A widely followed crypto analyst is warning that Bitcoin’s (BTC) historical cycle pattern may soon come to an end.

In a new strategy session, crypto trader Justin Bennett tells his 111,300 followers on the social media platform X that Bitcoin’s traditional four-year cycle could change if the business cycle contracts.

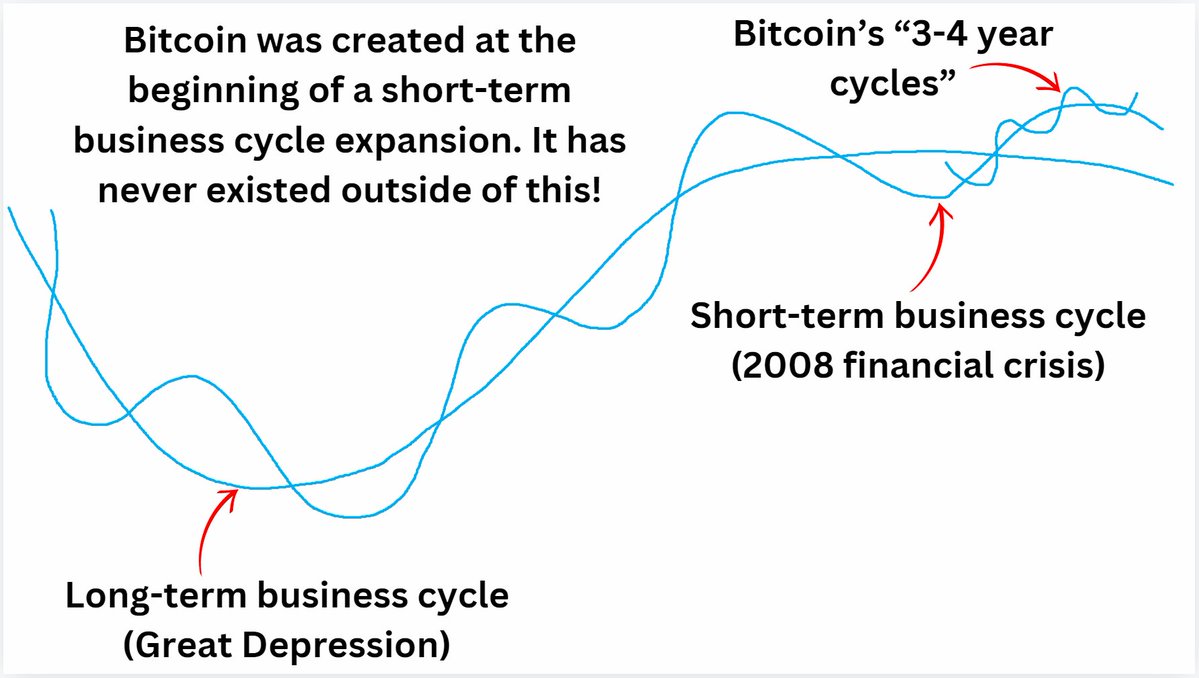

According to Bennett, Bitcoin’s cycles have been correlated to the performance of the overall macroeconomy.

“Since its inception, Bitcoin has followed mostly perfect three to four-year cycles: one to two years of a bear market followed by one to two years of a bull market. But that won’t last! Bitcoin was created at the start of a short-term business cycle expansion and has never existed outside of that. I can’t stress the significance of this enough.

These perfect four-year cycles for BTC are fueled by the environment in which Bitcoin was ‘born.’ What happens during the next short-term contraction? You guessed it – no more perfect three to four-year cycles.” In my opinion, we’re on the verge of a new era for crypto. That doesn’t mean Bitcoin can’t move higher or that this shift will occur immediately.”

Bennett believes that Bitcoin’s price action has historically followed key economic metrics.

“Some proof that Bitcoin follows business cycle expansions and contractions: PMI = Purchasing Managers’ Index. It measures the health of an economy via the manufacturing and service sectors. Note how BTC has tracked it from the start. It’ll be no different during the next short-term or even long-term contraction.”

In the near term, Bennett is closely watching on the daily chart whether Bitcoin can flip the key resistance level of $58,000 into support.

“This is the relief I said to expect while BTC is above $53,000. $58,000 is resistance (it was support on the way down), but get above that and we probably get a sweep of that $60,000 high. Invalidation below $55,500.”

Bitcoin is trading for $57,702 at time of writing, down more than 5% in the last two weeks.

Generated Image: Midjourney

dailyhodl.com

dailyhodl.com