Bitcoin (BTC) is currently trading near a critical support level, raising questions about its potential direction. At the time of writing, Bitcoin is priced at $59,340.68, reflecting a slight decline of 0.33% over the past 24 hours and a 2.69% decrease over the past week. Its market capitalization stands at approximately $1.17 trillion, with a 24-hour trading volume of $34.49 billion.

Key Support and Resistance Levels Under Scrutiny

Analysts are closely monitoring the $59K-$60K support range. According to Daan Crypto Trades, a prominent crypto analyst, Bitcoin is “still trading in the lower half of the range,” with the next resistance level projected around $66K-$67K. Should Bitcoin fail to maintain its position above the $59K mark, further declines may be expected. Conversely, a bounce from this level could pave the way for a move towards the mid-range target of $66,092.

#Bitcoin Still trading in the lower half of the range if you want to still label it as such.

— Daan Crypto Trades (@DaanCrypto) August 29, 2024

Regardless, $66K-67K is the next big level to break to see continuation higher.

$59K-$60K is the level to hold for the bulls. pic.twitter.com/2o49rXowdY

Mixed Technical Indicators for Bitcoin

Bitcoin's technical indicators present a mixed picture. The current price, hovering near $59,417, is close to the middle of the Bollinger Bands. The wide bands suggest increased volatility, while the price approaching the lower band indicates potential support. If this support does not hold, the next significant level to watch is around $56,266.

The Moving Average Convergence Divergence (MACD) histogram shows weakening bullish momentum. At press time, the MACD line was nearing a bearish crossover with the signal line, potentially signaling a downward trend. Traders are advised to keep an eye on this crossover as it could indicate further price declines.

Meanwhile, the Relative Strength Index (RSI) was at 45.76, suggesting neutral conditions but leaning slightly towards being oversold. This indicates that Bitcoin may still have room to move lower before reaching oversold territory. A rising RSI could suggest a potential reversal or consolidation before any significant price movement.

Bullish On-Chain and Exchange Signals

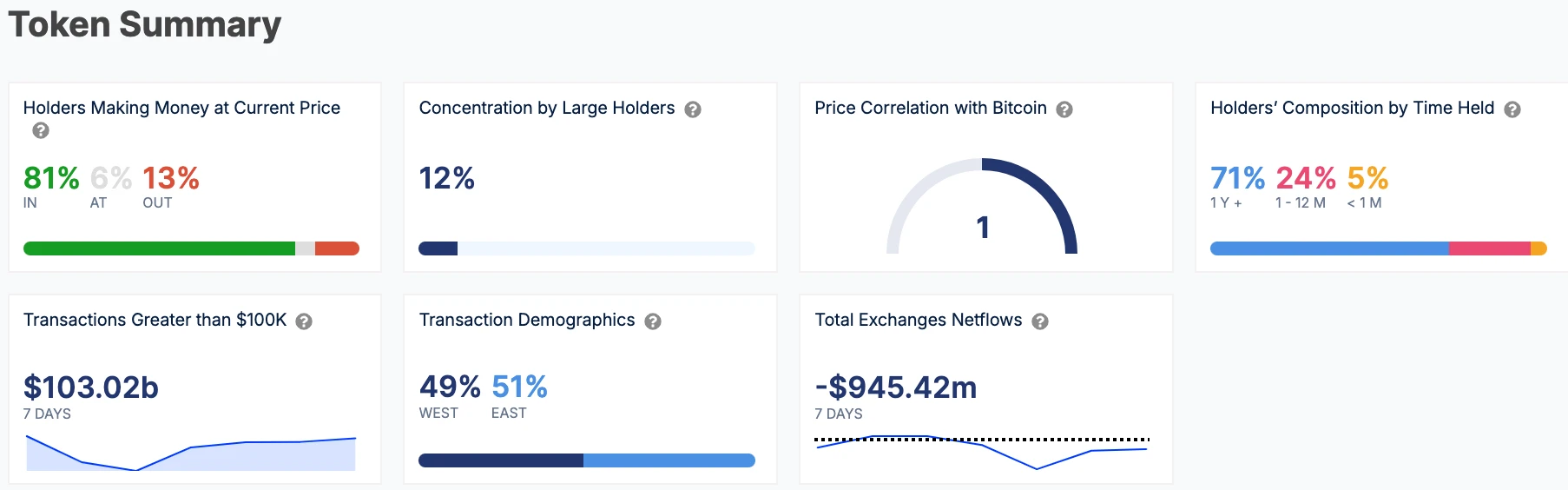

Despite the mixed technical indicators, on-chain and exchange data present a mostly bullish outlook. Data from IntoTheBlock shows that 81% of BTC holders are in profit, while only 13% are at a loss. Large holders account for 12% of the total supply, indicating moderate concentration.

Additionally, the net exchange flow for Bitcoin has shown an outflow of $945.42 million over the last seven days, suggesting that more BTC is being moved off exchanges, potentially indicating accumulation by holders. Exchange signals, such as the Smart Price and Bid-Ask Volume Imbalance, are also bullish, further supporting the possibility of a positive price movement in the near future.

Broader Market Trends Impacting Bitcoin

The overall cryptocurrency market cap has decreased by 1.7% over the past 24 hours, settling at $2.183 trillion. This decline reflects a broader market trend affecting Bitcoin and other major cryptocurrencies. Data from DefiLlama indicates that the Total Value Locked (TVL) in DeFi is currently at $527.89 million. Over the past 24 hours, the DeFi sector recorded $457,690 in fees and $11,017 in transaction volume, with 723,280 active addresses, indicating sustained activity in the ecosystem.

As Bitcoin continues to hover near critical support levels, traders and analysts remain vigilant, closely watching for the next significant move.