Bitcoin price rose for two consecutive days on Monday, Oct. 7, as traders embraced a risk-on sentiment.

Bitcoin (BTC) rose to an intraday high of $64,000, a 6.62% increase from last week’s lowest point. The rebound happened even as American equities retreated as the odds of a more dovish Federal Reserve eased. The Dow Jones, S&P 500, and Nasdaq 100 dropped by over 0.20% in early trading.

Some crypto analysts and investors remain bullish on Bitcoin. MetaPlanet, a Japanese company, has become the latest major Bitcoin buyer after adding coins worth $6.7 million to its reserves. According to Bitcoin Treasuries, it now owns 530 coins worth over $33 million.

The company is following in the footsteps of MicroStrategy, which has become the largest Bitcoin holder with 252,220 coins. Other major holders include firms like Marathon Digital, Riot Platforms, and Block, formerly known as Square.

In an X post, Michael van de Poppe, a popular crypto analyst with over 728,000 followers, predicted that Bitcoin will rise and retest the all-time high of $73,800. He expects Bitcoin to retest $62,000 and then bounce back to between $65,000 and $66,000. A break above that level will lead to a retest of its all-time high.

#Bitcoin has held the crucial support area around $60K and bounced upwards.

— Michaël van de Poppe (@CryptoMichNL) October 7, 2024

I'm expecting some lower timeframe retests at $62K, through which we will test $65-66K later this week.

Breakout above there = new all-time high test. pic.twitter.com/BhiFhCPT9r

Bitcoin’s rebound coincided with a significant increase in futures open interest. Data from CoinGlass shows that open interest rose to over $34 billion, its highest level since October 1. A higher open interest figure is often a positive sign for a coin.

The next potential catalysts for Bitcoin this week will be Wednesday’s Federal Reserve minutes and Thursday’s US inflation data. A sign that inflation is still falling will likely lead to a more dovish Fed, which would be positive for Bitcoin and other risky assets.

Bitcoin price needs to flip $66,600

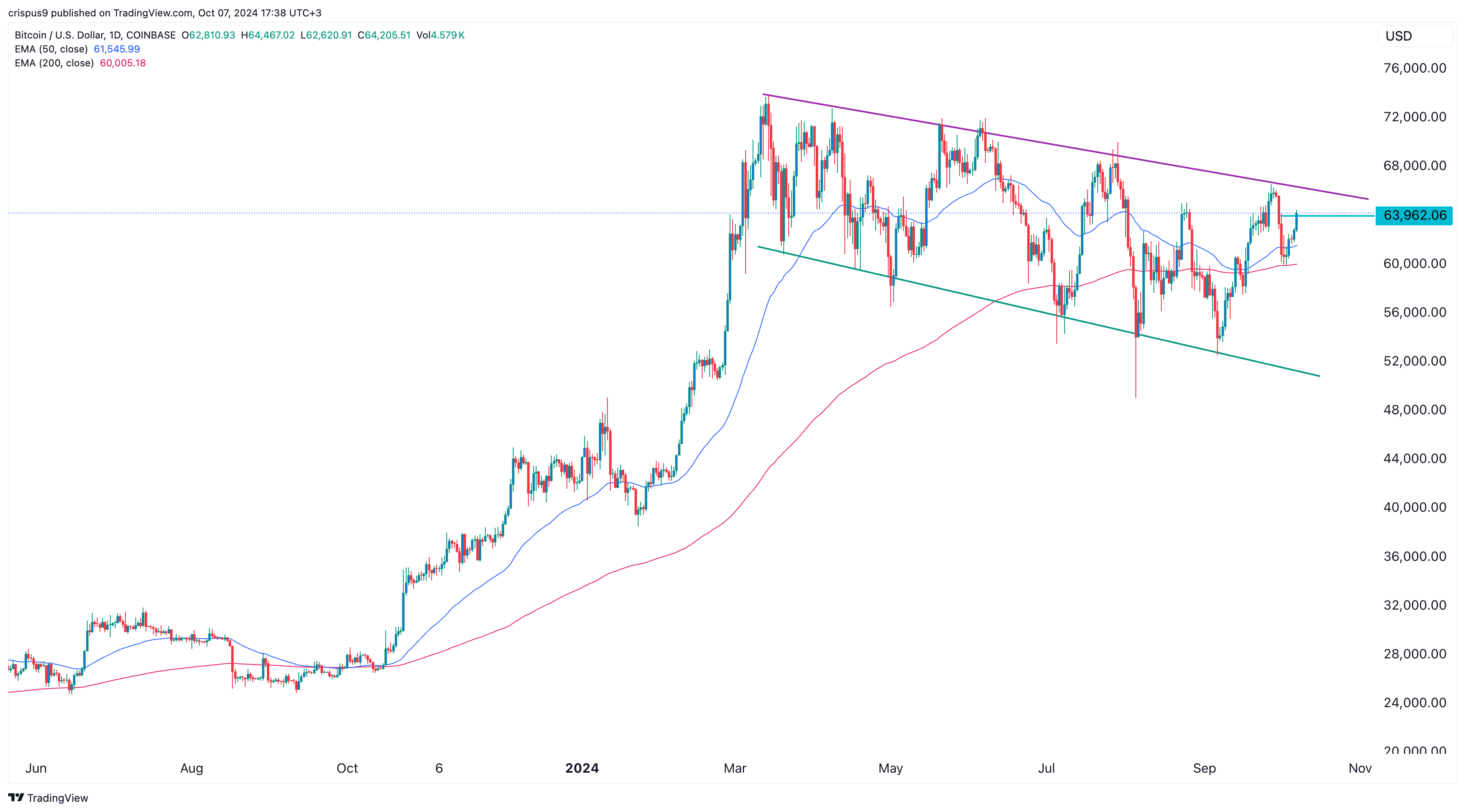

The daily chart shows that Bitcoin has faced strong resistance, indicated in purple. This resistance connects the highest swings in March, May, June, July, and September.

The trendline is also the upper side of the falling broadening wedge chart pattern. In price action analysis, this pattern often results in a bullish breakout. Bitcoin has also jumped above the 50-day and 200-day Exponential Moving Averages.

Therefore, there are rising odds that Bitcoin will have a bullish breakout and retest the all-time high. For this to happen, it will likely need to clear the descending trendline and the psychological levels at $70,000 and $72,000.