As Bitcoin (BTC) continues to trade below its all-time high of above $73,000, the maiden cryptocurrency has seen a growth in the number of millionaire holders in 2024.

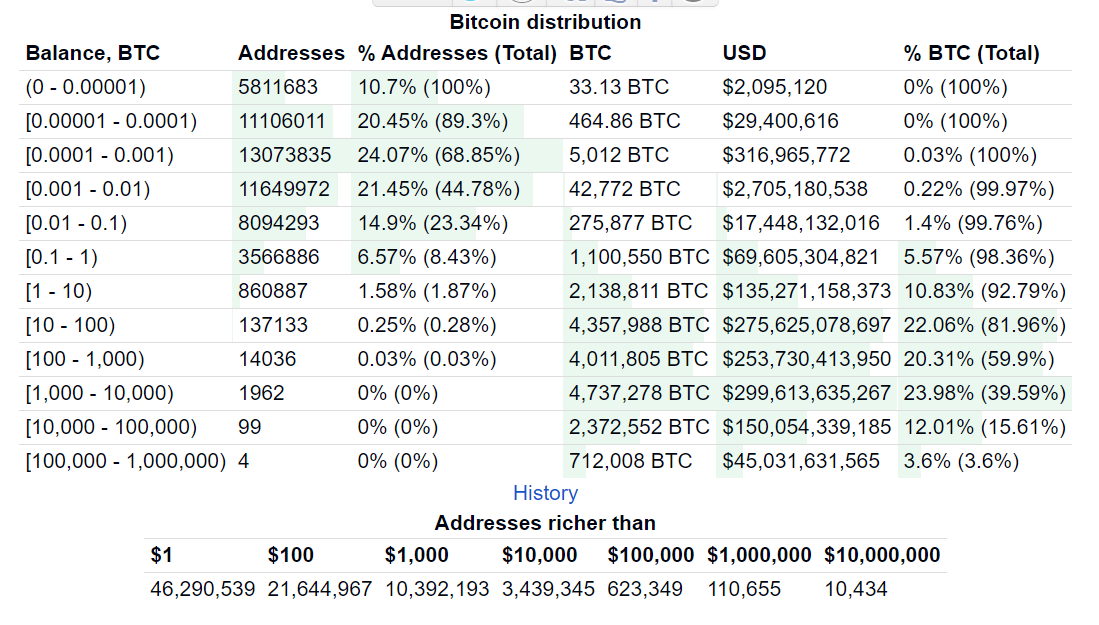

Currently, there are 121,089 Bitcoin addresses holding at least $1 million worth of BTC. Of these, 10,434 addresses contain holdings exceeding $10 million, data retrieved from BitInfoCharts on September 23 indicates.

To put this figure into perspective, data retrieved from the platform on January 4, 2023, using the Wayback Machine web archive tool, indicates that the number of Bitcoin millionaire holders has surged by 25.21% in 2024 as per the data calculated by Finbold.

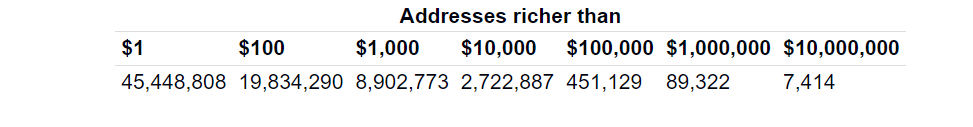

At the start of the year, the total number of holders stood at 96,736, with addresses holding at least $1 million, accounting for the largest share at 89,322. Therefore, there are now 24,353 new millionaire Bitcoin addresses year-to-date.

Meanwhile, it’s nearly impossible to determine the exact number of individuals holding over $1 million in Bitcoin. Due to the blockchain’s nature, each address’ balance is publicly available, but ownership details are undisclosed. In this regard, multiple addresses may belong to the same individual.

Notably, at the start of the year, Bitcoin was trading at $42,280, reflecting a 49% increase year-to-date. This means that holders potentially still possess the same amount of Bitcoin, which has gained approximately $20,000 in value

Implication of growing Bitcoin millionaire holders

This increase in millionaire investors highlights Bitcoin’s resilience in recent months. The cryptocurrency hit an all-time high earlier this year, boosted by the rollout of the spot exchange-traded fund (ETF) in the United States.

Although Bitcoin has corrected, the digital asset has mainly traded above the $60,000 mark, a price movement that some market players believe signals the asset’s continued bullish momentum.

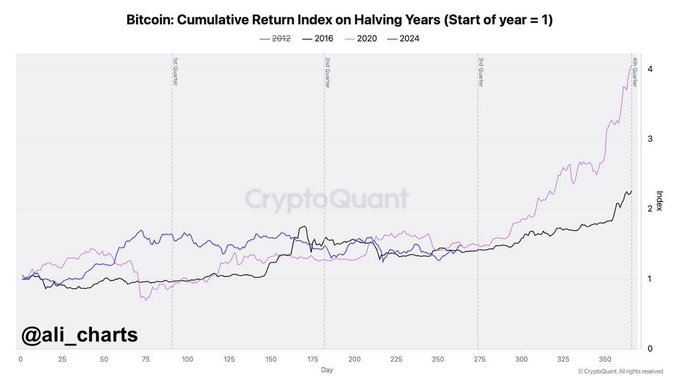

At the moment, investors are anticipating a possible Bitcoin price rally targeting a new record high above $70,000, a factor likely to drive the number of millionaire holders higher. To this end, crypto trading expert Ali Martinez observed in a post on X on September 23 that Bitcoin has historically experienced significant price surges during its halving years, and 2024 seems to be following the trend.

The analyst’s outlook indicated that Bitcoin gained 61% in Q4 of 2016 and 171% in 2020 during the same period. A comparative analysis of the Cumulative Return Index for Bitcoin halving years—2012, 2016, 2020, and 2024—shows that 2024’s price action mirrors the trends of both 2016 and 2020.

If this price action materializes, it could align with the historical pattern where Bitcoin rallies in October.

Indeed, the market is already signaling anticipation of a possible rally, with Tether (USDT) witnessing a significant capital inflow, pushing the market to a new record. This development is significant since USDT and stablecoins, in general, are viewed as gateways to cryptocurrencies.

Bitcoin rally critics

Meanwhile, not all market players believe Bitcoin has more upside potential. Specifically, economist Peter Schiff argues that despite Bitcoin’s impressive rally in 2024, the cryptocurrency has no long-term potential to benefit investors, urging holders to capitalize on short-term price growth to exit.

In his view, investors focusing on Bitcoin are missing out, noting that gold, which is trading at a record high, is a better alternative, he said in an X post on September 23.

In summary, with Bitcoin witnessing price swings in 2024, it remains to be seen how the valuation dynamics will impact the number of high-value holders.

finbold.com

finbold.com