Bitcoin has been in CryptoQuant's bearish phase since August 27.

There's been a decoupling from gold, which has been making record highs, while bitcoin struggles more than 20% below its record level of a few months ago.

BTC's MVRV ratio is below its 365-day moving average which suggests a further price correction may be on the cards.

Investors in this current risk-averse environment appear to be favoring traditional safe-haven assets like gold as opposed to bitcoin (BTC).

The correlation between bitcoin and gold has turned sizably negative of late, according to CryptoQuant, with gold recently pushing to new record highs above $2,500 per ounce while bitcoin has been declining and now sits more than 20% below its all-time high above $73,000 from March. The move into gold and out of bitcoin has come as U.S. stocks have struggled, with the S&P 500 slipping 3.6% since August 30.

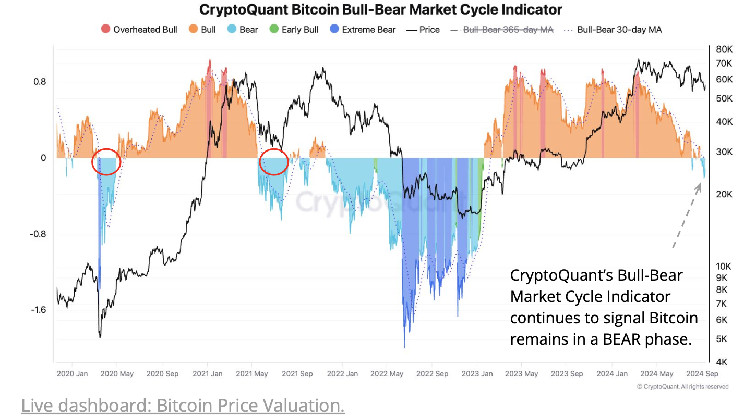

CryptoQuant's Bull-Bear Market Cycle Indicator has been in BEAR phase since Aug. 27, when BTC was trading at $62,000.

The MVRV ratio (market-value-to-realized-value), has also been below its 365-day moving average since Aug. 26, which suggests a further price correction may be on the cards, said CryptoQuant. The MVRV ratio dipping below the moving average acted as a precursor to a 36% drop in May 2021.

The decline in bitcon's price has also come alongside a drop in the U.S. dollar index, another indicator of broader risk aversion and uncertainty, according to CryptoQuant.

coindesk.com

coindesk.com