent years.

Brandt points to Bitcoin’s potential to break through key resistance levels in the BTC/GLD ratio. A breakthrough at 32 ounces of gold could signal a significant rally for Bitcoin, with projections indicating it could rise to over 100 ounces per Bitcoin.

thecryptobasic.com

thecryptobasic.com