Bitcoin has a high chance of soaring to a new high this year, according to a recently launched Polymarket poll.

Polymarket users see BTC hitting a new record high

Sixty-three percent of participants in the the poll believe that Bitcoin (BTC) will continue its uptrend and reach a new record high. The odds of this happening have risen from this month’s low of 42%.

With Bitcoin trading at $63,840, it needs to rise by 15.6% to retest its all-time high of $68,777. This is possible as it has entered a technical bull market after rising over 21% from its lowest point in September.

Bitcoin has several potential catalysts that could push it to new highs. From a macro perspective, the Federal Reserve has slashed interest rates and hinted at continuing the process.

Economic data released this week supports these cuts. According to S&P Global, the manufacturing PMI remained below 45 in September, indicating contraction. Another report by the Conference Board showed that consumer confidence slipped this month as concerns about the labor market escalated.

As a result, the Fed is likely to continue cutting rates to prevent a hard landing. Bitcoin and other risky assets tend to perform well when officials adopt a dovish stance.

Meanwhile, data shows that institutional investors are buying spot Bitcoin ETFs. According to Sosovalue, spot ETFs have seen inflows of over $392 million in the past four days, bringing the cumulative total to $17.8 billion.

Additional data shows that Bitcoin balances on exchanges have dropped to a new low, meaning that most holders have moved their coins to self-custody. There were 2.35 million coins on exchanges as of Sept. 25, down from the year-to-date high of 2.7 million.

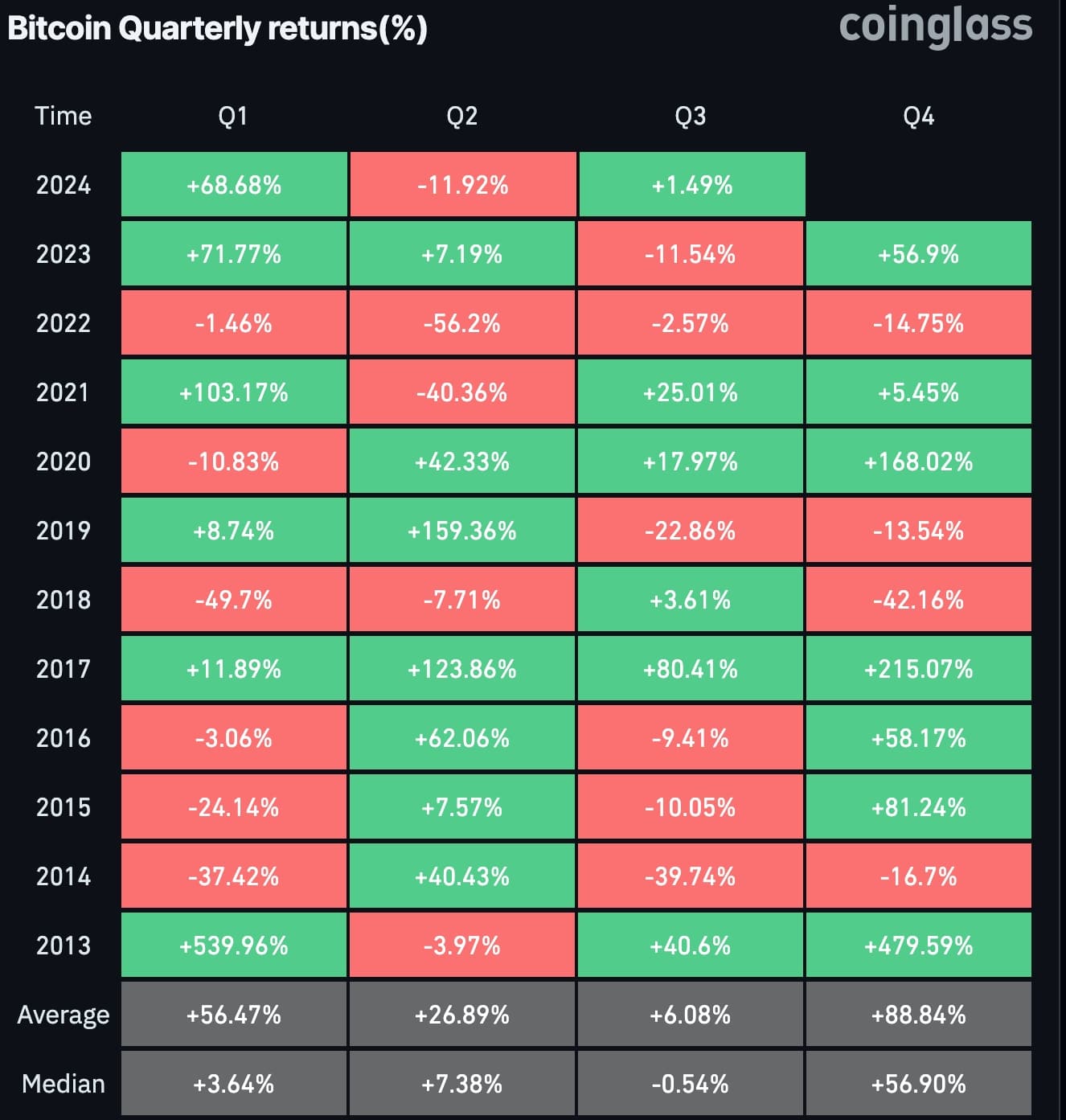

Another potential catalyst for Bitcoin is seasonality. According to CoinGlass, the average Bitcoin return in the fourth quarter is 88%, while the median return is 56.90%. These figures are significantly better than those from the first three quarters of the year.

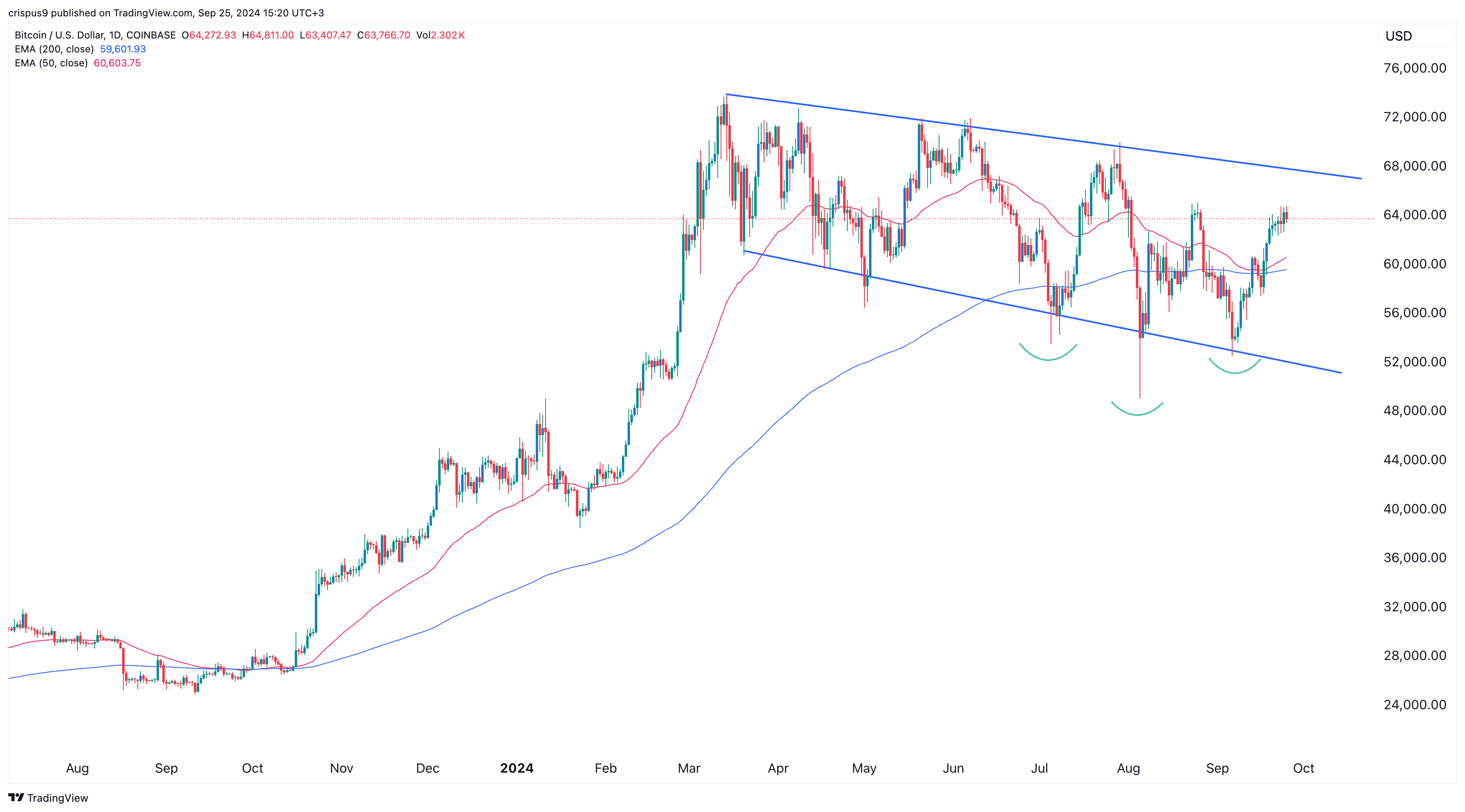

Bitcoin price narrowly avoided a death cross

Another potential catalyst for Bitcoin is that it has avoided forming a death cross, where the 200-day and 50-day moving averages cross each other. Historically, this cross has often led to a significant drop in Bitcoin prices.

Bitcoin has moved above both moving averages, indicating that bulls are currently in control.

Additionally, Bitcoin has formed two bullish patterns: an inverse head and shoulders and a falling broadening wedge. Historically, these patterns often lead to further upside.