While Bitcoin’s price has fluctuated between bullish and bearish trends in recent weeks, miners have managed to capitalize on these swings.

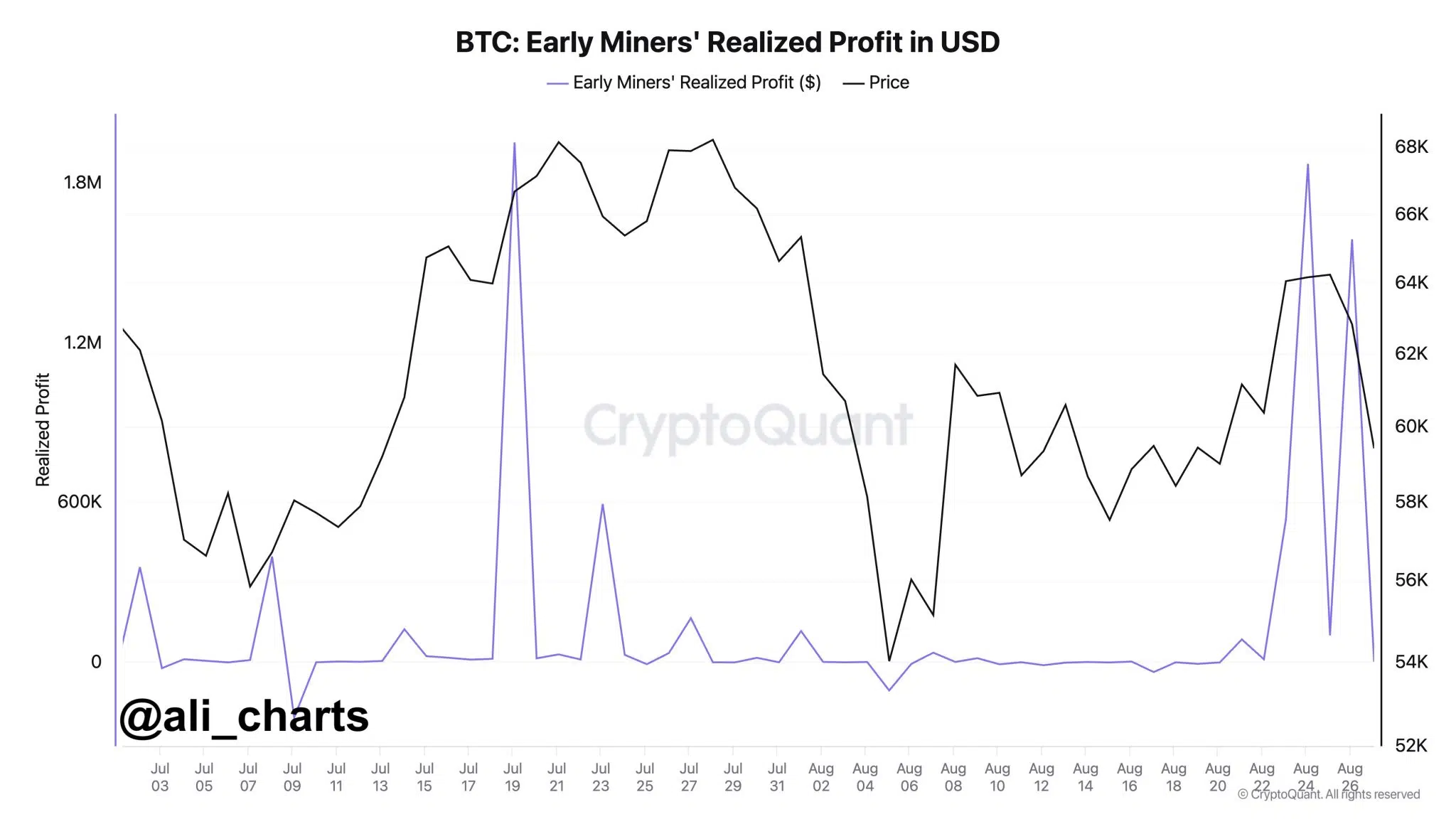

Bitcoin miners have collectively earned more than $3.40 million in profits over the past week. Before the recent spike in miners’ profitability, the graph of their realized profit, as presented by analyst Ali Martinez, depicted a flattened trend.

Meanwhile,data from the analytic platform CryptoQuant highlights significant spikes in miners’ realized profits during specific periods. One of the most prominent surges occurred mid-July when early miners’ profits exceeded $1.8 million.

This spike coincided with a sharp upward movement in Bitcoin’s price, which neared $68,000.

Following this peak, miners’ profits became more volatile, frequently oscillating below $600,000. However, another substantial spike was recorded towards the end of August, with miners’ profits again breaching the $1.8 million mark.

The fluctuations in Bitcoin’s price have closely mirrored these profit spikes. The black line tracking Bitcoin’s price indicates significant volatility during this period. Around mid-July, Bitcoin saw a dramatic price surge, climbing close to $68,000, which aligned with the miners’ profit spike.

By early August, however, Bitcoin’s price had dropped to below $52,000. A recovery was observed in mid-August as the price climbed back over $64,000, only to decline again later in the month.

Bitcoin Miners’ Historic Behavior?

A closer examination of Bitcoin miners’ behavior in July reveals their significant influence on price movements. On July 25, Bitcoin’s price plummeted 7% from its weekly peak of $68,477, dipping below $64,000.

On-chain data suggests that Bitcoin miners contributed to this price pullback by selling into the market’s euphoria. As the market rallied, miners took advantage of the increased demand to offload their holdings, particularly in the lead-up to the highly anticipated Ethereum ETF launch on July 23.

According to IntoTheBlock’s Miner Reserves chart, miners’ BTC holdings decreased from 1.92 million by July 15 as they capitalized on the hype surrounding the Ethereum ETF launch. This large-scale sell-off likely played a crucial role in triggering Bitcoin’s subsequent price correction.

Bearish Market Indicator Flashes Again

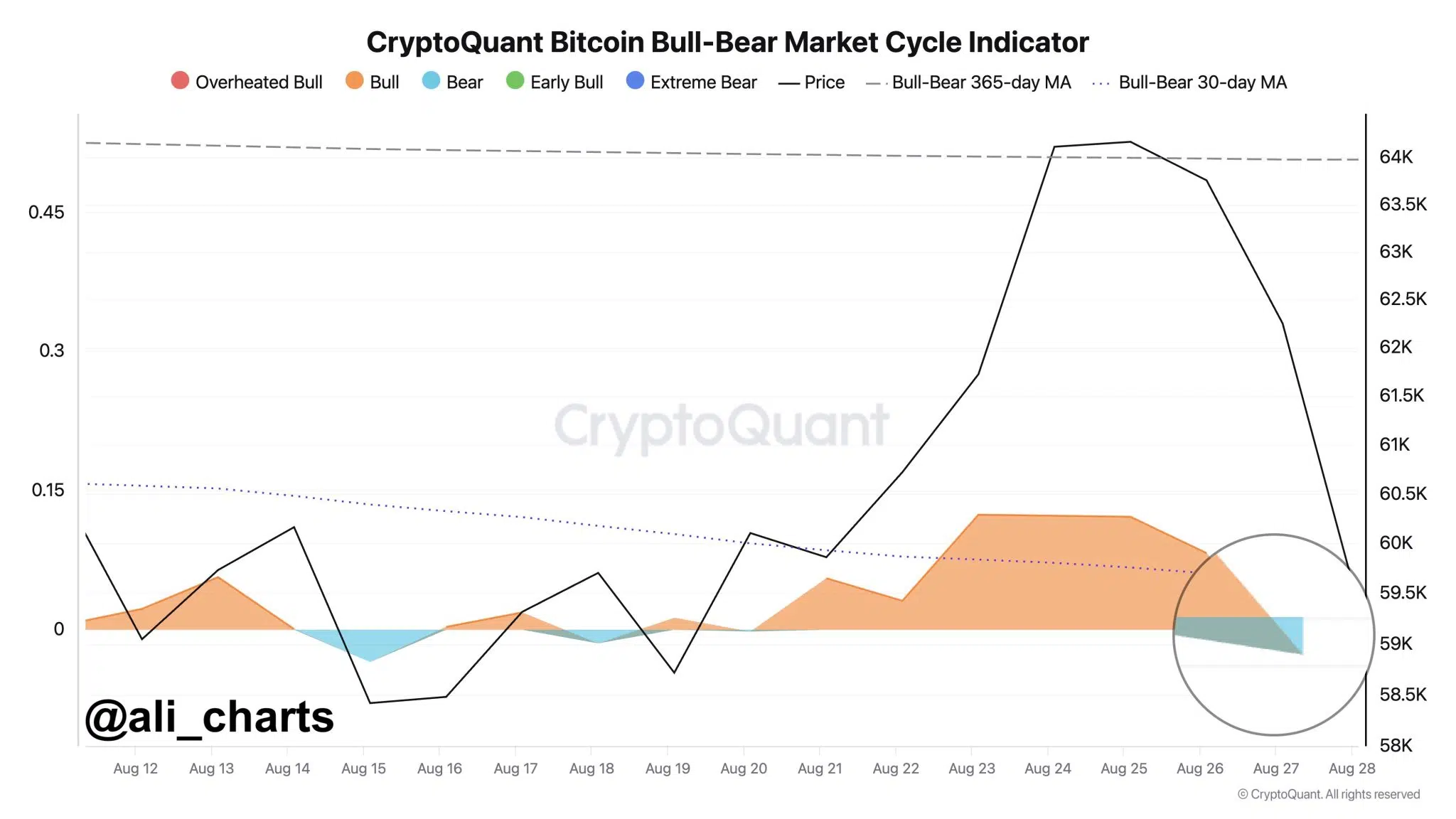

In a separate update, Martinez highlighted the market’s shifting sentiment between August 12 and August 28, based on the CryptoQuant Bitcoin Bull-Bear Market Cycle Indicator. The latest data shows a return to bearish sentiment, corresponding with a decline in Bitcoin’s price.

Notably, the indicator oscillated between bullish and bearish phases during this period. Initially, from August 12 to 13, the market was moderately bullish.

However, on August 14, sentiment shifted to bearish before oscillating multiple times. The market remained bullish from August 19 to 25, corresponding with a rise in Bitcoin’s price to $64,000 by August 23. By August 25, the indicator flipped to bearish again, with Bitcoin’s price dropping to $59,000 by August 28.

thecryptobasic.com

thecryptobasic.com