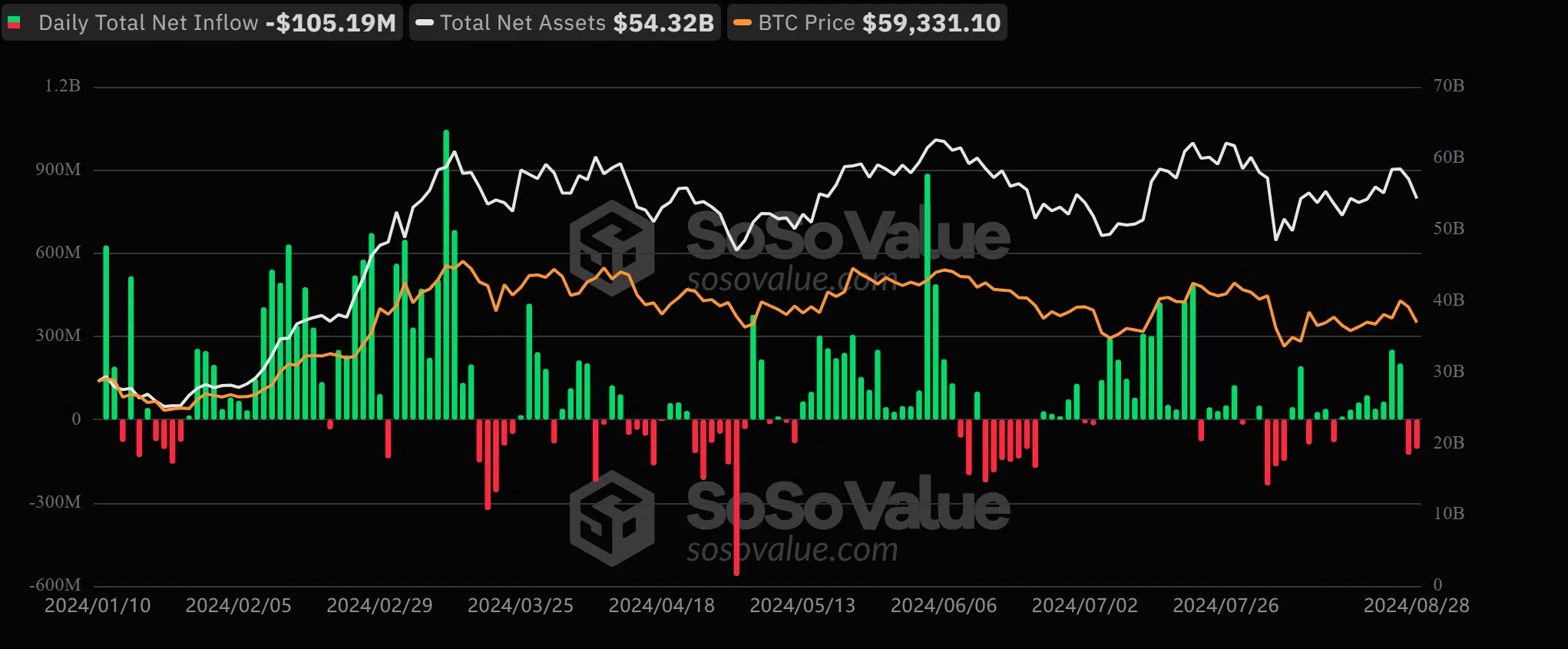

The US Bitcoin spot ETFs saw a net outflow of $105 million on Wednesday, their second consecutive outflow day.

The largest crypto asset, Bitcoin, recovered from a Wednesday scare despite the US Bitcoin spot exchange-traded funds (ETFs) selling 1,782 $BTC ($105 million). Bitcoin dropped below $58,000 yesterday but bounced 2.8% to trade at $59,659.

On Wednesday, the US ETFs saw their second successive outflow after an eight-day inflow streak. Investors pulled out $105 million from the funds as Bitcoin’s struggle to hold above $60,000 continued.

Ark Invest Lead Outflow

Ark Invest’s 21 Shares have led outflows from the US ETFs for the second consecutive day. ARKB sold 1,003 $BTC ($59.27 million) on Wednesday after selling 1,717 $BTC ($102 million) on Tuesday. The issuer now has a cumulative net inflow of $2.37 billion and a net asset of $2.69 billion.

Fidelity’s FBTC and VanEck’s HODL had a similar outflow, selling 176 $BTC ($10.37 million) and 171 $BTC ($10.07 million), respectively. Both funds had zero flow on August 27, signaling a cautious play among investors.

The two Grayscale funds (GBTC and $BTC) sold a combined 284 $BTC ($16.75 million) yesterday. GBTC saw a net outflow of $7.98 million, while $BTC sold assets worth $8.77 million.

Notably, this was the Grayscale Mini Trust’s first outflow since it started trading on July 31. The fund, which had the lowest annual management fee, has seen a cumulative inflow of $348 million since its market debut

Bitwise’s BITB sold 147 $BTC ($8.73 million) on Wednesday, while BlackRock recorded zero flows. August 28 was the second consecutive day that BlackRock, the leading asset manager by net asset, recorded zero flows.

Despite the outflow, US ETFs remain among the best-performing funds in the global market. After just eight months of trading, the Bitcoin products have seen a cumulative inflow of $17.85 billion and an asset under management (AUM) of $54.32 billion.

thecryptobasic.com

thecryptobasic.com