Despite multiple selling pressures, Bitcoin has stayed profitable this year, with an almost 30% increment year-to-date.

Bitcoin has had an eventful year filled with ups and downs. Yet, an investor who bought the asset at the start of the year would have almost a 30% return on investment.

Bitcoin dipped in August for several reasons, and selling pressure from large Bitcoin holders was a major factor. Sales from the German and United States governments, Mt. Gox’s distribution to creditors, and the Japanese Yen carry trade have all contributed significantly to Bitcoin’s poor performance.

Resilient Bitcoin

The German government started dumping Bitcoin seized from Movie2K, an online film piracy platform. According to reports, Germany’s Federal Crime Police Office (KBA) seized 50,000 BTC from the scam project.

In June, the on-chain wallet tied to the German government started selling bitcoins, dumping them incessantly in the open market. Within a few weeks, they sold all 5,000 BTC, causing a scare in the crypto market and affecting Bitcoin’s price.

While the German government was selling, its US counterpart joined the spree and began selling its Bitcoin stash. An earlier report showed that the country’s on-chain wallet sent 10,000 BTC ($593 million) to Coinbase Prime for sales after sending 3,940 BTC ($240 million) to the same exchange in late June.

To add to the FUD, Mt. Gox started reimbursing Bitcoin worth $9 billion to its creditors. The defunct exchange has distributed over $7 billion worth of Bitcoin to users affected by its closure and currently holds 44,899 BTC ($2.68 billion).

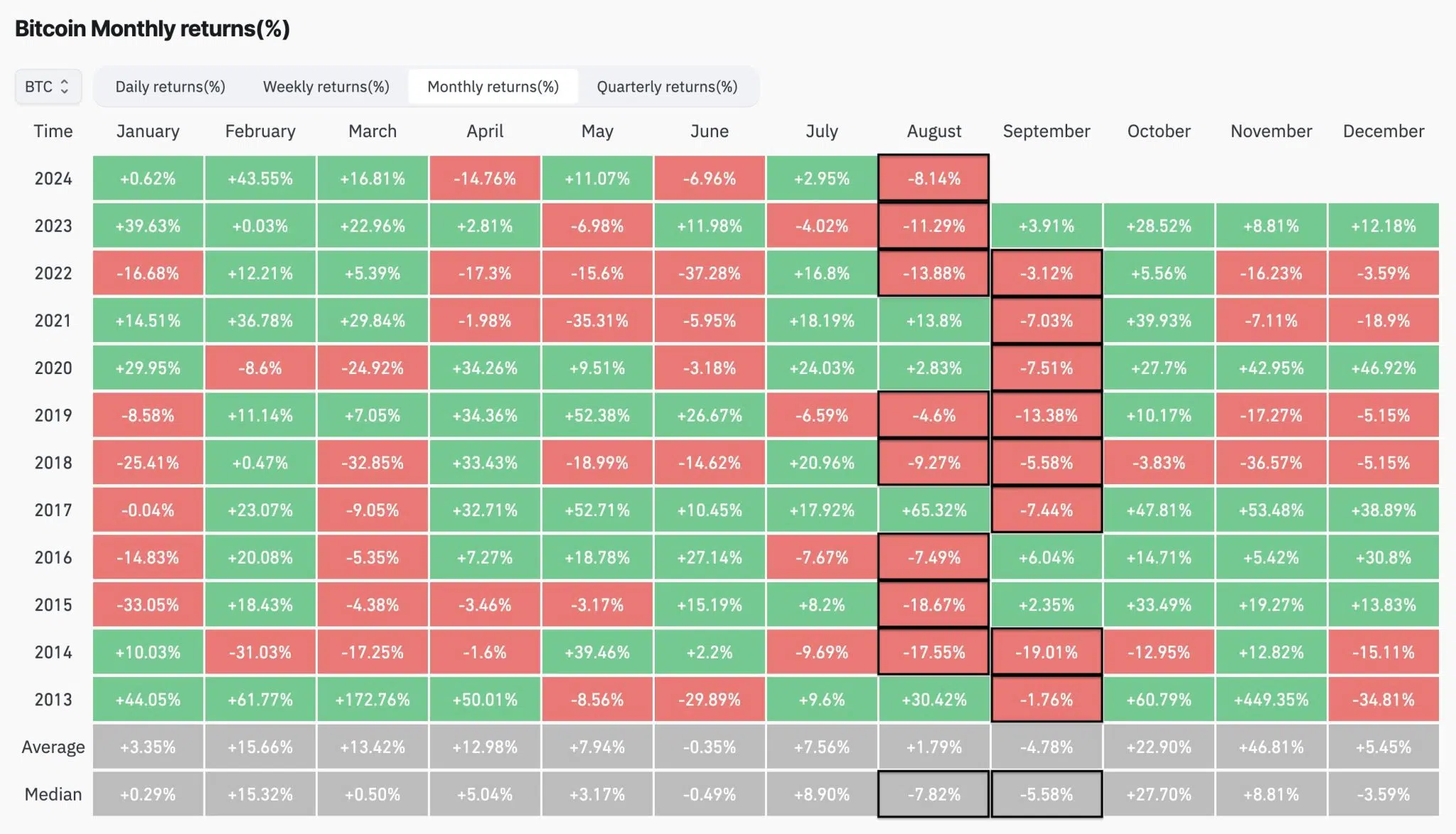

Other macroeconomics, like the Japanese Yen carry trade backfire, also affected risk assets like Bitcoin, causing further sell-offs. Notably, Bitcoin has withstood all this selling pressure, correcting just 18.5% from its all-time high and 16% from its price in early June.

What Next for Bitcoin

With improved macroeconomics, Bitcoin is tipped to rally soon. The Federal Reserve System (Fed) chair, Jerome Powell, recently said that the time has come to cut rates. If the federal agency slashes the interest rate in September, risk assets like Bitcoin could rally significantly.

Also, the fourth quarter of the year has been one of Bitcoin’s most performing periods. Bitcoin has historically rallied towards the end of the year, with the asset growing 3.91%, 28.52%, 8.81%, and 12.18% in September, October, November, and December 2023.

thecryptobasic.com

thecryptobasic.com